Why the Fed’s Post-Shutdown Playbook Could Ignite Crypto’s Biggest Shakeup Yet—And What Smart Investors Need to Know Now

Ever wonder why crypto keeps pulling in massive cash flows even when the bigger economic picture looks like a shaky Jenga tower? It’s like investors are sprinting ahead of the Fed’s next move, betting on the whispers of rate cuts while the U.S. government teeters in a shutdown-induced data blackout. Bitcoin didn’t just nudge upwards; it soared straight into uncharted territory at $125k, fueled by delayed key reports and the usual October mojo that seems to give markets a seasonal jolt. Meanwhile, the greenback is flexing hard — strengthening enough to squeeze liquidity and push money out of riskier assets like crypto, and back into the so-called safety of U.S. Treasuries. That $90 billion crypto sell-off this week? Far from random panic. It’s a calculated dance ahead of Fed Chair Powell’s big post-shutdown debut conference, where the tone he strikes could either fuel the bullish “rate cut” hype or slam the brakes. So here’s the million-dollar question: Are we witnessing a market that’s brilliantly front-running good news, or just setting itself up for a rude awakening? Buckle up — the next few weeks could redefine the macro and crypto playbooks alike. LEARN MORE

Key Takeaways

Why is crypto seeing major flows despite macro uncertainty?

Delays in key U.S. data and seasonal October tailwinds have funneled billions into crypto, with BTC hitting $125k as the market front-runs potential Fed rate cuts.

How are the dollar and bond markets impacting crypto?

A stronger USD tightens liquidity, making risk assets more expensive, while money rotates into U.S. Treasuries. The $90 billion crypto sell-off reflects these flows ahead of Powell’s post-shutdown conference.

The U.S. traders are waking up to a shaky macro pulse.

The next FOMC is just 20 days out, but updates are scarce amid the Federal shutdown. The backdrop already leans dovish for potential rate cuts. Bitcoin [BTC] breaking into an ATH further reinforces this setup.

However, the Fed Chair Powell is set to deliver his first conference post-shutdown, and the market is clearly on edge. Traders are left wondering whether his tone will reinforce a rate-cut narrative or not.

September FOMC minutes: What traders need to know

The Fed recently released highlights from its September minutes.

The report emphasized weaker-than-expected employment data. According to ADP, 32k jobs were lost in September, adding pressure for the Fed to consider rate cuts despite a 0.2% uptick in inflation. The report highlighted,

“Near-term expectations for the policy rate had moved lower in response to weaker-than-expected employment data and the apparent rise in downside employment risks.”

It further stated,

“Almost all respondents to the Desk survey expected a 25 basis point cut in the target range for the federal funds rate at this meeting, and around half expected an additional cut at the October meeting.”

In short, the Fed isn’t on the defensive, with half of its members agreeing on an October rate move. All eyes now turn to the Community Bank Conference, where analysts will assess the shutdown’s impact on banks.

According to AMBCrypto, the impact will be key in mapping the U.S. macrocycle and, more importantly, in gauging potential flows into the crypto market, which has been closely tracking macro trends lately.

Crypto investors eye the Federal Reserve for direction

Crypto investors are closely monitoring the potential U.S. government shutdown, watching for its impact on market sentiment and regulatory developments.

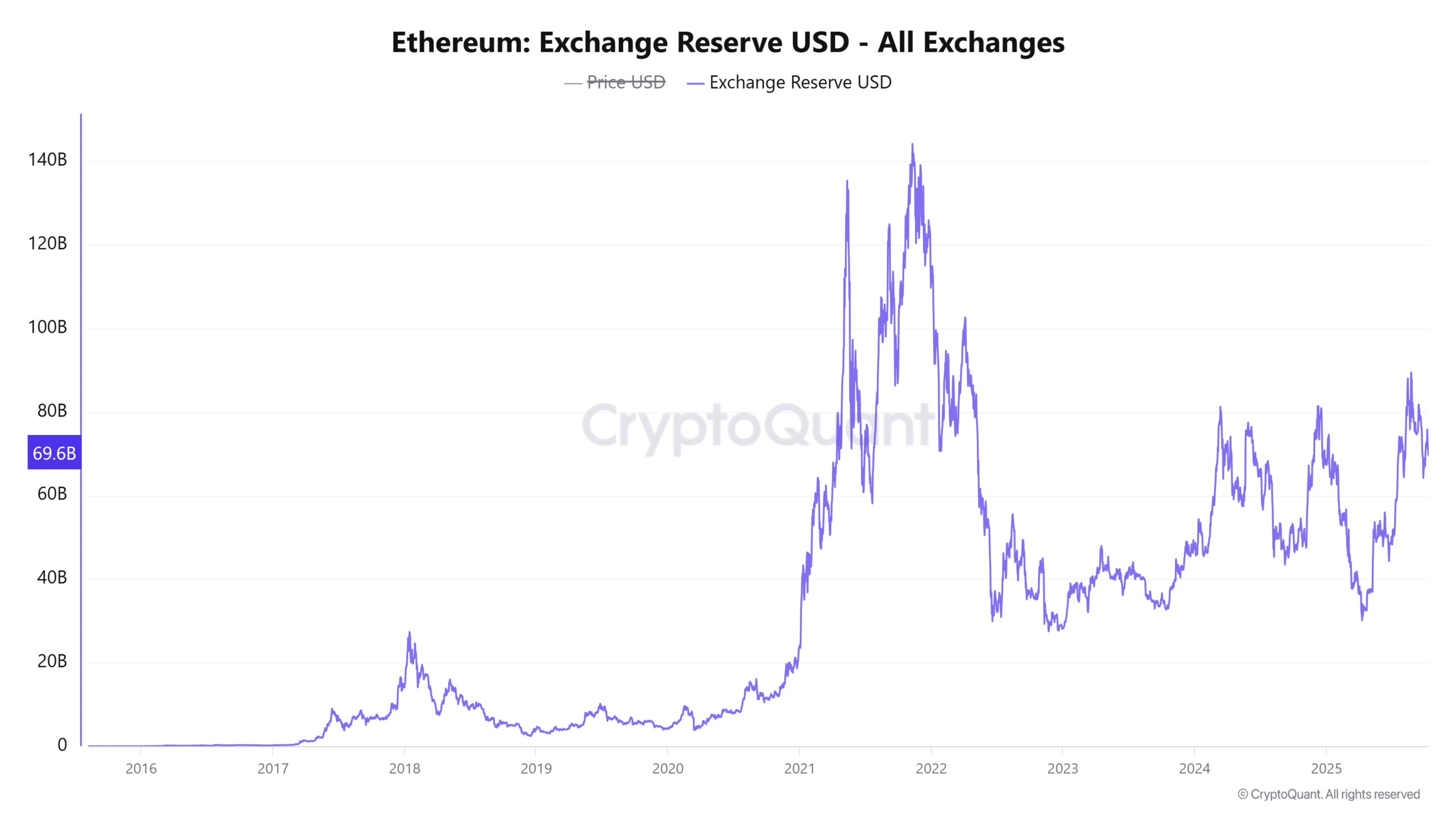

Beyond the typical October seasonal tailwind, delays in key economic data (CPI, PPI, and employment figures) have funneled over $300 billion into the crypto market, with BTC hitting a $125k all-time high.

In short, the market has “front-run” an October rate-cut narrative amid ongoing employment risks. The question now is: Will the Fed deliver? That’s why U.S. traders are waking up to a key macro pulse.

