Why This $124K Bitcoin Retest Could Rewrite the Rules of Crypto Millionaires Forever

Just when you thought Bitcoin might be gearing up for another wild July-style leverage flush, the crypto landscape is throwing us a curveball — with some serious divergences stacking up like a high-stakes poker game. BTC dominance is holding strong at 59%, institutional ETFs keep streaming in, and long-term holders are tightening their grips, keeping the jittery hands at bay. It’s like watching the market holding its breath, daring Bitcoin to challenge that hefty $124k ceiling once again. Behind the scenes, $90 billion in open interest and a shifting tide of short-term coins flooding exchanges hint at potential volatility, but the real kicker? Minimal altcoin rotation and heavy institutional spot inflows are painting a scene ripe for a clean breakout rather than a messy trap. So, is Bitcoin prepping for a breakout party or just playing a risky game of cat and mouse with resistance? Let’s dive into why this time feels different and how the market’s pulse is keeping that bull trap at bay. LEARN MORE

Key Takeaways

Why is Bitcoin unlikely to see a July-style leverage flush?

Bitcoin divergences are stacking up. BTC.D is steady at 59%, ETFs continue flowing, and LTH conviction is rising, keeping weak hands in check.

What supports BTC’s potential breakout above $124k?

Heavy institutional spot inflows, minimal alt rotation, and underlying bid set up a clean path for price discovery.

Bitcoin [BTC] is hovering just 1.3% below its $124k all-time high, and all eyes are on whether it can punch through. Historically, this zone has carved out heavy resistance, which could temper investor risk appetite.

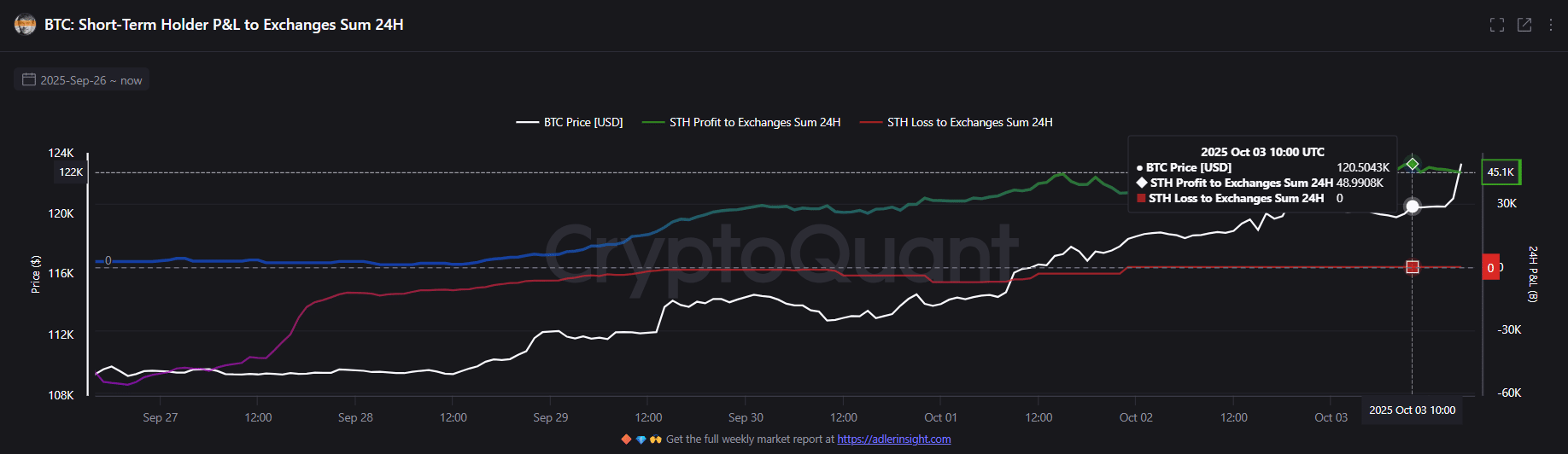

Reinforcing this, Open Interest (OI) has hit a fresh $90 billion ATH, marking a 7% jump from the last peak, while 46k BTC have flowed from STHs to exchanges, priming BTC for a potential volatility loop.

However, divergences are stacking up. BTC.D is holding 59%, unlike the August top when money rotated into alts. ETFs are still flowing in, with $985 million hitting on the 3rd of October, keeping bids under BTC strong.

Battle lines drawn as Bitcoin tests resistance

Bitcoin has kicked off Q4 as investors hoped.

In just over a week, BTC climbed from $108k to $122k, lifting its supply in profit from 84% to 99.5% and flipping above the short-term holder (STH < 155 days) on-chain cost basis of $111k.

Simply put, the 48k BTC moved by STHs at $120k wasn’t random. In fact, it was the largest 24-hour STH-to-exchange spike ever, showing weak hands are being shaken out as BTC approaches a key resistance zone.

Layer on overheated derivatives, and it’s a classic bull trap setup.

