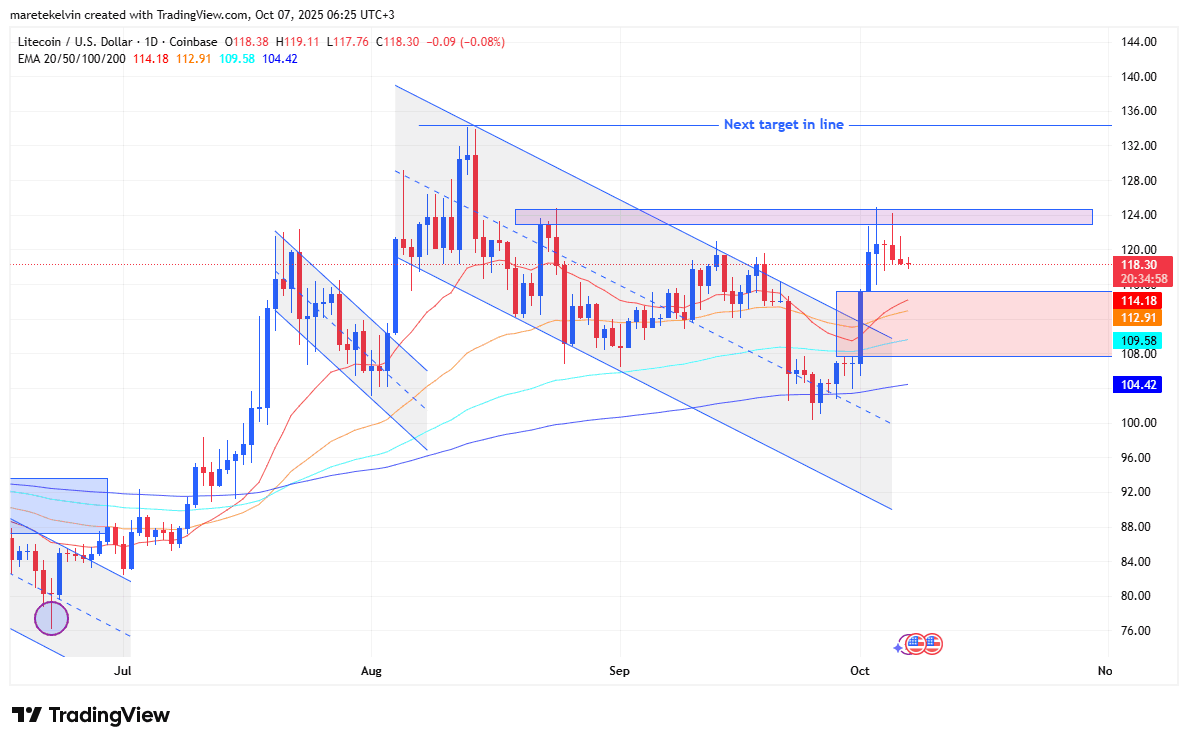

The One Resistance Zone That Could Skyrocket Litecoin to $135—Are You Ready to Capitalize?

If you’ve been watching Litecoin lately, you might be wondering: Can this crypto really shake off recent dips and shoot for the stars again? Well, it’s holding strong above the 20-day EMA, which is no small feat in these choppy markets. Add to that a rising open interest—a telltale sign that the big institutional players are quietly piling in—and suddenly, LTC’s looking like it’s gearing up for a serious rally. But here’s the kicker: to keep the momentum humming, Litecoin has to successfully breach the $124 supply zone; otherwise, all bets might be off before it even eyes the $135 resistance. It’s a fascinating tug-of-war between sellers and buyers, and if you’re in the game, now’s the time to pay close attention—because this could be the moment LTC flips the switch from consolidating to breaking out. Intrigued? Let’s dig into the details. LEARN MORE

Key Takeaways

What supports Litecoin’s bullish outlook despite recent corrections?

LTC’s sustained hold above the 20-day EMA and rising open interest signal strong institutional accumulation and bullish sentiment.

What level must LTC clear to continue its rally?

LTC needs to break past the $124 supply zone to target the $135 resistance level.

Litecoin [LTC] is showing signs of renewed momentum on the daily chart after multiple rejections at the $124 supply zone. The altcoin’s sell-side momentum seems to be fading as the prices approach the market gap at around $115.

