Why Info-Tech Systems Might Be the Hidden Gem Wall Street Is Sleeping On—Here’s My Take

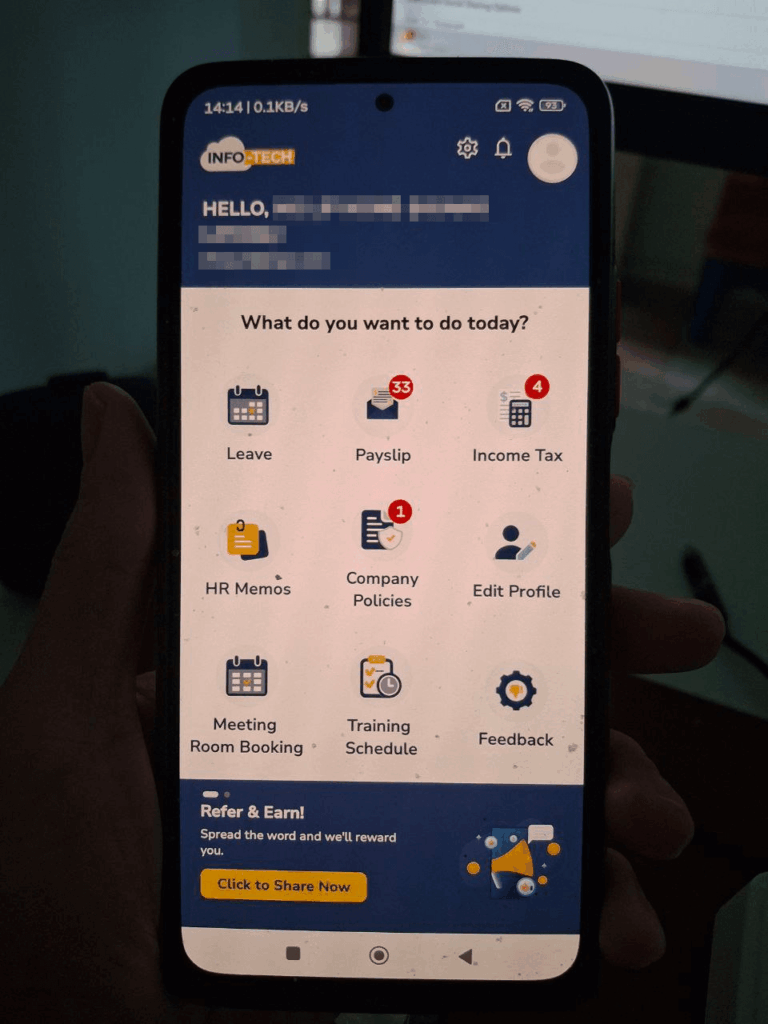

When Info-tech Systems quietly dropped its IPO back in July 2025, it caught quite a few of us off guard. An HR app that many of us have been using—some for as long as four years—stepping onto the big stage with 24.9 million shares at just $0.87 each? Suddenly, this familiar tool wasn’t just an office utility; it was a public company with a market cap soaring to $207 million. But here’s the kicker: why would a company flush with nearly $30 million in cash decide to raise a modest $21.6 million through the IPO? Is this just smart foresight or a classic case of taking “free money” while it lasts? As we peel back the layers of Infotech’s financial health, growth trajectory, and the ever-elusive question of whether it wields any real competitive edge, it feels like we’re navigating a corporate puzzle with some intriguing twists. Buckle up, because what looks like a simple SaaS platform might just hold more surprises than meets the eye. LEARN MORE

img#mv-trellis-img-1::before{padding-top:133.33333333333%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:73.33984375%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:70.1171875%; }img#mv-trellis-img-3{display:block;}

Some of us were shocked when Info-tech Systems went IPO (initial public offering) not too long ago (4 Jul 2025).

Infotech (ticker: ITS) IPO with 24.9 million shares at $0.87 each. This will raised roughly $21.6 million which they want to use in their working capital, research and development and sales.

We been using that as our HR app for a while now. I can’t fully remember. Was it for the past 4 years?

I thought its a pretty nice platform actually. Gets the job done. I have no idea how my other colleagues thought about it. I spoke to our head of finance, who used to take care of the human resource roles and general sentiments is that it is not too bad from his angle!

One feedback is that they are very responsive when clients have problems getting things done.

I just want to take down some notes regarding the financials.

How does Info-tech’s financial profile look like?

There are about 225 million shares outstanding and Infotech currently trades at $0.92. This gives it a market cap of $207 million.

I have compiled some of the main financials below:

Year 2022 to 2024 are the financials before IPO and to the right, I show the financials for the first half of 2025.

Infotech is just net cash. You can also see that prior to listing, Infotech is very profitable. Free cash flow growth is very good. The cash has grown from $11.7 mil to $29.7 mil. For the past 3 years before listing, money is pulled out of the company rather than put in.

