Vanguard’s Crypto ETF U-Turn: What Their Delay Means for 50 Million Investors Ready to Strike Gold

So, Vanguard’s finally dipping its toes into the crypto waters — after playing hard to get for a solid stretch. Why the sudden change of heart? Turns out, it’s all thanks to client demand pushing the $10 trillion asset manager’s hand to open its brokerage doors to third-party crypto ETFs. No longer the outsider looking in, Vanguard’s decision to embrace crypto ETFs hints at a broader shift in how traditional finance views digital assets. What’s really intriguing though, is whether this pivot will turbocharge the crypto market or simply help Vanguard catch up with the pack. According to Bloomberg’s ETF guru Eric Balchunas, it’s a smart move and a positive signal for the sector — especially given Vanguard’s colossal investor base. So, is this just the beginning of more institutional crypto adoption, or a late encore performance? Let’s unpack the guts of this strategic shift and why every investor should be paying attention. LEARN MORE

Key Takeaways

Why has Vanguard changed its stance on crypto?

Client demand for crypto ETF access reportedly drove the shift, forcing Vanguard to adapt and open its brokerage platform to third-party products.

How will it impact crypto markets?

According to Bloomberg ETF analyst Balchunas, it will be positive for the sector.

Vanguard, a $10 trillion asset manager, is reportedly planning to offer access to crypto ETFs after distancing itself from the industry since 2024.

According to a former Fox Business reporter, Eleanor Terret, the firm is planning to allow clients access to third-party crypto ETFs.

The world’s largest mutual fund and second-biggest asset manager will enable access through its brokerage platform.

Reactions as Vanguard plays crypto catch-up

Gerald Gallagher, General Counsel at Sei Labs, confirmed the Vanguard plans, citing a senior insider familiar with the issue. He added that the asset manager had “regrets” and wished they had done it “sooner.”

Gallagher noted that the firm will not do original crypto ETF issuance but will offer access to third-party providers due to client demand.

By contrast, Bloomberg ETF analyst Eric Balchunas said the pivot was expected. He previously predicted that the new Vanguard CEO, Salim Ramji, who spearheaded BlackRock’s Bitcoin [BTC] ETF, would accept crypto.

He added that it was “smart of them” to end the Bitcoin ETF ban.

“Smart of them imo. Bitcoin and Ethereum [ETH] ETFs hugely popular, and Salim (the CEO) was one of IBIT’s midwives, so he knows.”

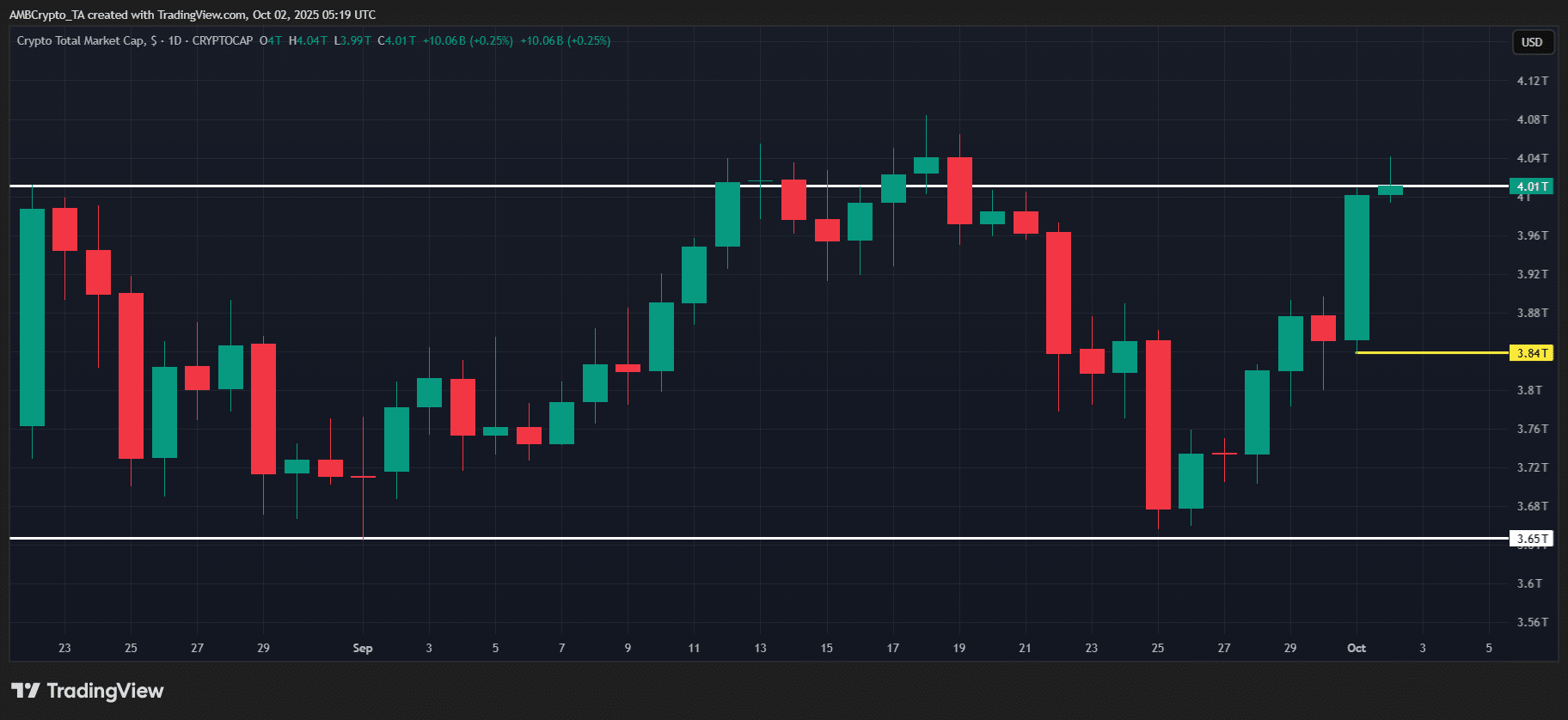

Market backdrop

As of September, BlackRock crypto holdings were worth about $100 billion. Its Bitcoin ETF, iShares Bitcoin ETF (IBIT), had over $85B worth of assets at current market prices.

Overall, the world’s largest asset manager was earning about $250 million in revenue from its crypto section, surpassing its equity business line.

Fidelity was the second-largest crypto ETF player, with about $25 billion in net crypto assets under management.

That being said, the details on Vanguard crypto ETF plans will be known in the near future. But the impact will be positive for the market, added Balchunas.

“Vanguard has 50 million investors. Obviously, many are not the bitcoin type, but that’s massive; they are the biggest fund company in the US by two times over.”

Post Comment