SEI’s 120% Surge: The Hidden Bullish Trigger Wall Street Doesn’t Want You to Know!

Ever wonder what keeps certain altcoins like SEI [SEI] holding the line when most are wobbling? This crypto contender didn’t just cling to $0.2887—it fiercely defended the $0.27 mark while boasting a jaw-dropping 16x surge in daily transactions since 2024. Talk about flexing some serious network muscle! But here’s the million-dollar question—can SEI capitalize on this momentum and sprint towards $0.36, especially with analysts spotlighting that crucial 50SMA support? As someone who’s navigated the wild waves of investment markets, I find SEI’s resilience and potential bounce-back intriguing, and it’s precisely this mix of solid fundamentals and savvy trader positioning that sets the stage for a possible breakout. If you’ve been watching the space, you know it’s not just about the flash—long-term network strength like SEI’s is what builds lasting value. So, what’s next for this altcoin? Let’s dive in and see why the experts are buzzing—and if the charts back up their optimism. LEARN MORE

Key Takeaways

Why does SEI matter now?

SEI held $0.2887, defended $0.27, and daily transactions grew 16x since 2024.

What could traders expect next?

Analysts flagged 50SMA support, suggesting that the altcoin might rebound toward $0.36 if momentum continues.

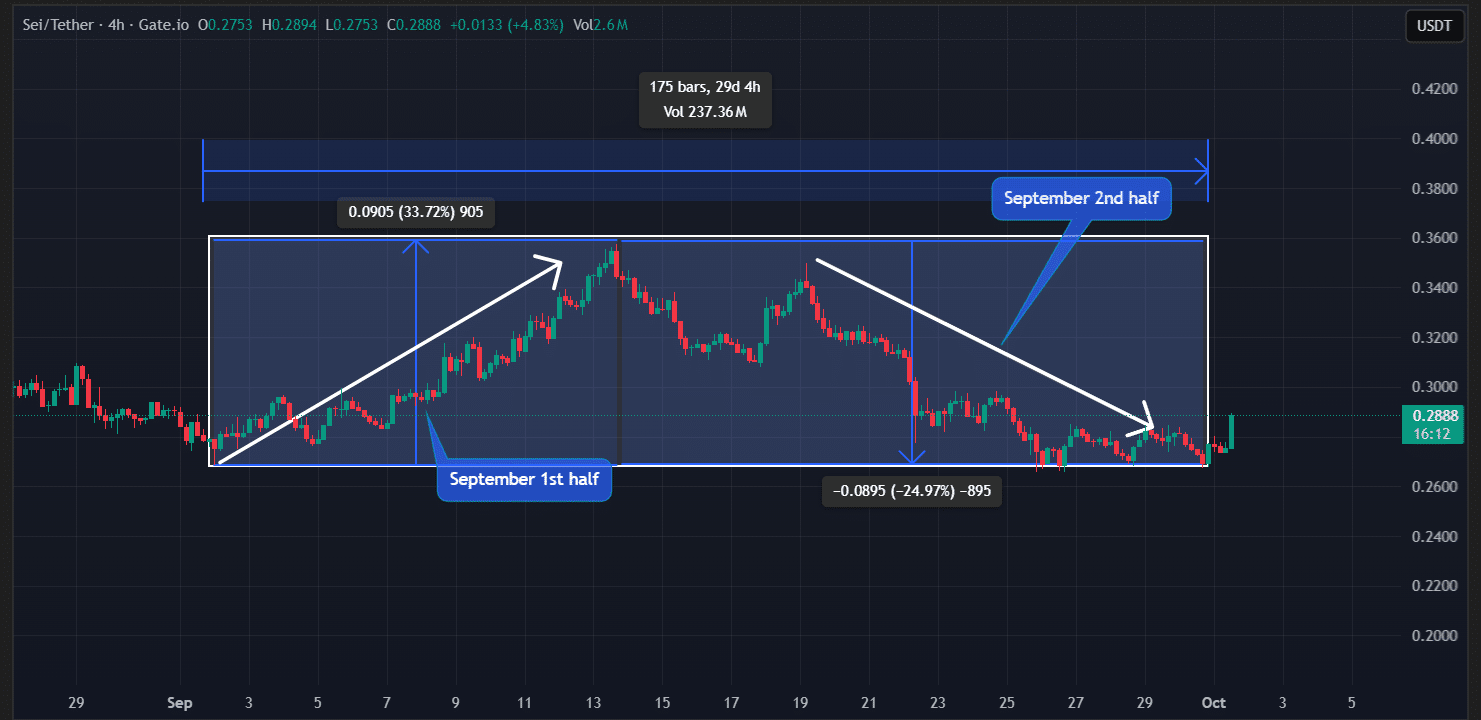

Sei [SEI] spent the past week consolidating near $0.2887 after a volatile September that erased early gains. TradingView data showed a 33.7% rally in the first half of the month, followed by a 24.9% pullback that left the price unchanged.

At press time, SEI traded near $0.2887, up 5% in 24 hours. Trading volume jumped 30% to $155 million, reflecting renewed participation.

