The Hidden Supply Lock on Solana That Could Ignite a Massive SOL Price Surge—Are You Ready to Cash In?

Ever wonder what happens when 70% of a cryptocurrency’s supply is locked up tighter than your favorite pair of Spanx? Welcome to Solana’s unfolding drama — a meticulously crafted squeeze that’s making waves and stirring up FOMO like a Black Friday sale. With Forward Industries dropping a staggering $4 billion equity play to scoop up SOL, the stage is set for something big. Could this be the push that sends Solana soaring past $300 by mid-Q4? Hold onto your hats, because with supply crunching hard and institutional giants playing a high-stakes game, this looks like more than just a market ripple — it’s gearing up to be a tidal wave. Curious to see how this all plays out? LEARN MORE

Key Takeaways

Why is Solana’s setup looking bullish?

Solana has 70% of its supply staked, tightening supply and fueling a strategically engineered squeeze.

What could trigger a breakout?

Forward Industries’ $4 billion accumulation and strong bid support could push SOL toward $300+ by mid-Q4.

Solana’s [SOL] liquid float is getting squeezed.

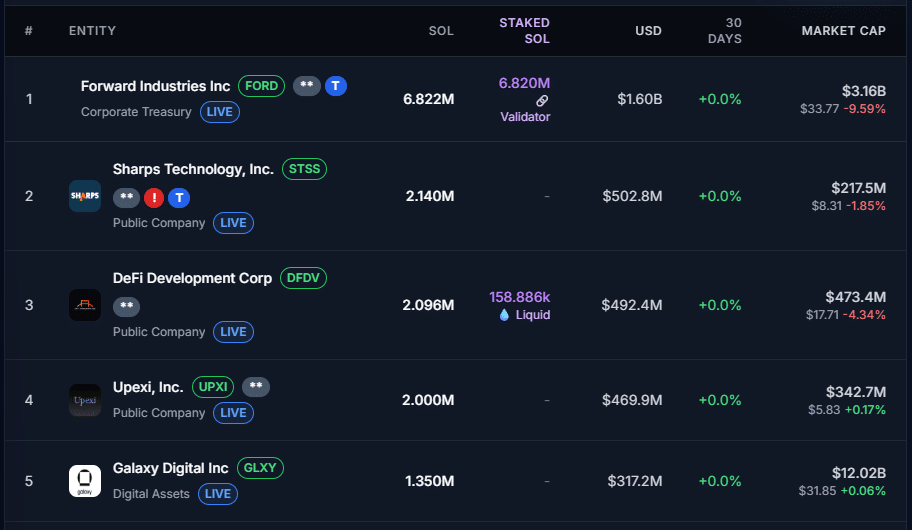

According to Strategic SOL Reserve, 16 institutional players hold about 15.83 million SOL, roughly 2.75% of circulating supply.

In fact, nearly 2 million SOL has flowed in just this past month, showing rising accumulation.

Among these top holders, Forward Industries [NASDAQ: FORD] leads the pack, holding 6.822 million SOL. Technically, that represents 43% of Solana’s total institutional float, making it a major liquidity lever for SOL.

In that case, any shift in their position could ripple through the market.

Interestingly, Forward Industries has kicked off a $4 billion at-the-market (ATM) equity program. In other words, the company would gradually sell new shares into the market to raise cash, which it could use to buy SOL.

The market’s reaction? Quick and decisive. Solana is retesting its $250 yearly peak, which threw a 6.4% pullback last week, but with FOMO off the charts, it’s looking ready to kick into full price discovery mode.

Solana scarcity signals potential mid-Q4 breakout

Solana’s tokenomics is going through a major bullish shift.

