Bitwise Drops a Game-Changer: The First U.S. Spot HYPE ETF That Could Flip the Investment World on Its Head—Are You Ready?

Imagine being at the frontline of a financial revolution—where digital assets meet traditional investing in one bold leap. Bitwise, the $15 billion heavyweight in asset management, has just filed for the very first U.S. Spot Hyperliquid (HYPE) ETF. If this baby gets the green light, it won’t just open the doors widely for investors to tap into one of crypto’s speediest rising stars—it’ll set a new standard. But here’s the twist: with HYPE’s price having taken a 31% nosedive and short-term headwinds swirling, the big question looms—can this ETF filing flip the script and breathe new life into the altcoin’s fortunes? As we brace for what the SEC’s upcoming decisions might unleash, the stakes couldn’t be higher for traders and investors alike. Ready to dig into the full story and uncover what this means for your portfolio? LEARN MORE

Key Takeaways

Why does the Bitwise HYPE ETF filing matter?

If approved, it will be the first spot HYPE ETF in the U.S., allowing exposure to one of the fastest-growing crypto ecosystems.

What’s next for the HYPE price?

HYPE has dropped 31% and erased the September gain amid short-term headwinds.

The $15 billion digital asset manager, Bitwise, has filed for the first U.S. Spot Hyperliquid [HYPE] ETF.

The update comes after the SEC unveiled a new and faster general listing standard (GLS) for crypto ETFs ahead of a massive wave of approvals expected in October.

This would allow U.S. investors a much more convenient exposure to HYPE without worrying about wallet keys and security. A similar product is already live in the European market, via 21Shares ETP.

As such, if the Bitwise proposal is approved, it would lift the altcoin to the level of Bitcoin [BTC], Ethereum [ETH], and Solana [SOL], which have ETF and crypto treasury demand.

Timeline and market reactions

Bloomberg ETF analyst James Seyffart was positive about the SEC greenlighting the application in the ‘near future.’ He said,

“Kinda up in air with the GLS approval. I don’t know the exact timing, but near future. So technically we likely have many that will be coming in the next month+”

Despite the positive outlook, HYPE has been under pressure amid a broader sell-off and competition from rival perpetual DEX like Aster.

In fact, over the past week, a key whale has offloaded over $130 million of HYPE. The large player reduced its position by nearly half to 2.63 million HYPE (about $110M).

He rotated some of the profits to ASTER, further reinforcing rival competitors as HYPE’s short-term headwind.

That being said, with the ETF expectation and corporate treasury trend, will HYPE’s recovery odds improve?

In fact, Polymarket betters were assigning a 32% probability that HYPE could reach $70 by 2025.

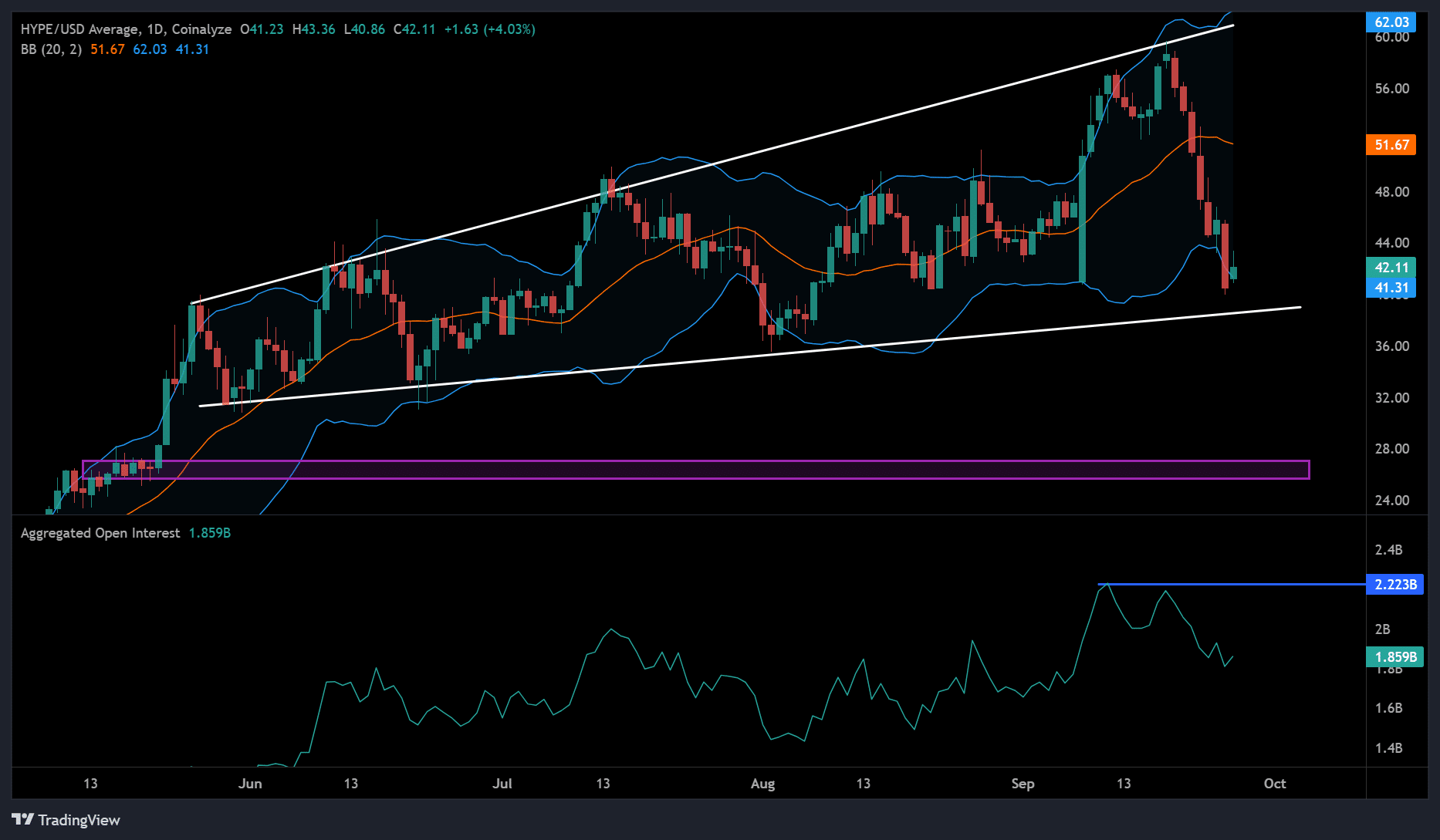

As of writing, though, HYPE’s speculative interest as measured by Open Interest (OI) was down 16% from $2.2 billion to $1.88 billion.

The dip in demand in the Futures market and weak sentiment have dragged HYPE lower by 31%. It has dropped from $59.6 to $49 and attempted to hold above $40 at the time of writing.

The $40 aligned with the range low of a megaphone (white). A breakout below the pattern would be bearish, while a bullish breakout would be positive for HYPE.

Meanwhile, whether the ETF expectation will ease the caution linked to upcoming monthly unlocks remains to be seen.

Post Comment