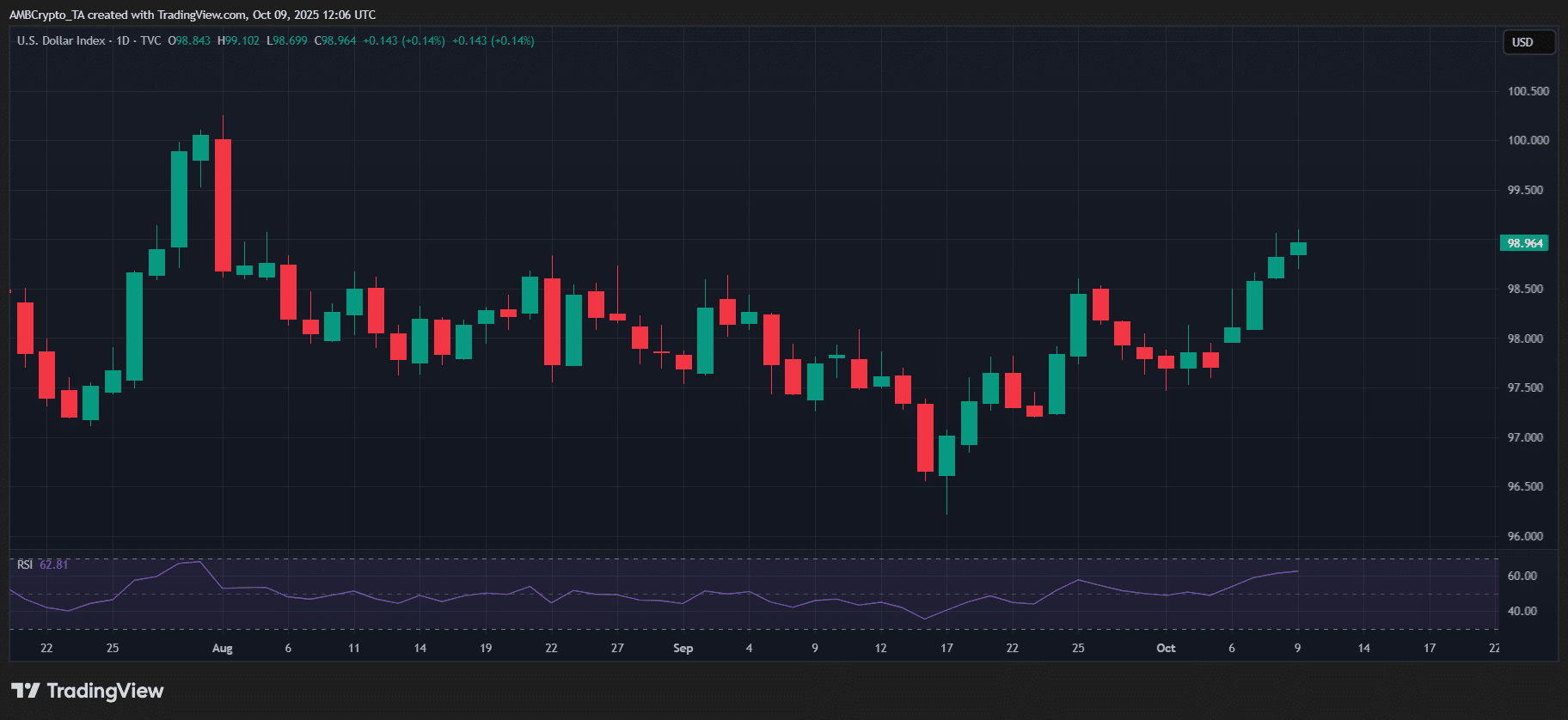

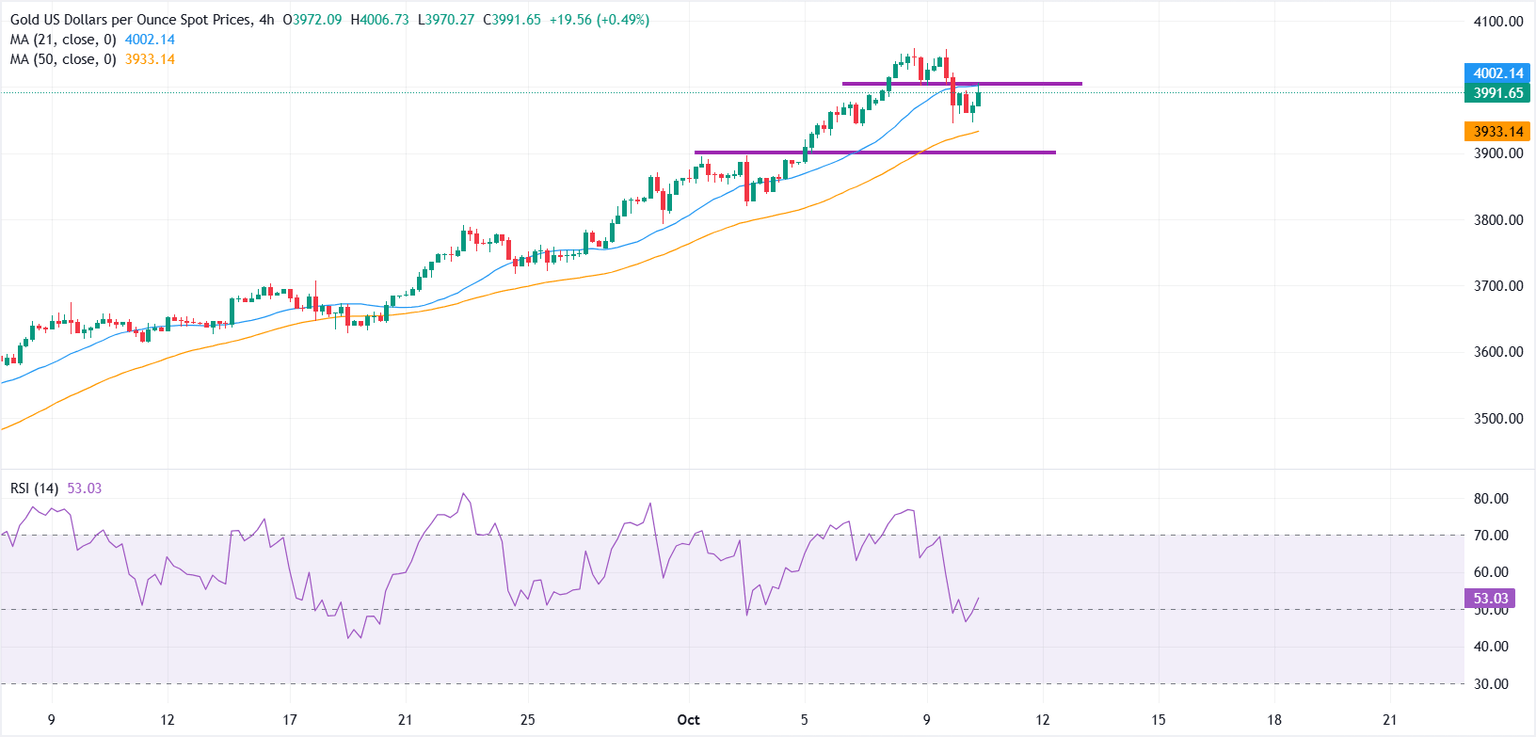

Notably, the U.S. dollar (DXY) is regaining strength, breaking the 98 wall.

In simple terms, a stronger dollar is tightening liquidity, making USD-based trades more expensive and putting pressure on risk assets, such as cryptocurrencies. Bonds, especially U.S. Treasuries, are soaking up the safe-haven flows.

Backing this, the 10-year Treasury yield dropped below 4.15%, signaling a rotation of money back. Thus, the $90 billion crypto bleed this week isn’t random, which makes the Fed’s conference a key directional read.

Post Comment