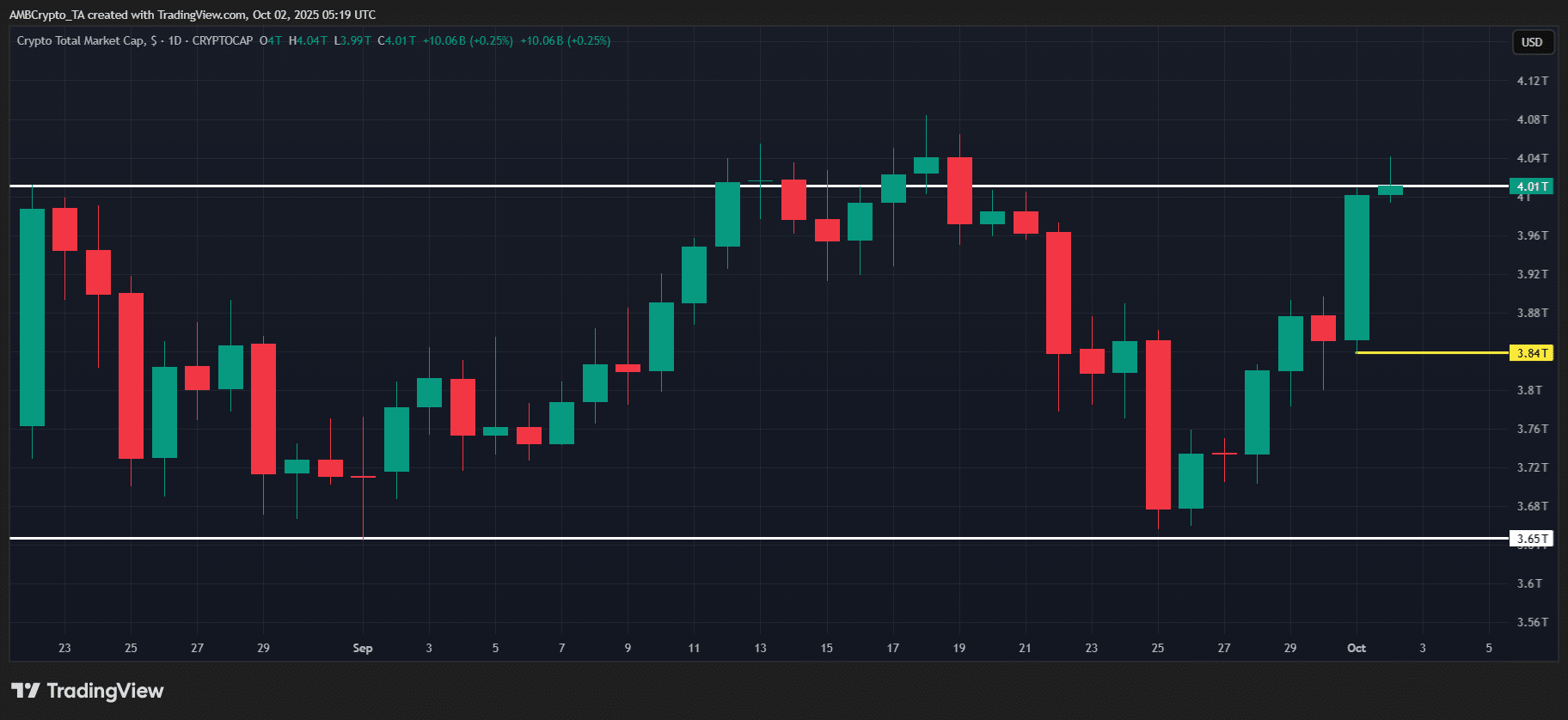

The key catalyst behind the altcoin’s sudden price uptick appeared to be Bitcoin [BTC] and other major assets that rallied significantly in recent hours.

In addition, another factor strengthening and propelling the alt’s price was its strong fundamentals.

Network fundamentals strengthen SEI’s case

Data shared on X (formerly Twitter) highlighted SEI’s network expansion.

Daily Transactions rose 16x since September 2024, while cumulative Volume climbed $73 billion in one year. This history kept sentiment constructive for long-term adoption.

Looking at the atlcoins’s price outlook, expert Ali Martinez shared a bold claim. In a post on X, he stated that SEI’s price appeared to be taking support from the 50 SMA on the 3-day chart.

The last time this happened, the asset experienced a 120% price uptick, which could potentially repeat.

Technical setup points to $0.36 for SEI

According to AMBCrypto’s technical analysis, SEI seemed bullish and poised for a massive upside rally. On the daily chart, the alt bounced from its support near $0.272.

If SEI’s upside momentum held above $0.272, the asset could rally over 25% toward $0.36 in the near term.

At press time, Bollinger Bands flashed a reversal signal. The altcoin bounced from the lower boundary, hinting at a potential shift upward.

Liquidation map signals trader positioning

CoinGlass revealed that SEI’s major liquidation levels, meaning where traders were over-leveraged, stood at $0.27 on the lower side and $0.293 on the upper side.

At these levels, traders have built $4.27 million worth of long positions and $665.86K worth of short positions.

Even so, this positioning suggested bulls defended the $0.27 zone, reflecting confidence that SEI would not slip beneath that level.

Post Comment