AUD/USD Dips Near 0.6600: What Australia’s Latest Data Means for Your Next Big Investment Move

You ever wonder how a single rumor can send waves through the markets faster than a viral tweet? That’s exactly what happened to the Australian Dollar (AUD) this Wednesday. Bloomberg dropped a bombshell claiming China’s state-run China Mineral Resources Group had told steelmakers to halt purchases from BHP, Australia’s mining heavyweight. Naturally, the AUD took an immediate hit, slinking down to trade near 0.6600 against the US Dollar during Asian hours. But hold on — the plot thickens. The Australian Financial Review quickly quashed the chatter, citing Mysteel, a Chinese commodity firm, who insists the story is baseless. Talk about a tug-of-war between fear and facts! Meanwhile, Australia’s industrial heartbeat isn’t racing just yet; the AiG Industry Index modestly climbed but still lingers in contraction territory at -13.2, and the manufacturing sector’s expansion slowed per the latest PMI numbers. And just to keep things spicy, the US Dollar isn’t flexing its muscles either, weighed down by weak US jobs data that’s fueling bets on imminent Fed rate cuts. So, what’s the play here? Is the AUD’s slump a fleeting hiccup or a sign of deeper turbulence amid global economic jitters? Let’s dive into this rollercoaster and unpack the moves shaking up currencies and markets alike. LEARN MORE

- Australian Dollar holds losses amid uncertainty after Bloomberg reported that China Mineral Resources Group instructed steelmakers to stop purchases from BHP.

- Australia’s AiG Industry Index climbed 7.6 points to -13.2 in September.

- The US Dollar struggles after recent US jobs data increased the odds of further Fed rate cuts.

The Australian Dollar (AUD) depreciates on Wednesday, with the AUD/USD pair trading around 0.6600 during the Asian hours. The AUD struggles after Bloomberg reported that China’s state-run iron ore buyer, China Mineral Resources Group (CMRG), directed steelmakers to stop new purchases from Australian mining giant BHP. The news came as China entered its October 1–8 holiday period.

However, the Australian Financial Review cited a Chinese commodity pricing firm, Mysteel disputed the report, saying it had “verified through relevant channels and confirmed that this rumour is not true.”

Australia’s AiG Industry Index rose 7.6 points to -13.2 in September, showing slight improvement but remaining in contraction. The S&P Global Manufacturing Purchasing Managers’ Index (PMI) fell to 51.4 in September from 53.0 in August, indicating that the sector continued to expand but at a slower pace.

The Reserve Bank of Australia (RBA) decided Tuesday to hold the Official Cash Rate (OCR) steady at 3.6% after concluding the September monetary policy meeting. RBA Governor Michele Bullock said at a post-meeting press conference that components of the monthly CPI little higher than expected, and inflation is not running away. Not giving forward guidance, will have more data in November, Bullock added.

Australian Dollar declines despite a weaker US Dollar on government shutdown

- The US Dollar Index (DXY), which measures the value of the US Dollar USD) against six major currencies, is remaining subdued around 97.80 at the time of writing. Traders are likely to await the release of September’s US ADP Employment Change and ISM Manufacturing PMI data, which could be affected due to the government shutdown.

- The Greenback remains subdued after soft US jobs data increased the odds of Federal Reserve (Fed) rate cuts. The CME FedWatch Tool suggests that markets are now pricing in nearly a 97% chance of a Fed rate cut in October and a 76% possibility of another reduction in December.

- The latest Job Openings showed the labor market is slowing, yet vacancies rose from 7.21 million to 7.23 million in August. Meanwhile, the hiring rate edged down to 3.2%, the lowest level since June 2024, while layoffs remained at a low level.

- The US government has shut down, with around 750,000 federal employees facing furloughs after Congress failed to pass funding bills. The US Labor Department said Monday that its statistics agency would suspend data releases, including Friday’s closely watched monthly jobs report, if a partial shutdown occurs.

- The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

- China’s NBS Manufacturing PMI improved to 49.8 in September, following August’s 49.4. The reading came in above the market consensus of 49.6 in the reported month. The NBS Non-Manufacturing PMI inched lower to 50.0 in September, from August’s 50.3 figure and missed the expectations of 50.3.

- Australia’s Building Permits fell 6% month-over-month in August, following July’s 8.2% drop and surpassing the forecast decline of 5.5%.

