Unlock Hidden Savings: The Secret to Cheaper Bond Funds Nobody’s Talking About

Ever wondered if bonds are the misunderstood middle child of the investment family? Just when you think they’ve settled down and found their place, Vanguard shocks the scene by slashing fees on seven of its bond ETFs—barely a whisper in the financial noise, yet a move that’s got savvy investors scratching their heads. Is it a desperate plea to breathe life back into a tired asset class post-2022’s infamous bond crash, or a savvy repositioning as money quietly floods back into bonds despite the lingering skepticism? I got the skinny from a sharp Monevator reader who nudged me to dig deeper, and what I found flips the script on conventional wisdom. Bonds aren’t just limping along; they’re staging a comeback with yields that might just make your portfolio sing—and with fees dropping even lower, the questions are: Are bonds ready to reclaim their glory? And are we ready to rethink our biases? Let’s untangle the paradox and discover why even the “safe” haven might deserve a second look. LEARN MORE

What caught my eye this week.

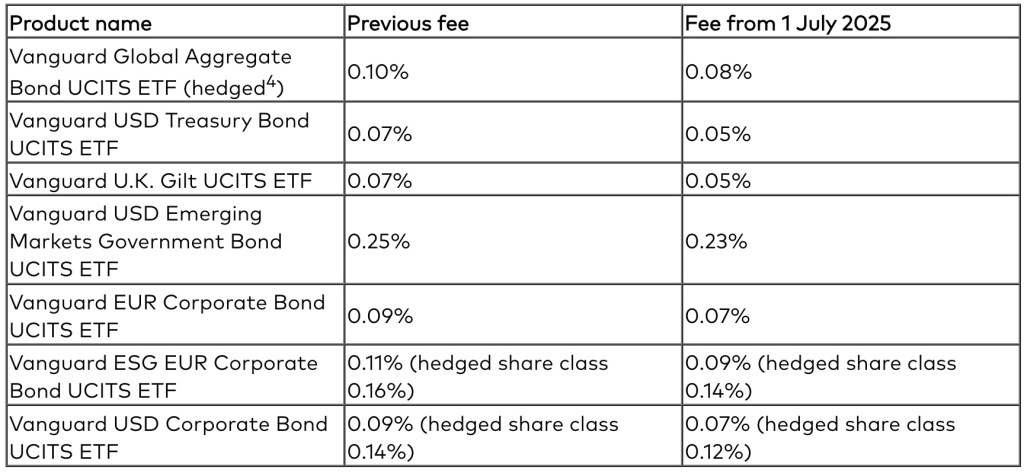

Vanguard cut the fees on seven of its bond ETFs this week. For the full list see the table below.

I got a heads-up on this fee-flailing from a thoughtful Monevator reader. They speculated that perhaps the price cuts were needed to gee up enthusiasm for bonds after the big crash of 2022.

Given the scorn that some Monevator commenters heap upon bonds nowadays, I can see where this thinking comes from. But I don’t believe it’s right.

In fact money has been pouring into bonds recently.

UK bond funds recorded net inflows of £57bn in 2024, after two years of outflows.

Also many cash-rich private investors have also been buying short-dated gilts for the tax benefits. We explained why and how in a member post in November.

So why the disconnect?

Once bitten by bonds

I believe that many thoughtful and engaged passive investors were a bit blindsided by the bond rout as interest rates soared a few years ago.

These investors had commendably educated themselves about the benefits of a diversified portfolio.

But they’d taken away an over-simplified mantra that ‘bonds are safe’, and skipped the small print.

In fact, bonds at near-zero yields were primed for likely poor returns. The unpredictable thing was the bad returns came all at once. Instead of a slow bleed for a decade, balanced portfolios lost an artery.

Thus investors who’d put their money into, say, a 60/40 portfolio believing they were doing the responsible thing were blindsided when owning bonds made things even worse in 2022. Not such much a buffer as melting butter.

It might have gone differently. There are timelines were equities crashed and instead of inflation we got deflation. For instance: if governments and central banks hadn’t flooded the system with liquidity to fight the pandemic in 2020. In that case, think 1930s lost decade-style returns for equities.

True, you probably still wouldn’t have seen good returns from bonds – that’s maths – but annualised small losses from bonds may have buffered huge declines in the stock market.

Bonds are back

Today’s expected returns for bonds are much healthier anyway.

The yield-to-maturity on a ten-year gilt is 4.5%. Lend the government money for three decades and a 30-year gilt will pay you 5.2% annualised for doing so.

Of course you have to account for inflation, but in theory that should be around 2%. If you’re not convinced that will hold then an index-linked gilt of the same duration will deliver a 2% real return, if held to maturity.

Lower fees please

Vanguard’s cuts are small in that they’re just a few basis points – but chunky reductions with respect to these already tiny fees:

Source: Vanguard Investor

What’s ironic is that these fee cuts have come when the expected returns from bonds are much higher.

Even ten basis points of fees made barely-there returns even worse when fixed income was brain-numbingly expensive back in 2020.

