Is the Chainlink Whale’s Sell-Off a Smart Move or the Beginning of LINK’s Collapse?

Ever wonder what happens when a giant whale decides to exit the LINK party with a $21.46 million splash? That’s exactly what shook the waters recently when a whale sold a hefty 938,489 LINK tokens, sparking some serious short-term selling pressure. But here’s the twist—while it might look like a retreat at first glance, savvy traders and chart watchers have their eyes locked on a classic cup and handle pattern brewing beneath the surface. Combine that with Open Interest climbing a solid 6.72% to $1.65 billion, and you’ve got a recipe hinting at mounting speculative demand pushing LINK toward the $30.86 mark. So, is this whale’s move a sign of trouble ahead… or just the calm before a bullish storm? Stick around as we unravel whether Chainlink is gearing up to reclaim its momentum or buckle under the pressure.

Key Takeaways

How is whale activity affecting LINK?

A whale sold 938,489 LINK worth $21.46M, creating short-term selling pressure.

What signals point to a potential bullish breakout?

A cup and handle formation combined with Open Interest rising 6.72% to $1.65B suggests growing speculative demand, pushing LINK toward $30.86.

Chainlink [LINK] has faced heightened attention after a whale sold 938,489 tokens worth $21.46M at an average of $22.87, realizing a $212K profit.

This exit coincided with a broader market debate over short-term price resilience as LINK traded near $23.81.

Traders are closely monitoring whether this move signals renewed sell pressure or simply profit-taking before another push higher. This selloff could also reduce overhead pressure if absorbed by new buyers.

The central question now is whether investors interpret the exit as weakness or merely opportunistic profit-taking.

Sellers tighten their grip

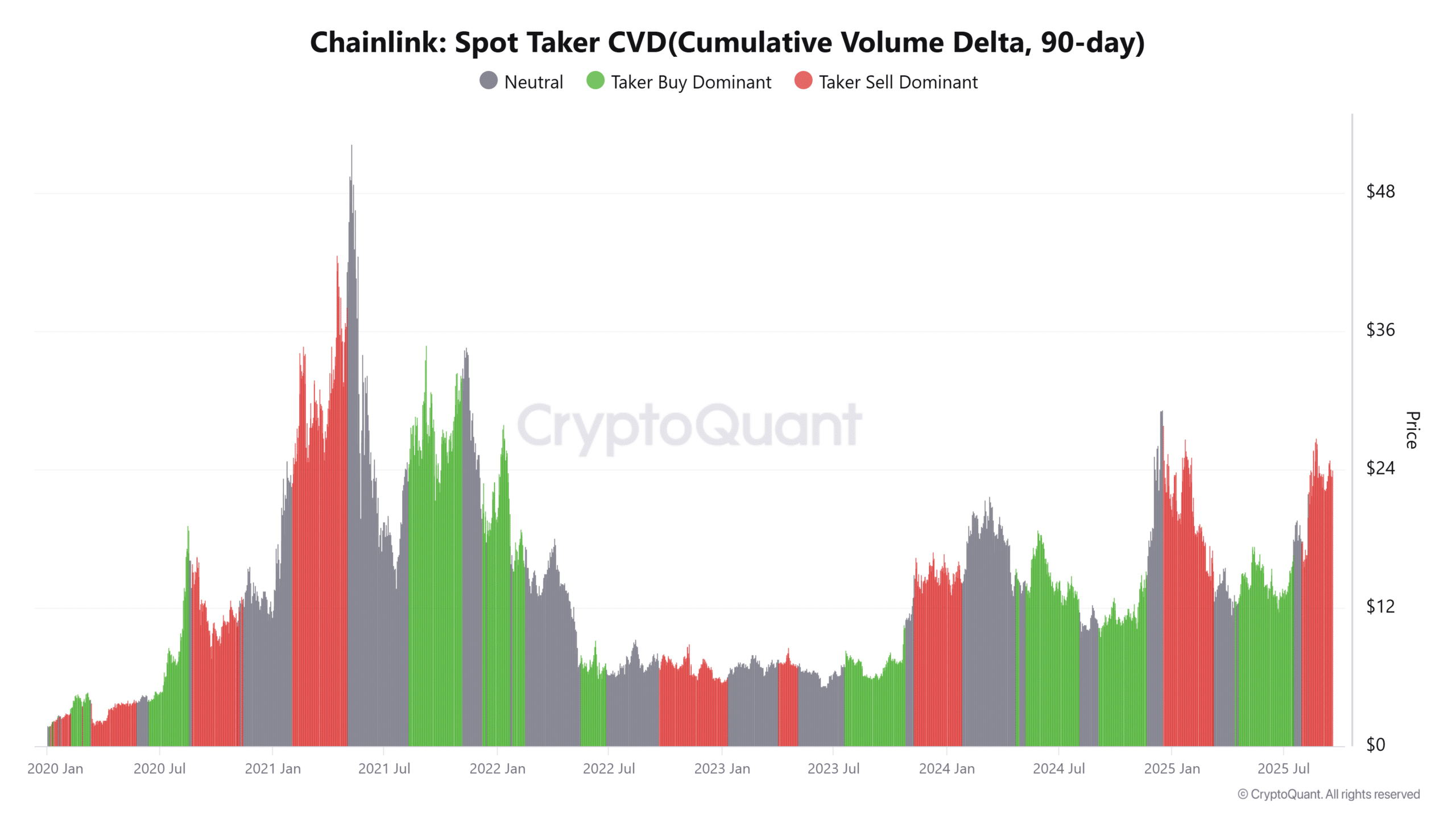

Spot Taker CVD metrics revealed that sellers dominated trade execution, with aggressive market sells outweighing buy-side activity. This dynamic signaled weakening conviction among bulls at higher ranges.

Taker-sell dominance often pressures intraday momentum by forcing bids lower and increasing volatility. Although some traders anticipate a rebound, persistent sell-side control reinforces caution in the short term.

For LINK to regain traction, buy-side flows must increase decisively to shift cumulative volumes in favor of buyers. Until then, market activity appears skewed toward downside risks.

Source: CryptoQuant

Can Chainlink see a breakout instead?

Despite near-term pressure, the daily chart displayed a developing cup and handle formation at press time, typically a sign of bullish continuation.

LINK hovered between support at $21.96 and resistance at $26.66, with a breakout above this level targeting $30.86.

The pattern will remain intact as long as LINK sustains its support without deeper breakdowns. This technical setup offers bulls a narrative that contrasts sharply with whale-driven weakness.

If price breaks above the handle, speculative flows could accelerate toward higher targets, reshaping sentiment rapidly in LINK’s favor.

Open Interest rises

Open Interest surged to $1.65B, climbing 6.72%, signaling growing speculative positioning despite caution from whale selling.

This increase suggests derivatives traders are preparing for volatility, with many expecting a breakout attempt.

Higher Open Interest often fuels strong moves once resistance or support is tested, amplifying whichever direction prevails.

In this case, the alignment of OI growth with a bullish chart pattern adds weight to a potential upside scenario.

Traders now face a critical juncture where conviction meets technical structure and on-chain pressure.

Source: CoinGlass

Can LINK beat sell pressure, reclaim resistance?

Chainlink will overcome the recent whale-driven sell pressure as long as it sustains support above $22.00.

The cup and handle structure, paired with a steady rise in Open Interest, signals that bullish continuation is the more likely outcome.

A break past $26.66 resistance should confirm strength and open the path toward $30.86.

Despite near-term sell dominance, the overall technical and derivatives setup points to LINK regaining momentum and pushing higher.

Post Comment