Case in point: Bitcoin’s the 14th of July all-time high. OI peaked at $87 billion, while STH NUPL (Net Realized Profit/Loss) hit 0.15, showing STH optimism. However, as BTC topped $122k, overexposed longs got flushed.

The result? OI slid to $80 billion, STH NUPL dropped to 0.05 in two weeks, syncing with BTC’s 8%+ dip to $107k. So, with the Long/Short Ratio still skewed bullish, are we looking at another textbook long liquidity sweep?

Divergences build as BTC bids stay supported

To sustain the rally, BTC needs to diverge from the previous two ATHs.

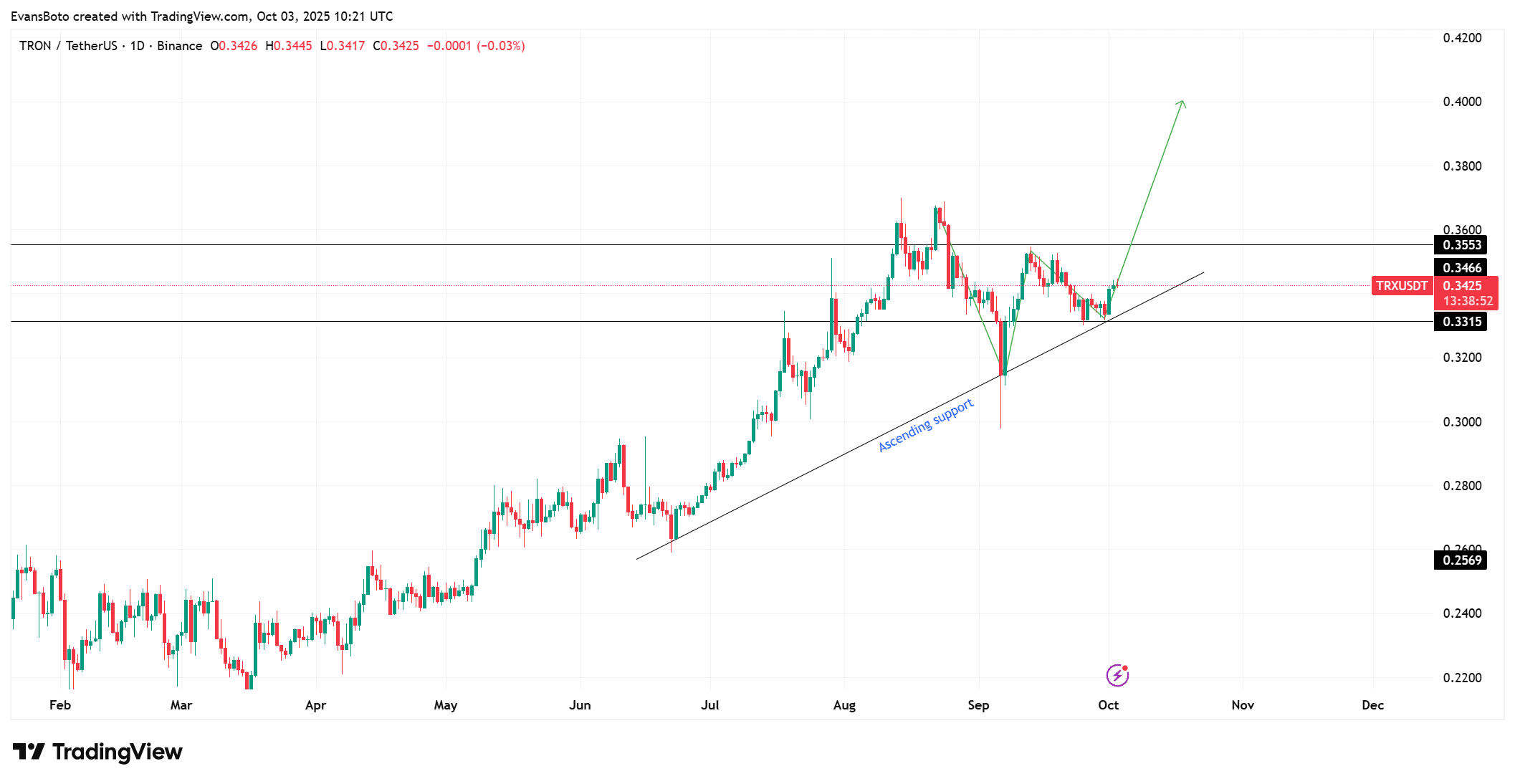

On the upside, Bitcoin dominance (BTC.D) is still holding 59% of the market cap, which amounts to roughly $2.48 trillion, while Ethereum dominance (ETH.D) remains well below the 15% peak seen in late August.

Meanwhile, the share of BTC held for 18–24 months has jumped to 5% for the first time since March 2024. In other words, more coins are moving into long-term hands, showing growing conviction in Bitcoin’s upside.

In short, these divergences are ruling out a July-style leverage flush.

Bitcoin’s retest of $124k is backed by heavy spot institutional inflows, minimal rotation into alts, and strong LTH conviction, setting up a clean path for price discovery, while also keeping a bull trap unlikely.

Post Comment