Mantle (MNT) Poised for a Breakout—But This Hidden Factor Could Change Everything for Investors

Ever found yourself wondering if a rising star in the crypto universe like Mantle [MNT] really has the grit to keep climbing higher? It hit a fresh all-time high at $1.91 recently, sparking a wave of optimism — yet, like any savvy investor knows, momentum can be a tricky beast. Daily charts whisper bullish vibes, but the past week’s subtle weakening stirs up caution, while the hourly chart’s recent bullish flip hints that maybe, just maybe, the bulls are gearing up for another charge. But here’s the kicker: breaking through the stubborn $1.69-$1.73 supply zone and the $1.86 range high stands as the ultimate litmus test for the next big breakout. So, is Mantle ready to soar past these hurdles and blast off toward $3 and beyond, or will current market jitters — especially Bitcoin’s ongoing correction — keep things rangebound for a little while longer? Let’s dive into the charts, the momentum signals, and what they mean for the coming weeks. LEARN MORE

Key Takeaways

Does Mantle have enough momentum?

On the daily chart, it seemed bullish, despite it weakening over the week. On the 1-hour chart, it flipped bullishly recently.

Can Mantle set new highs soon?

The $1.69-$1.73 supply zone and the $1.86 range high must be overhauled for the next uptrend.

Mantle [MNT] set a new all-time high of $1.91 on Tuesday, 23 September. At the time of writing, it seemed to have a strongly bullish outlook for the coming weeks, with the price prediction being a move to $2.34, $2.64, and possibly even the $3-mark.

However, with Bitcoin [BTC] facing a correction and market-wide sentiment cautious due to this week’s price action, MNT will likely remain rangebound in the short term.

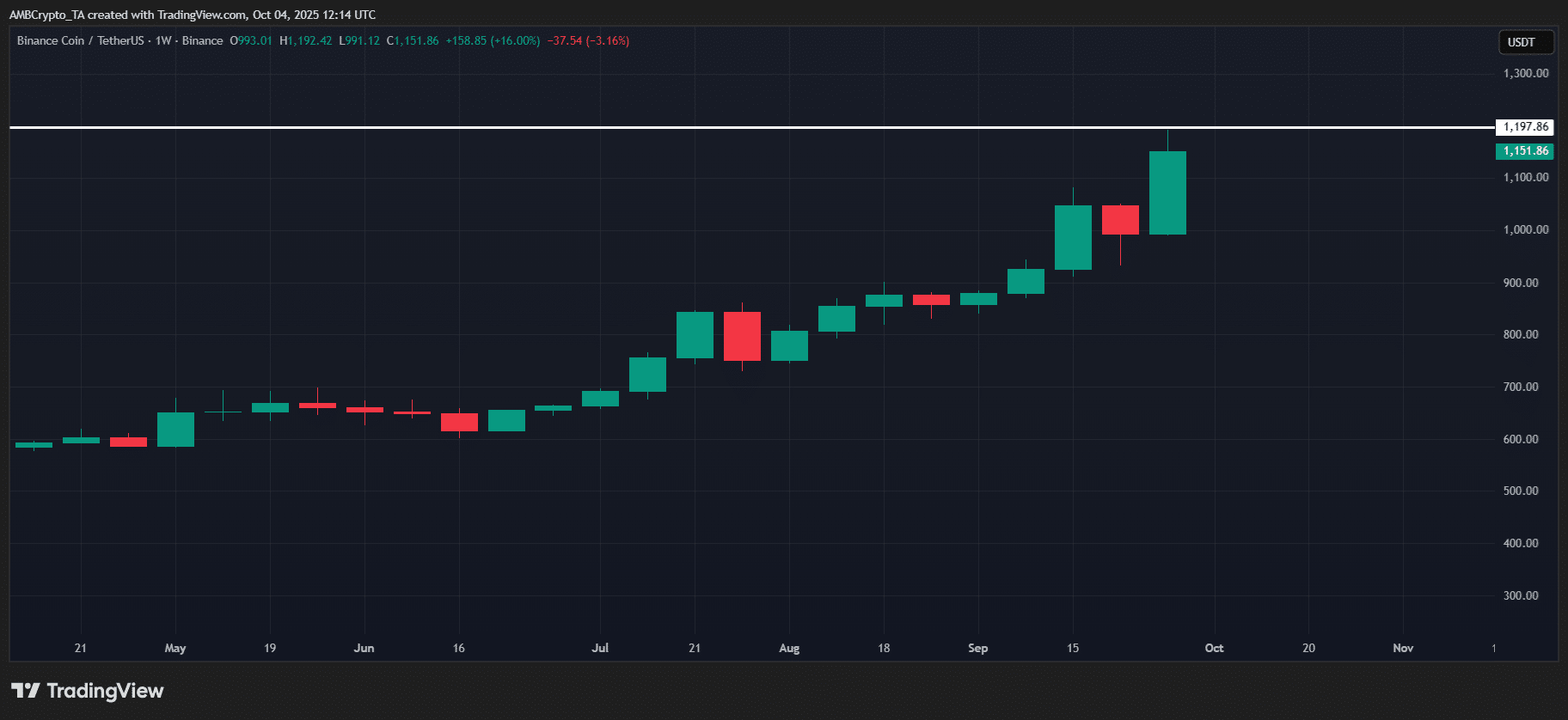

On the 1-day chart, the trend has been firmly bullish since August. After Mantle broke above the $0.84-resistance that had been in place since March, the strength of the buyers was established. The OBV also signaled a shift towards greater buying pressure, with the same beginning to trend higher in July.

The 20 and 50-day moving averages reflected steady bullish momentum. They also served as dynamic support levels. At the time of writing, MNT was bouncing higher from the 20-SMA at $1.6.

The Awesome Oscillator registered red bars on its histogram to reflect weak bullish momentum over the past week. During this time, MNT bulls ran into resistance at the $1.8-zone.

Bitcoin’s correction, which is still ongoing, has dented market sentiment in the short term though. The Fibonacci retracement levels showed that the $1.47, $1.377, and $1.245-levels would be key support levels in case of a price drop for MNT.

However, such a deep correction is not expected right now. A move past $1.8 is more likely. That should take Mantle’s price to $2.04 and $2.34.

Short-term MNT price prediction

Since the second week of September, MNT has traded within a range (cyan) that extended from $1.52 to $1.86. The mid-range resistance at $1.69 opposed further gains in the short-term.

The 1-hour chart highlighted the supply zone from $1.69-$1.73. MNT fell below this zone on Thursday, 25 September. And, it has not been able to climb back above since.

Finally, the Awesome Oscillator highlighted a bullish momentum shift with a crossover above the zero line. However, the OBV remained subdued compared to the start of the week. This suggested that buying pressure was not yet dominant in the lower timeframes.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Post Comment