Why Gold’s $4,000 Breakout Is the Silent Signal Every Investor’s Been Waiting For—And What It Means for Your Portfolio Now

Ever wonder why gold still manages to steal the spotlight, even in an age dominated by digital currencies and volatile markets? With whispers growing louder that gold could soon top a whopping $4,000 an ounce, it seems the classic safe haven is back in vogue—and not just among the usual institutional players. Retail investors are flooding in, shifting their bets from traditional assets like treasuries to that shiny metal we’ve trusted for centuries. It’s like watching a comeback tour where both central banks and everyday investors are jamming to the same tune amidst the dizzying dance of global financial instability. If you think gold is just shiny rocks, think again—its role in portfolio strategies is evolving, and the market momentum suggests this glittering asset is gearing up for a historic surge. Curious to dive deeper into what’s fueling this golden rally? LEARN MORE.

Central banks and individual investors both turn to gold as a safe haven amid global financial instability and shifting portfolio strategies.

Key Takeaways

- Gold prices are projected to surpass $4,000 per ounce amid rising retail demand, as reported by The Wall Street Journal.

- Individual investors are increasingly moving funds from traditional assets like treasuries to gold, boosting price momentum.

Share this article

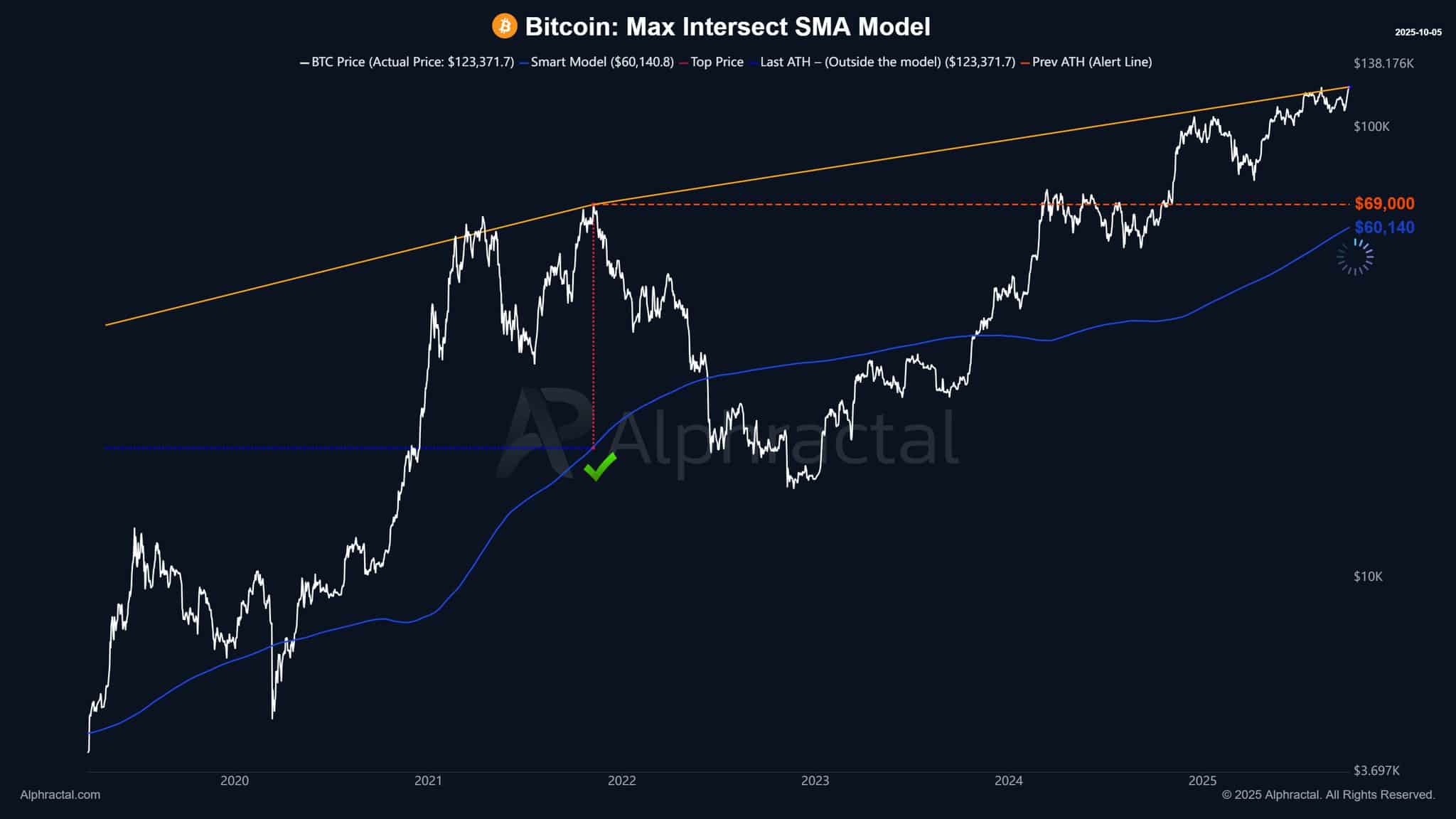

Gold is positioned to reach $4,000 per ounce as retail demand continues to surge, according to The Wall Street Journal. The precious metal has attracted significant interest from individual investors seeking alternatives amid economic uncertainties.

Private investors have shifted from traditional assets like treasuries to gold, amplifying upward price momentum. The trend has been supported by increased enthusiasm for gold through exchange-traded funds in 2025.

Central banks have actively increased their gold holdings as a hedge against geopolitical risks and currency devaluation. This institutional demand has reinforced the broader trend driving retail interest in the precious metal.

Goldman Sachs has updated forecasts to emphasize sustained central bank and investor demand for gold, highlighting its growing role in diversified investment portfolios.

Share this article

Post Comment