Why Ethereum’s Quiet Phase Could Be the Calm Before a Massive Crypto Storm—Here’s What Smart Investors Are Missing

Ever wonder what it means when Ethereum holders suddenly start acting like squirrels hoarding nuts come winter, refusing to leave their precious ETH on exchanges? Well, that’s exactly what’s happening — Ethereum Exchange Outflows are taking a nosedive, signaling a fresh wave of long-term confidence right around the $3,800 support mark. It’s as if the market’s whispering, “Hold tight, something big’s brewing.” Meanwhile, institutional investors are stepping up, piling into funds with a nifty surge to 6.5 million ETH, even as Spot ETFs play it a little more cautiously. Could this mix of savvy holders leaning in and cautious ETFs be the recipe for a breakout past the $4,000 barrier? Let’s dig into the data, decode these subtle signals, and see what might be propelling Ethereum’s next move — because in the game of crypto, knowing when to hold ’em might just trump knowing when to fold ’em. LEARN MORE

Key Takeaways

Why are Ethereum Exchange Outflows falling?

Outflows declined sharply, showing holders preferred keeping ETH off exchanges, strengthening long-term confidence near the $3,800 support level.

What signals support ETH’s next move?

Fund Holdings surged to 6.5 million ETH while Spot ETF flows showed caution, suggesting institutional backing could fuel a $4,000 breakout.

Ethereum [ETH] investors appeared less eager to take short positions. Over the last three days, Exchange Outflows from centralized exchanges declined sharply, according to recent CryptoQuant data.

The drop in Exchange Outflows suggested Ethereum holders grew confident and preferred to keep assets off exchanges for potential long-term gains.

Ethereum price action sparks reversal signals

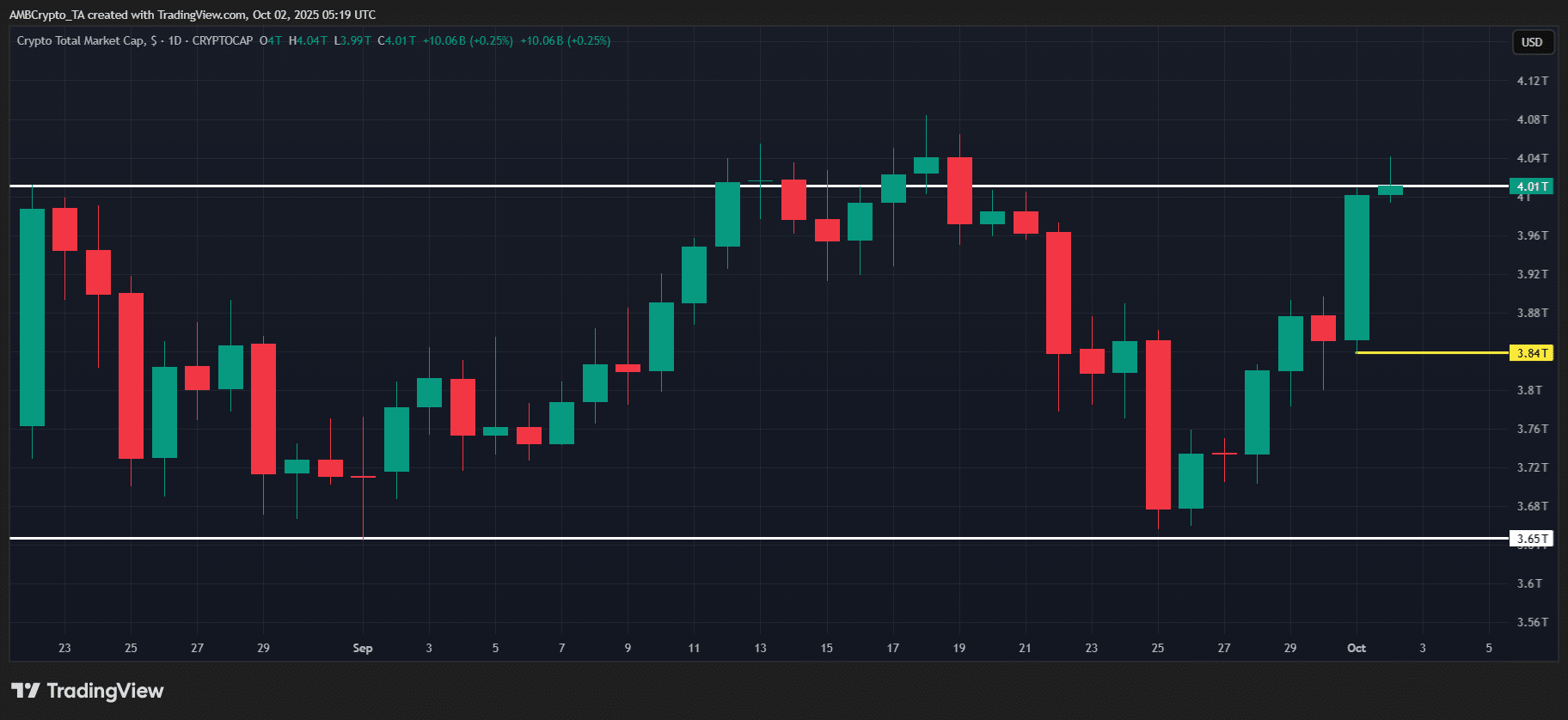

The shift came as the ETH price recovered from the gap rejection near $3,800.

After the rejection, Ethereum built upside momentum despite a brief stall over the last 24 hours. ETH recorded a 0.34% daily change, signaling low activity in the short term.

Even so, technical indicators pointed to longer-term optimism. Stochastic RSI approached oversold territory, showing bearish pressure exhaustion among Ethereum bears.

Institutional holdings strengthen the bullish case

Alongside retail sentiment, institutional exposure also grew.

Fund Holdings tied to Ethereum rose sharply, now totaling about 6.5 million ETH, not $6.6 million as earlier stated.

That steady rise reflected that larger players stayed engaged even as broader conditions remained volatile.

At the same time, Spot ETF Net Flow data painted a more cautious picture. The recent Total Ethereum Spot ETF Net Inflow indicated a slight surge in Ethereum ETF outflows.

Roughly $65,000 in Ethereum ETF outflows were recorded over the past 24 hours, according to CoinGlass. About $51,600 worth of Ethereum ETFs shifted into the ETHA product, with the remainder allocated to the FETH ETF.

Still, these ETF outflows were not large enough to significantly affect price action.

What is ahead for ETH

The convergence of shrinking Exchange Outflows, resilient fund inflows, and supportive technicals could set up Ethereum for a rally.

But still, for a stronger move to materialize, ETH will need to break through the previous trendline support that recently turned into a resistance.

As of writing, Ethereum held above the $3,800 demand zone. If buying strength persisted, a move toward the $4,000 psychological mark and beyond could follow.

Post Comment