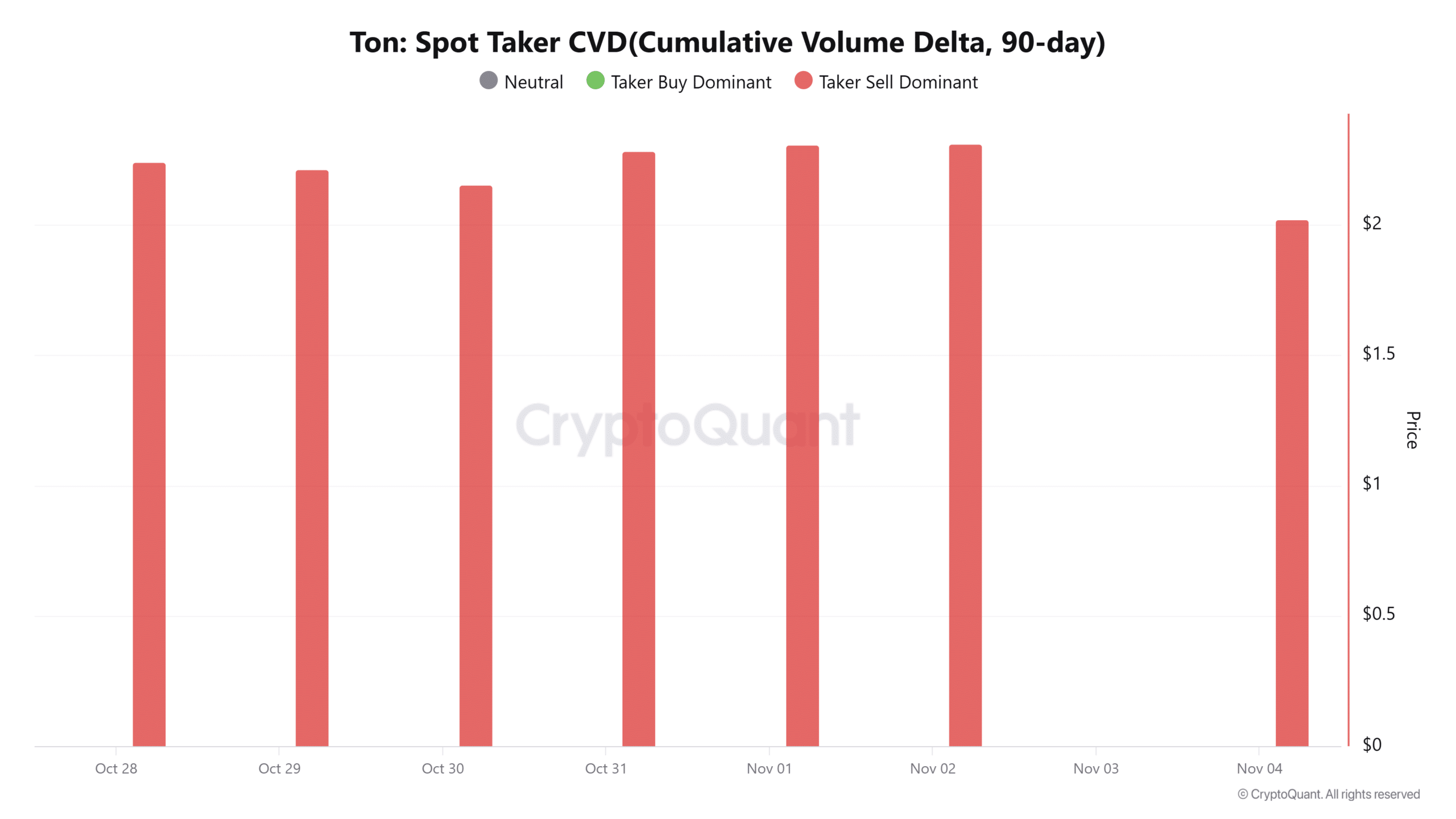

On-chain, 411 million SOL are staked, representing 70% of the circulating supply. That means most tokens are locked up, reducing immediate liquidity, and creating a serious supply squeeze.

Notably, this includes the 15.83 million SOL held by 16 institutional players.

From an investor standpoint, it’s a clear sign these whales are stacking with conviction, locking up their float to earn yield while controlling liquidity.

In short, a strategically engineered supply shock is driving Solana’s upside.

Backing this, a top analyst noted only 85 million SOL are truly tradable. The rest is locked or off-exchange. At the current daily accumulation pace, the analyst predicts Solana’s liquid float could dry up in 45 days.

That sets SOL up to test its $250 ceiling and push into price discovery, with the first stop likely at $295. However, with strong bid support and tight liquidity, a $300+ breakout by mid-Q4 is looking increasingly likely.

Post Comment