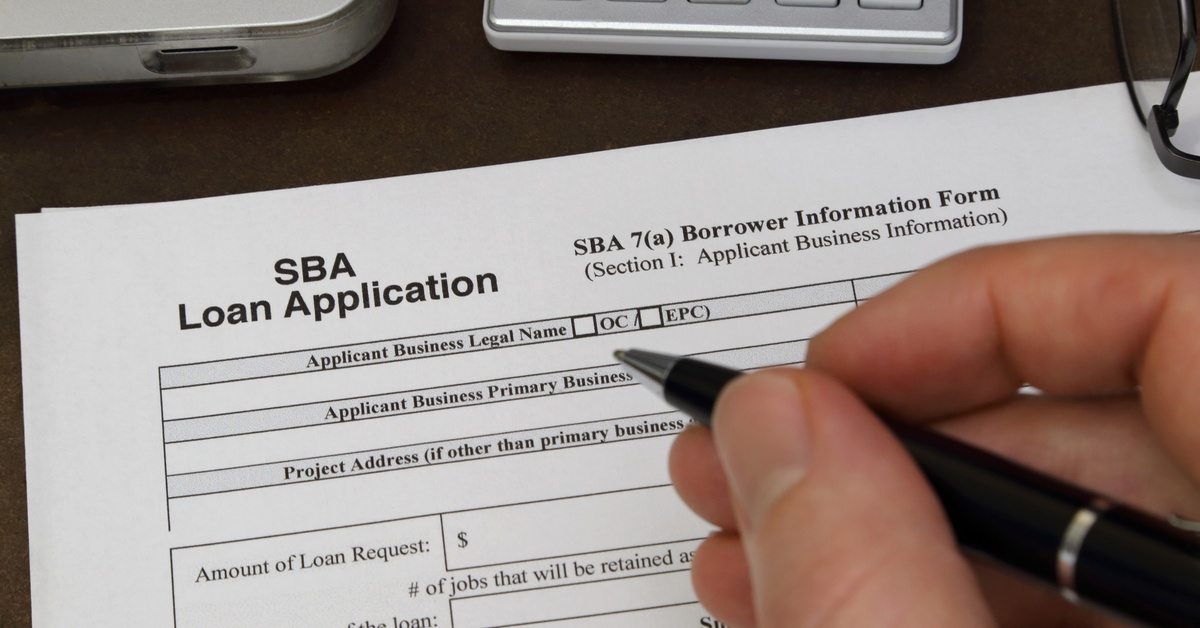

The Shocking Truth About SBA Loan Approval Timelines That Could Make or Break Your Next Big Move

Thinking about snagging an SBA loan for your business? Smart move! These loans come packed with perks — think competitive rates and smoother repayment plans — but here’s the catch: the approval process can feel like watching paint dry.

What if I told you that knowing the ins and outs of that timeline could save you a boatload of headaches? Stick with me here, and I’ll walk you through every twist and turn so you’re fully armed for the ride.

Kickoff: The Application Stage

Everything starts here. Picture your application as the golden ticket — but not just any ticket; it has to be pristine. Missing even a single crucial doc like a rock-solid business plan or proper financial statements? Expect delays. Gathering these might take a handful of days, or weeks if your records are scattered like confetti at a party.

Pro tip: double-check every line before hitting submit. A clean, complete app zips through quicker — fewer roadblocks, faster lender feedback.

What Unfolds After You Hit Submit?

The lender takes first crack at your file, scrutinizing your credit score, business health, and those numbers you’ve so meticulously compiled. This dance lasts 1-3 weeks. Pass this hurdle, and your dossier gets bumped to the SBA for their final verdict.

The SBA plays by its own clock. Popular loans like the 7(a) can dawdle for 3-4 weeks thanks to their stringent underwriting. Smaller, less tangled loans might speed by faster. Also, partnering up with a savvy lender familiar with SBA’s quirks? That’s like having pit crew speeding you ahead.

The Timing Game: What Slows You Down?

Not every application cruises through at the same pace. Got messy past financials or questionable business history? Your file might get flagged, triggering extra scrutiny — who wants surprises mid-race? Chat with your lender upfront about any potential bumps.

Startups, buckle up — securing funding often means longer waits. More paperwork, sharper focus on your revenue forecasts, and deeper dives into your business plan all add time. Is patience your strongest virtue yet?

Keeping The Momentum Alive

Nothing kills progress like radio silence. When lenders ping you, reply pronto. Got docs to share or questions to answer? Don’t make them wait. Lean into communication like your loan depends on it (because it does!).

A lifeline? An application checklist. Seriously. Gather everything from balance sheets to leader bios, and heck, even those quirky industry licenses so you’re not scrambling later.

The Finish Line: Final Steps

Congrats — your loan is approved! But don’t pop all the champagne just yet. Signing the dotted lines, ticking off last-minute conditions, and setting up disbursal can tack on another week. After that, you’re usually looking at 5-7 days before the cash hits your account. Sound worth the wait?

Closing Thoughts

Here’s the million-dollar question: What’s more certain in entrepreneurship than uncertainty? Patience and persistence — that’s your secret sauce to navigating the SBA loan maze. Play your cards right, handle what’s in your hands, and every step marches you closer to the sweet spot of funding your business deserves.

Hungry for savvy, out-of-the-box funding ideas? Pango Financial’s funding solutions tool is your backstage pass — a must-have for any entrepreneur serious about growth!

Post Comment