But with expected annual returns from UK bonds in the 4-5.5% range, smaller fees are gilding the lily.

Finally – just to reassure the strangely persistent Vanguard conspiracy theorists out there – no Vanguard didn’t pay for this post. It didn’t even alert us about the price cuts.

And yes other good ETF providers are available.

I just thought the move was worth highlighting given Vanguard’s size and all the ongoing confusion about the asset class.

Also, it’s a great demonstration that even very cheap funds can get cheaper.

Have a great weekend.

p.s. If you’ve ever been a fan of Formula One racing then you need to see F1: The Movie on a big screen. It’s Top Gun: Maverick on wheels and a nostalgic blast from the past!

From Monevator

Profiting from the UK stock market liquidation – Monevator [Mogul Members]

Trump’s ‘revenge tax’ and your US investments – Monevator

From the archive-ator: What to expect from commercial property – Monevator

News

Starmer’s benefits U-turns will cost £4.5bn, warns think tank – Independent

Number of higher-rate UK taxpayers expected to breach 7m this year – Guardian

Workers on-track for a ‘lost decade’ of stagnant earnings – Resolution Foundation

JP Morgan turns bullish on British bonds – This Is Money

UK set to ‘lose more millionaires’ than any other country… – City AM

…while new map shows where Britain’s population will grow by 2032… – Yahoo

…with 300,000 middle-earners priced out of Inner London by 2035 – Standard

Edinburgh GDP-per-head surpasses London for the first time – Edinburgh News

Gates close for private equity buying British companies cheap – This Is Money

European countries ranked by average family income [Infographic] – Visual Capitalist

Russia’s economy is down but not out – BBC

The US has bounced back into the danger zone (decile 1 in this chart) – Charlie Bilello

Tough jobs market mini-special

UK graduates enduring worst jobs market since 2018, says Indeed – Guardian

Young people face a hiring crisis. AI isn’t helping – The Atlantic

UK jobs market is among worst I’ve ever seen, says Reed CEO – City AM

Big Four slash graduate jobs as AI takes on entry-level work – City AM

Government launches £54m fund to attract top researchers and innovators – GOV.UK

Young professionals swamped by ‘infinite workdays’ – Guardian

Economic inactivity is falling, but there’s more to be done – Economics UK

Products and services

Zopa enters current account market with cashback and 7.1% savings interest – Standard

Retirees risk losing thousands by not shopping around for annuities – Which

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this link. Terms apply – Charles Stanley

Premium Bond prize fund rate will be cut from August – P.A. via Yahoo

eSims for traveling abroad: how much can you save? – Be Clever With Your Cash

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply. Capital at risk) – InvestEngine

10 ways wedding guests can save money in 2025 – Which

Got your Monevator mug? – Monevator shop

Mortgages and property mini-special

Nationwide changes rules to allow first-time buys with a 5% deposit – T.I.M.

FCA revisits rules on interest-only mortgages – Guardian

Average two-year BTL rates below 5% for first time since 2022 – T.I.M.

Ten hotspots for million pound properties – Rightmove

Rules protecting homeowners from repossession may be scrapped – Guardian

Homes for sale in harbour towns and villages, in pictures – Guardian

Comment and opinion

Are UK workers over-taxed? Three infographics – Tax Policy Associates

Happiness and money – Humble Dollar

The rollercoaster ride of Britain’s financial markets [Paywall] – FT

Allan Roth: lessons on money and life learned from Warren Buffett – Advisor Perspectives

What’s better than US bonds for downside protection? – Of Dollars and Data

Being human means being a bad investor – Behavioural Investment

A 2025 perspective on active management’s persistent failure – Wealth Management

Investing in inflation-linked government bonds [US but relevant] – Morningstar

If IHT rules come in, there will be a ‘sea change’ in retirement portfolios – FT Adviser