Despite minor pullbacks in recent days, Litecoin has maintained its position above the 20-day Exponential Moving Average (EMA), which continues to serve as short-term support.

This stability boosts confidence among investors and traders considering long positions around $115, particularly given the still-bullish long-term outlook.

However, if the EMA support fails and prices drop below it, sellers could regain control and shift market momentum.

Institutions enter as Open Interest surges

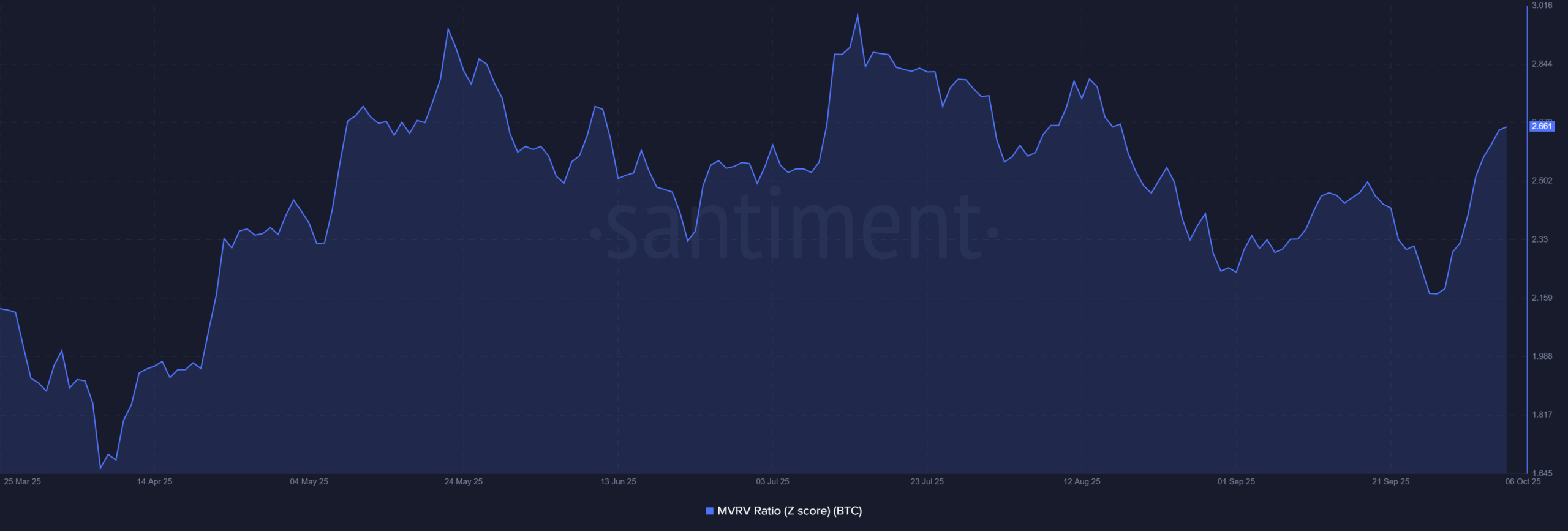

On-chain metrics also support the long-term bias. One encouraging signal flashing green lights for bulls is the sharp rise in Open Interest (OI).

LTC’s OI stood at 730 million, at press time, a significant surge from last month’s dips that pushed the open interest down to 600 million.

The steady climb suggests that institutional traders are re-engaging with LTC, adding leveraged positions that could amplify any sustained upside move.

Analysts often view rising OI during consolidation as a sign of accumulation, especially when it aligns with key technical levels of the holding firm.

Source: Messari

LTC’s Sharpe Ratio hints at more returns

Alongside steadily surging institutional activity, LTC’s 90-day Sharpe Ratio is also on a surge. The ratio stood at 2.14, as of writing, underscoring improved returns for long-term investors relative to risk.

The rising Sharpe Ratio indicates that LTC holders are being rewarded for playing the long game, a dynamic that preceded continuation trends in the past.

LTC trend points to healthier investor sentiment compared to earlier months, when returns lagged behind market benchmarks.

$135 resistance zone in focus

The key question among the investors and traders at the moment is whether the combination of institutional interest and improving long-term metrics can fuel a decisive breakout for LTC.

Breaking above the $124 supply zone could pave the way for LTC to rally toward the $135 resistance level from a technical standpoint.

However, if momentum weakens, a short-term pullback to fill the market gap at $115 or a retest of the 20-day EMA support may occur.

Post Comment