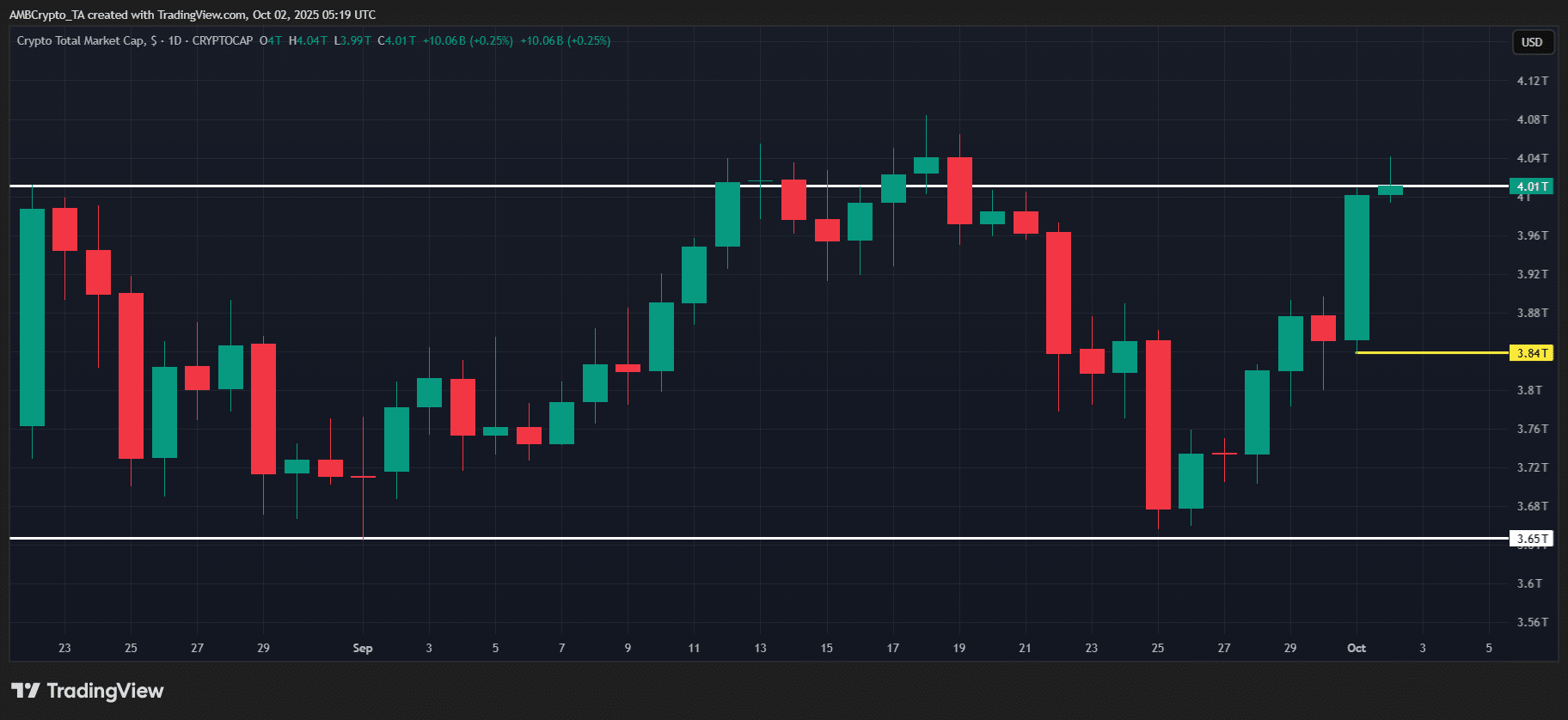

Australian Dollar moves below 0.6600 to near nine-day EMA support

The AUD/USD pair is trading around 0.6600 on Wednesday. Technical analysis on the daily chart shows that the pair has rebounded to the ascending channel, indicating a bullish bias is active. Additionally, the 14-day Relative Strength Index (RSI) is positioned slightly above the 50 level, strengthening the bullish bias.

On the upside, the AUD/USD pair may explore the region around the 12-month high of 0.6707, recorded on September 17, followed by the upper boundary of the ascending channel around 0.6760.

The immediate support lies at the nine-day Exponential Moving Average (EMA) of 0.6590, followed by the 50-day EMA at 0.6555 and the ascending channel’s lower boundary around 0.6540. A break below the channel would cause the emergence of the bearish bias and prompt the AUD/USD pair to navigate the region around the fourth-month low of 0.6414, recorded on August 21.

AUD/USD: Daily Chart

Australian Dollar Price Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.29% | -0.23% | -0.41% | -0.06% | 0.02% | -0.24% | -0.33% | |

| EUR | 0.29% | 0.08% | -0.16% | 0.23% | 0.34% | 0.08% | -0.04% | |

| GBP | 0.23% | -0.08% | -0.20% | 0.15% | 0.27% | 0.00% | -0.11% | |

| JPY | 0.41% | 0.16% | 0.20% | 0.39% | 0.44% | 0.42% | 0.19% | |

| CAD | 0.06% | -0.23% | -0.15% | -0.39% | 0.09% | -0.15% | -0.27% | |

| AUD | -0.02% | -0.34% | -0.27% | -0.44% | -0.09% | -0.26% | -0.38% | |

| NZD | 0.24% | -0.08% | -0.01% | -0.42% | 0.15% | 0.26% | -0.12% | |

| CHF | 0.33% | 0.04% | 0.11% | -0.19% | 0.27% | 0.38% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Post Comment