Naughty corner: Active antics

Investment trust numbers down 17% as ‘takeover frenzy’ continues – Trustnet

Swapping a rental property for a share portfolio – Fire V London

Cliff Asness of AQR on quant investing and more [Podcast] – Money Stuff

The King of Spacs is back [Paywall] – FT

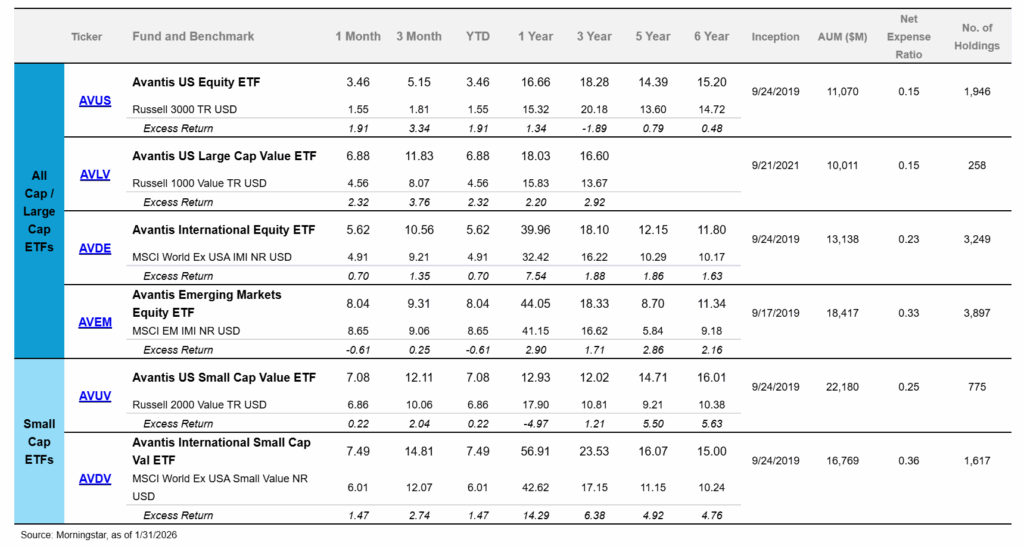

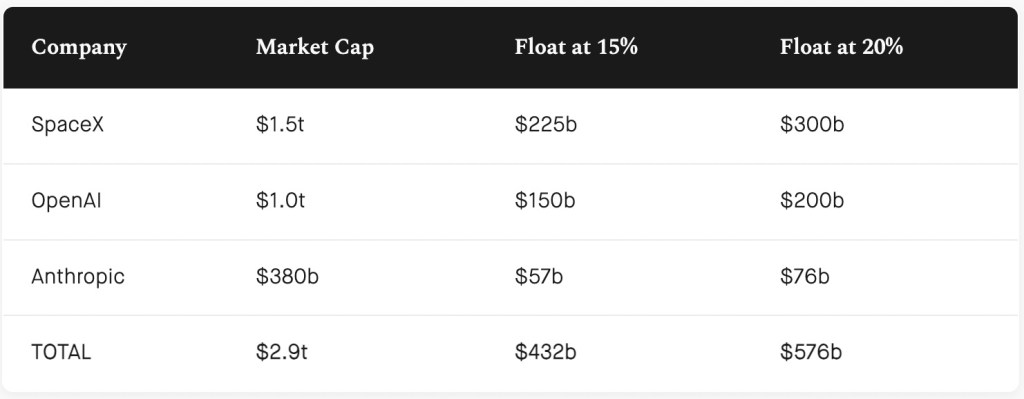

Private markets are eating the world – The Irrelevant Investor

Bitcoin company goes from £4m to £1bn in two months [Um…] – This Is Money

Are stablecoins money? [Paywall] – FT

Kindle book bargains

How to Own the World by Andrew Craig – £0.99 on Kindle

The Algebra of Wealth by Scott Galloway – £0.99 on Kindle

The Big Short by Michael Lewis – £0.99 on Kindle

Skunk Works: A Memoir of My Years at Lockheed by Ben Rich – £0.99 on Kindle

Environmental factors

Green investing with a vengeance – Klement on Investing

The next financial crisis could start with the climate [Paywall] – FT

What do floating solar panels mean for wildlife? – Grist

Plastic bag bans and fees curb shoreline litter, study suggests – BBC

Extinction crisis could see 500 bird species disappear within a century… – Guardian

…and it’s looking bad for coral reefs, too – Guardian

No meat mini-special

Why there’s a growing backlash against plant-based diets – The Conversation

Vegan, but you don’t try to convert others? You’ve a high EQ – VegOut

Robot overlord roundup

Is talking to ChatGPT about personal finance ever a good idea? – White Coat Investor

Can AI speak the language Japan tried to kill? – BBC

Recalculating the costs and benefits of Gen AI – Harvard Business Review

Checking in on AI and the Big Five – Stratechery

Judge rules Anthropic training on books it purchased was ‘fair use’ – Sherwood

How AI models remember, not predict, financial data – Larry Swedroe

Not at the dinner table

How Britain’s new political divide delivers votes to Reform and the Greens – The Conversation

The neocons a generation on [Paywall] – Financial Times

Attention and speculation are now primary economic drivers – Kyla Scanlon

In the US, the expectation of political violence is becoming endemic – The New Yorker

Off our beat

Science says these five simple tests can predict how long you will live – Inc

The business of betting on catastrophe – MIT Press

Elio sees Pixar peter out… – Spyglass

…with its woes emblematic of bigger problems for Hollywood – CNBC

The afterlife of our online accounts – Six Colours

Prescribe weight-loss drugs first, say top cardiologists – Fortune

Inside Hollywood’s $200m bet on Formula One – Huddle Up

The UK’s best seaside towns, ranked – Which

And finally…

“What was generally described as a ‘financial crisis’ a decade or so ago was just part of a huge structural change in how the world’s economy works. This is not some temporary cyclical blip; it is not just part of a normal business cycle. Things are not going to return to ‘normal’ and the economy is not going to ‘recover’, at least not to the way it was between 1945 and 2007.”

– Andrew Craig, How To Own The World

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment