Solana’s Transactions Crash 50% Amid Price Surge – What the Market Isn’t Telling You Could Change Everything

Isn’t it curious when the market’s pulse tells two very different stories at once? Solana’s native token, SOL, has been flexing with a price rally, yet the daily transactions on its network have plunged by a staggering 50%. What gives? According to CryptoQuant’s latest report, this disconnect hints at a market being driven less by real, organic growth and more by speculative fervor and trader sentiment. It’s like cheering for a game where the home team barely showed up—price action is up, but actual network activity took a nosedive. This raises a pressing question: Are we witnessing a token price bubble inflated by hype, or does Solana have a silent strength beneath the surface? Digging deeper into the data might uncover whether the network’s slowing activity is a sign of caution or just a temporary shift in user behavior. Ready to dive into what this means for Solana and the crypto landscape? LEARN MORE

Key Takeaways

- Solana’s daily transactions have decreased by 50% although SOL token price is up.

- Speculative trading and sentiment may be driving SOL’s gains rather than organic network growth, per the report.

Share this article

Solana daily transactions have dropped 50% despite the network’s native token $SOL recently experiencing a price rally, according to CryptoQuant, an on-chain data analytics provider.

The decline reflects reduced on-chain activity as meme coin enthusiasm shifts to competing platforms like BNB Chain.

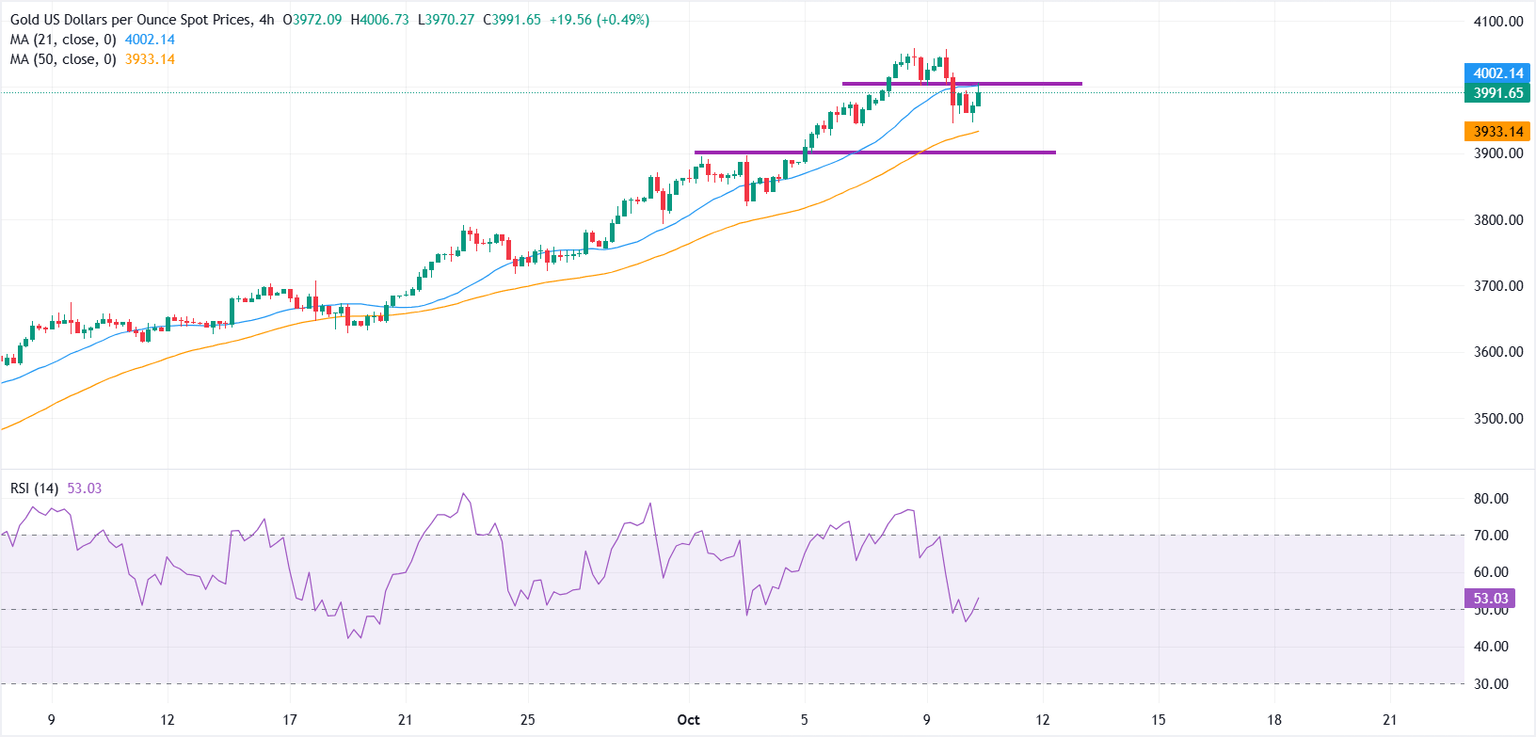

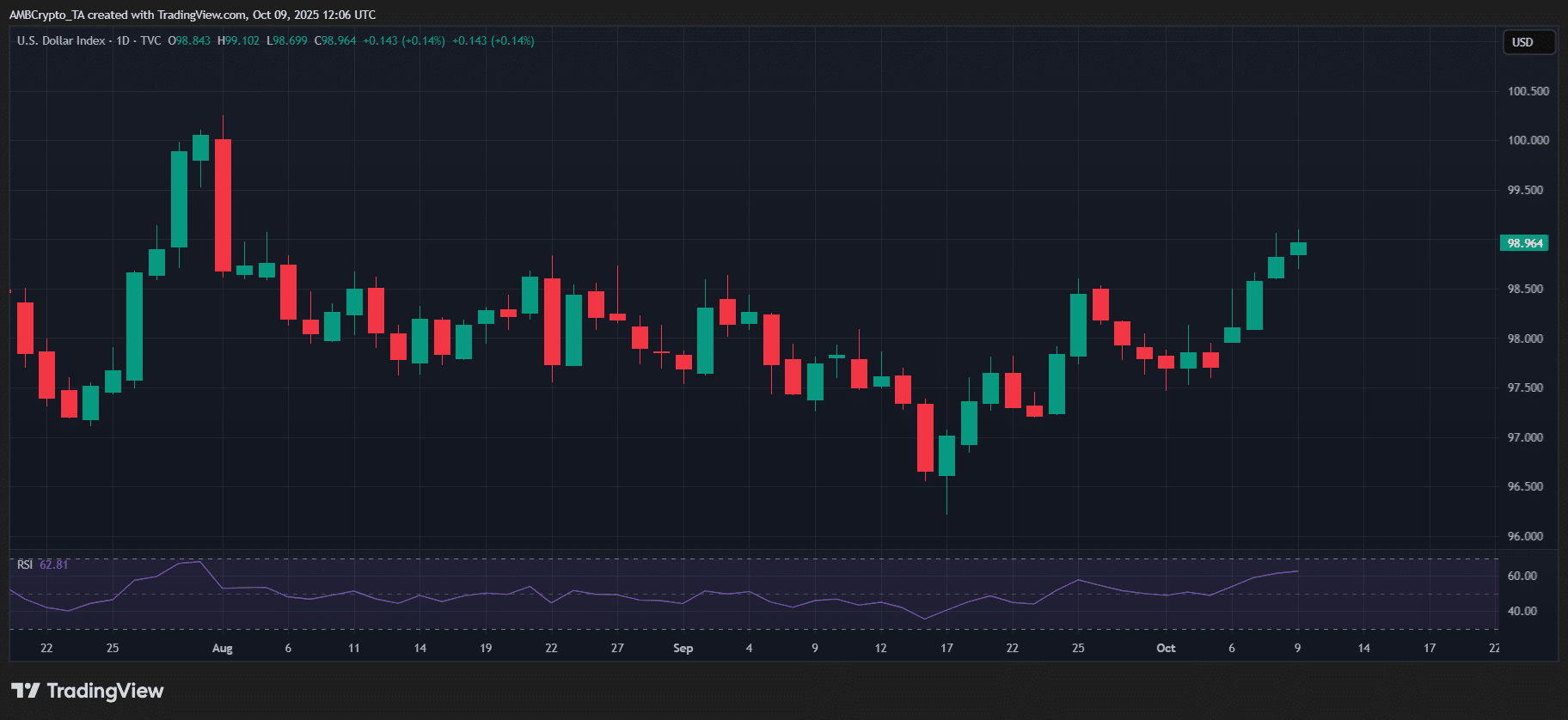

The report shows a negative divergence between price momentum and on-chain activity, suggesting that the recent price surge may be driven more by speculative market sentiment than by organic network demand. In a healthy market cycle, price appreciation typically coincides with growing on-chain engagement.

The decline in network activity warrants further analysis to determine whether it comes from a drop in user-driven transactions across DeFi and NFTs, or from a reduction in validator voting activity, which accounts for the majority of Solana’s on-chain operations.

Share this article

Post Comment