Unlock the Secret Self-Talk That Shields Your Wealth When Markets Crash—And How You Can Master It Today

Ever wonder what it really feels like to watch millions evaporate on paper overnight? It’s a gut punch no matter how fat your portfolio is. Recently, I had the rare chance to dive deep with Der Shing—a savvy investor who retired at 39 and carefully crafted a portfolio with a cautious 60/40 balance to dodge the dreaded sequence of returns risk. His openness about the emotional rollercoaster of market dips, especially those surprise drops nobody plans for, was refreshingly honest and, frankly, pretty eye-opening. It turns out that no matter how solid the math or how low the assumed spending rate, the psychological weight of seeing your net worth plunge can shake even the most seasoned investors. What I found most striking is how he reframes “loss” not as doom, but simply “less rich”—a mindset that seems to tame the midnight worries and stops panic selling in its tracks. Whether you’re just starting to optimize your withdrawals or a grizzled market veteran, understanding this mental balancing act might just be the edge you need when the unexpected hits. Ready to rethink what “financial safety” truly means? LEARN MORE

Sometimes, I am privileged enough to have people who is of a certain level of wealth, sophisticated enough technical, and clear in their communications in my community to share their thoughts with me.

Der Shing, made a reply to my last post on Net Worth Going Up Even After Spending in Retirement. -The Flawed Takes.

I just want to take a moment to capture these thoughts because it is uncommon for people that understand the subject, yet vulnerable enough to share what others would consider as a weakness.

Sequence matters a lot.

Turns out opposite happened for stocks.

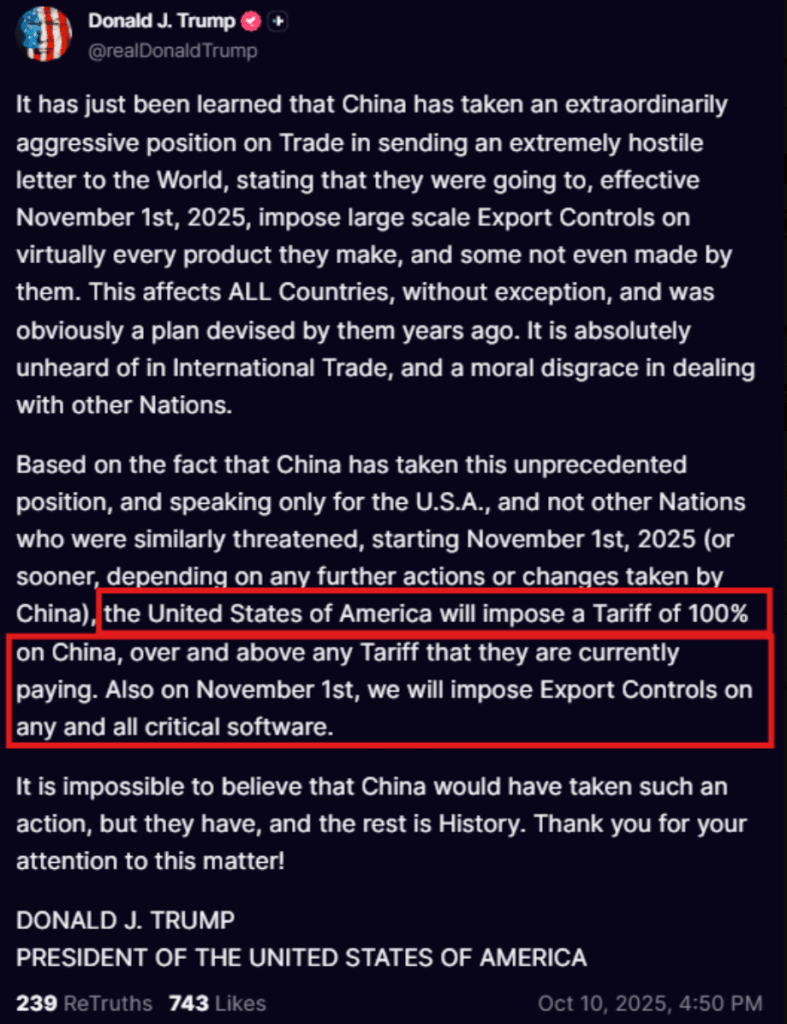

So in 2022, having benefited from a positive sequence and significant net worth growth like your friend, we decided it’s ok to take sequence risk now and so are 80% equity last few years.

My math back then and today is similar.

When I sold business in 2011 and retired in 2014 at 39, we ended up selecting a 60/40 type portfolio precisely because of fear of negative sequence.

Construct portfolio that gets 6-7% return on net worth annually. Spending is about 2%, rest compound. No work income modeled but in actual fact had a little that helped with spending.

I commented on Der Shing’s income strategy then that the plan works mainly because the planned spending is low enough.

Using a Safe Withdrawal Framework to assess, an initial 2% spending on a portfolio, when inflation-adjusted is really perpetual inflation-adjusted income.

Yes 2% is very low so psychological buffer very high. Just sharing my mindset regards sequence of returns risk.

I also learned from stories of Wall Street bankers who retired in 30s/40s with 8 figures and ended up 9 figures in their 60s just riding market. So inspired to invest my way into that too.

Also deliberately purchase right size home only. Only after successful sequence then bought current place.

I asked Der Shing if he had to constantly go back during the times of volatility to remind himself that he is roughly spending 2% of his portfolio to help him find his comfort spot:

No it doesn’t work that way.

Portfolio drops not anticipated are far more stressful.

Anything anticipated or planned for is manageable.

So most stress last 14 years was in 2021 bought a much bigger house and used up a good chunk of invested capital. Then in 2022 had a negative sequence when stock market tanked. Same time the PE side gains also became uncertain.

So had a few nights where rationally I know more than enough money but psychologically felt the many millions lost on paper. And what if really Great Depression scenario. Then I may actually have to sell the house I bought in 10-15 years time.

Luckily worst case didn’t happen though PE still not great but stocks and property has been spectacular. So it’s like hit another super positive sequence last 3+ years.

I appreciate his honesty and vulnerability here.

My conversations with people is that they would only really try their best to describe what they feel if they are face-to-face and trust a person enough.

Sometimes, the part about learning is to start feeling you don’t know a lot.

Even if you have a high absolute net worth, you will feel like shit if you realize you just lost a chunk of your absolute money.

Sometimes, I remind some of my colleagues who are client advisers: “There is a difference between percentages and absolute figure. To you, it may be part and parcel that a market goes down 8%. But someone who lost 8% on a $16 million portfolio, who grew up with almost nothing, had to build something up just saw cold, hard $1.3 million evaporate like that.”

When that happens, your brain will go wild. Comparing against the safe money figures that you have in your mind.

Der Shing then shared what really helps re-centers himself in these challenging times:

Not just learn from past but remember anything is possible.

So the plan must contemplate all scenarios.

For me, the nights of worry disappeared once I reminded myself it’s just money and it’s not like in any danger no food or shelter or have to go back and work. It’s just become less rich.

Once I could rationalize and internalize the thinking, the fear disappeared. Market still falling when it disappeared actually which turned out good cuz we didn’t sell anything and bought a bit more.

Entire process from real fear to rationalization to normal state about 2 weeks?

I agree with Der Shing.

There are sound plans and there are plans that feels sound to you but are actually not. Der Shing talks the most challenging times are the unanticipated drops that are most stressful.

Experience plays a role here. If you only experience V-shape recovery, you will think all drops recover in V-shapes.

You won’t know that there are markets that went no-where for 8-9 years.

This is why people call Singapore, Hong Kong, REITs shit, because they never see their beloved MSCI World go through such shitty period of going nowhere and they assume only shit market does that.

Our way of coping is also different when we see 20% of our portfolio evaporate.

You need some self-talk.

I assumed Der Shing’s self talk is that he is spending 2% of his portfolio. I was wrong.

Der Shing is able to know that there are more negotiable or flexible spending and there are non-negotiable or essential spending.

$20 mil gets cut in half is $10 mil.

You will feel rotten but at the end of the day, if you know markets will be like this, that you could be in an unlucky sequence, what you want is for your plan to work.

And working means you still be able to spend on your non-negotiables.

That is the mental framing behind the Safe Withdrawal Rate framework and how I think about my Daedalus Income Portfolio. I have to accept that I may see $750,000 and that $750,000 would still be enough to make that income stream work.

Overtime, I learn that everyone’s language for income safety is very different. And for the colleagues reading this, it is important to remember that.

Income planning is a unique financial goal in that there may not be an easy way to recover once you execute it because you don’t have a work income anymore. Therefore some plans need to me more sound than others.

I thank Der Shing for his honest sharing because that has helped me in some ways.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment