South Korea and US Strike a Silent Deal to Keep Currency Wars in Check—What This Means for Global Markets!

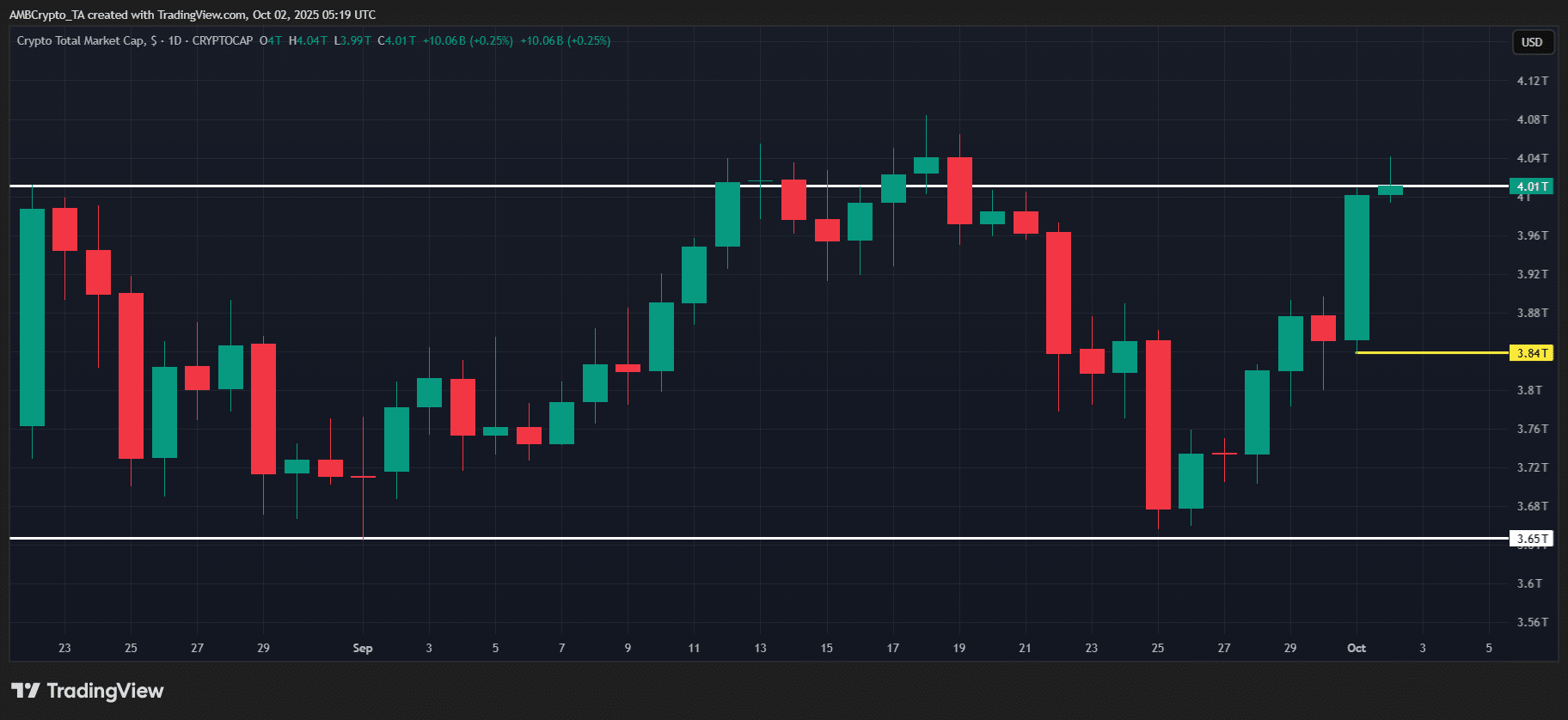

Ever wonder what happens when two economic powerhouses like South Korea and the United States shake hands on currency policy? It’s not just a diplomatic handshake — it’s a high-stakes dance with global markets watching every step. This week, they dropped a pretty tight joint statement promising no funny business with exchange rates, agreeing to keep interventions clean and transparent. But here’s the kicker — despite the commitment, the South Korean won didn’t exactly throw a party; it lost its early gains and reversed course almost immediately. Makes you think, right? Are these agreements more about calm talk than actual market magic? Stick around as we peel back the layers on what this could mean — from FX interventions to those subtle signals sent across the trading pits. LEARN MORE

South Korea and the United States (US) released a joint statement on a foreign exchange policy agreement on Wednesday.

Key takeaways

South Korea, US agree to avoid manipulating exchange rates to gain unfair competitive advantage.

South Korea, US agree any macroprudential, capital flow measures will not target exchange rates – joint statement

South Korea, US to exchange fxFX intervention operations on monthly basis.

South Korea, US agree FX market intervention should be reserved for combating excessive volatility and would be considered for both disorderly depreciation and appreciation.

The joint statement does not mention bilateral currency swap, South Korea’s state-run pension fund.

South Korean won erases early gains to turn lower after FX agreement with the US.

Market reaction

The South Korean Won (KRW) erased early gains to turn south after FX agreement with the US, with USD/KRW spiking from 1,402.50 to as high as 1,409.45 in the last hour. The pair is up 0.20% on the day, as of writing.

Post Comment