Contract liabilities is there because Infotech operates in a SAAS model so there are committed revenue but the service is not used yet. Eventually, this will flow to the revenue.

We are seeing some good revenue & gross profit growth in the past prior to IPO. After that, it has tapered off for the past 6 months. Net profit and free cash flow growth is good as well.

Net profit for first half 2025 was lower because of one-off listing expenses and one-off relocation cost of a Malaysian office. If not the net profit would have been $7.2 mil or 9% growth.

There is definitely some sort of operating leverage for a business like Info-tech and it will be interesting if we are seeing this in a stabilized state.

The earnings yield if using 2024 profit is 5.9% [PE: 17 times] and if we annualised 1H 2025 is 6.9% [PE: 14 times]. The latter is not always advisable for a young company because we won’t know how lumpy the sales is, but whatever, I have done it.

The free cash flow yield is higher.

I think Infotech is trading at an interesting valuation. If this is more of a techy business, a fairer valuation would be 20 times. But if it is a business that is in a competitive landscape where the margins can be eroded easily 17 times looks fair.

Actually, if we understand the cash on the balance sheet better they don’t seem to be needed. But then again, why did they IPO in the first place to raise money if the cash is unnecessary?

The percentage of revenue allows us to see how much they are spending on sales, admin and R&D.

Kyith which figure should we zero in on more? Profits or free cash flow?

I think we should look at net profits more if we are zeroing on long term sustainability. The main reason is that the capital expenditure for the business at this point is minimal. However, a more technology and sale business is manpower intensive and the profits will consider the ongoing efforts to make sure they stay competitive.

Not so easy because likely, you have to invest in manpower upfront to scale, so there can be some lumpiness there. IT is always good to look at the two of them and value the company together by triangulation instead of one figure alone.

Ok let me pen down some more qualitative thoughts.

Does A Business like Info-tech has any Moat at All?

I won’t be able to tell.

Infotech basically provide a human resource management system (HRMS) to mostly small and medium sized companies. More and more, they are also providing basic accounting software (which I have not experienced)

I think it is easy to offboard as well as onboard. Sure, we won’t want to do them often but if their target are firms that have 6 employees, 20 employees, it is not too difficult to switch. You just need to export the data, or find a way to import the data into a new HR system.

If it is as easy to get a prospective client to switch to Infotech’s system, it may just as easy to switch away.

But then maybe we talked about moat too much in this world.

Some services like Info-tech can be just right:

- Good support

- Does what others do as well.

- Do something more.

- Not too expensive especially relative to the SME’s overall revenue.

- Got no stupid problems.

- Shows that you move forward with the times and improves.

- Doesn’t show like every time got new feature you want to charge me extra.

I call this the “Munchi Model” (If you don’t know Munchi is a Mee Jiang Kueh brand)

You don’t have to be special you just have to do it well. Sure, you cannot do everything, such as cross function features.

But for the SME, this might be the sweet spot.

Ultimately, some will leave you because they grown bigger, and you will need new clients to fill those that leaves you.

Wouldn’t competition dramatically reduce Infotech’s margins?

That is possible but I think in a different way.

What kind of environment is Infotech operating in?

I reckon there are HRMS out there. Confirm there is a big one in Workday there.

And so why are we observing that kind of growth in 2022 to 2024 and this margin despite the environment?

Perhaps the market is big enough and there is a sweet spot there.

There are competitors and Infotech’s offering is good enough.

Why did Infotech List in the First Place?

Again, they raised about $20 million and these are the reasons why they decide to raise:

The skeptical part of me wonders that if you have $29 mil in cash, and so cash flow generating, why do you need to IPO?

Why not just keep all the money within the key directors?

I think there might be a few reasons:

- There are some listing incentives by SGX or Singapore government in general.

- Visibility

- Cheaper financing in the future.

- Why not take free money?

The IPO money actually amount to one year of their sales & distribution, admin expenses. It is two year’s worth of their R&D expenses.

It feels to me like its more anyhow money.

But we will see.

New IPOs with pristine balance sheets always give off the S-chip vibe for us old Singapore stock birds.

Info-tech’s Potential

Now this is the skeptical part but hear me out.

At a certain point, once you have a viable product (and they do seem to have something), then the difference in growth is how good is your sales team to grow and use it.

How do you account manage and do business development well.

While product makes a lot of difference, how good the sales team is also makes a lot of difference.

I think some of my readers in IT sales would know this better than me.

The reason why I am skeptical is because of the previous reasons. The cash is already there and if cash is a constrained, the cash wasn’t a constrain in the first place.

Epilogue

I guess Infotech is a wait and see.

I don’t understand how the sales could see such a drop off after two good years. We have not seen their revenue mix or customer mix.

I hope there isn’t a lot of situation like the customer is a related friend. Perhaps 2023 is unique. There are questions definitely.

Have this eerie feeling that I might worry too much and it turns out they were just marketed to list and they just list lor. Might just be that kind of business that Kyith started if he has a good idea and it just grow to an animal by itself.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment