Rare Earth Tariffs: The Hidden Trap That Could Make or Break Your Portfolio—What Every Investor Must Know Now

So, your portfolio just took a nosedive—don’t worry, you’re not alone, and yes, I’m purposely not spilling all the beans upfront! This week, the market’s been dominated by two heavyweight topics: Is the AI frenzy spiraling out of control? And is the debt market, especially private credits, quietly brewing the next system-wide headache? Oh, and just when you thought it was settling down, throw in a spicy serving of trade tantrums. China tightened its grip on rare earth exports—those critical materials that power everything from AI chips to defense tech—right before the big showdown between Trump and Xi. And Trump? Well, he’s playing the classic ‘maybe I’m meeting you, maybe not’ game, sending markets on a rollercoaster that’s more dramatic than a reality TV finale. If you peek at Ethereum prices right after the US market closes, you’ll see the tension etched into crypto, bouncing with every twist in the trade talks. Meanwhile, the financial sector’s got its own storm brewing. Private equity giants like Apollo, Blackstone, KKR, and Ares are taking a beating as investors jitter over shadow banking risks exposed by the collapse of First Brands—a tangled web of off-balance-sheet maneuvers and disappeared billions. It’s a stark reminder: in this era of financialization, nothing is quite what it seems, and ‘safe bets’ are a relative term. So, are we facing a market correction, a bubble ready to burst, or just the usual chaos that precedes the next big move? Let’s dive in and unpack what’s shaking the markets, and what it means for your investments. LEARN MORE

img#mv-trellis-img-1::before{padding-top:130.11435832274%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:51.66015625%; }img#mv-trellis-img-2{display:block;}

I think I won’t tell you what just happen to your portfolio haha.

Most of you would have seen it by now.

There were probably two things that dominated the market this week:

- If the A.I. story is getting too crazy.

- The health of the debt markets and whether we are going to have another systemic issue as a result of private credits.

Well we can add trade tantrums on to the table again.

Rare earths have been very important to the United states for the production of weapons, chips, AI and other stuff and the United States gets about 70% of its rare earths from China.

Earlier in the day, China further tightened its export restrictions on rare earths ahead of talks between President Donald Trump and Xi Jinping at the end of the month.

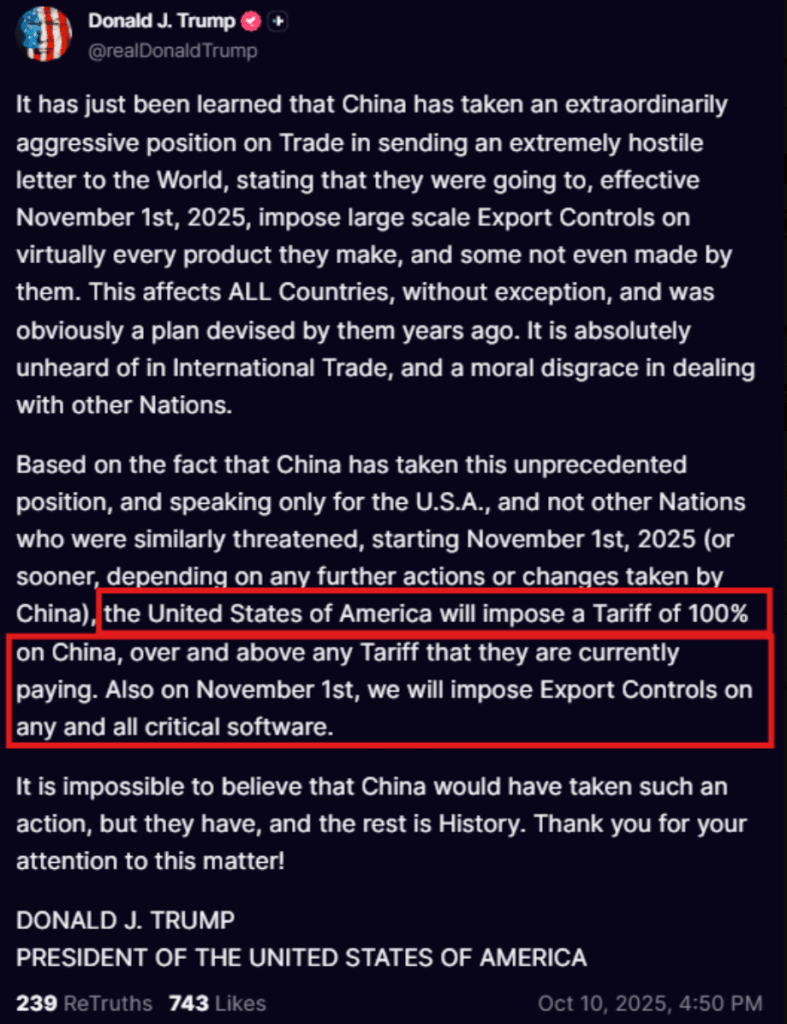

Trump announced a 100% tariff on China starting in 1st Nov and export controls on “any and all critical software.” Those are probably what is important to China and not tariff heavily before this.

Trump then says there is “no reason” to meet with President XI.

Then, Trump says he has not cancelled his meeting with China’s President XI and he “might still” have a meeting.

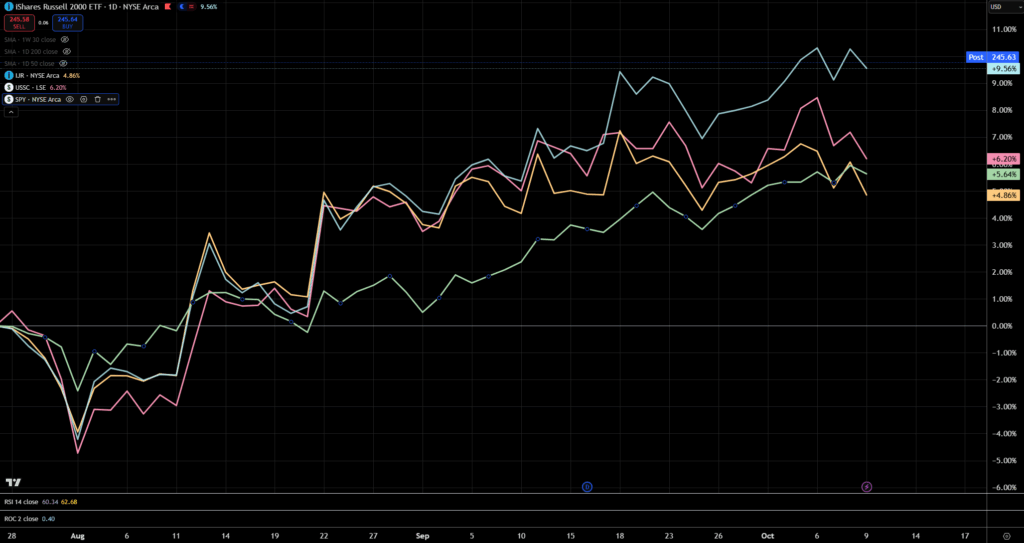

Markets are down big:

- SPX: 2.7%

- DJ Industrial Average: 1.9%

- Russell 2000: 3.0%

- Brent crude: 4.6%

- USD: 0.2%

- US 10 Year Treasury Yield: 2%

Gold is up. VIX up to 20

I think market need a way to take profit and this might be it. The most affected areas seem to be away from the large caps but in all the edges of the market be it in energy (which hasn’t done well!), consumer discretionary(which also hasn’t done well).

In a way, this feels like posturing on both side before the negotiation take place, which means there might be some conclusion in end Oct or Nov.

You can kind of tell the state of the markets by looking at Ethereum prices after trading in US equities have ended:

Ethereum was down a lot and then recovered when it seems Trump may still meet Xi.

The Dangers in Financials

My portfolio hasn’t been doing so well largely due to the exposure to financials, energy, consumer discretionary.

Investors have been dumping shares of Apollo, Blackstone, KKR and Ares. These are the private equity firms that have expanded aggressively into private credit. You can consider this as what people say as “shadow banking” and that should raise some eyebrows.

But if you are a high net worth person, you might really like private credit!

The financial markets seem to be sniffing out potential systemic issues.

The recent collapse of First Brands, a US car parts supplier leads people to think that First Bands is not the only one.

- First Brands is an automotive-parts conglomerate (spark plugs, wiper blades, brakes, filters, etc.) built through a long series of acquisitions. Over time, it relied heavily on off-balance-sheet financing — particularly selling customer receivables to third parties — to generate liquidity and support its operations.

- Creditors began noticing discrepancies in how receivables and invoices were handled. One major creditor, Raistone, claimed that up to US$2.3 billion in assets had “vanished” from the factoring arrangements. There are allegations that First Brands may have double-pledged invoices — using the same receivables to secure multiple loans — and that payments due to factor investors were not always passed through.

- On 29 September 2025, First Brands filed for Chapter 11 bankruptcy protection.

In its filings, it disclosed liabilities between US$10 billion and US$50 billion, while assets were valued between US$1 billion and US$10 billion — a striking imbalance. - The U.S. Department of Justice has opened a preliminary inquiry into First Brands’ collapse, focusing on its accounting and creditor dealings.

- Trade-credit insurers are also bracing for potentially large claims if invoices or supplier payments go unpaid. Regulators in both the U.S. and U.K. are now monitoring the situation closely, viewing it as a potential warning sign for the wider private-credit and shadow-banking markets.

If you buy the private credit you are like lending through Funding Societies or lending to finance the working capital of a company, that maybe has trouble getting that well from main sources.

The financialization of the markets is always going to have more and more of these products.

Here is a list of entities potentially affected:

- Point Bonita Capital a fund under Jefferies

- Jefferies disclosed that its asset-management arm, through Point Bonita, holds about US$715 million in receivables tied to First Brands. Many of these receivables are owed by large retailers such as Walmart, AutoZone, and O’Reilly — but First Brands acted as the servicer, collecting and passing on payments to lenders.

- Another Jefferies entity, Apex Credit Partners (a joint venture with MassMutual), has roughly US$48 million exposure through loans.

- O’Connor fund under UBS

- Reports suggesting more than US$500 million of potential exposure through debt or supply-chain finance arrangements with First Brands.

- A joint venture between Japan’s Norinchukin Bank and Mitsui & Co. reportedly has about US$1.75 billion of exposure to First Brands. This makes it one of the largest single exposures outside of the U.S.

- Major trade-credit insurers — including Allianz, Coface, and AIG — are expected to face large claims linked to unpaid supplier invoices and receivables financing.

- Raistone, which helped arrange and finance much of First Brands’ receivables and supply-chain factoring programs, is deeply entangled.

- A number of smaller private-credit and supply-chain-finance firms are within the “blast radius.”

- Blackstone is reported to have indirect exposure through debt investments related to First Brands’ financing vehicles.

From what I understand, the issue here is the double counting of invoices. It is not that the services is not done. Walmart, AutoZone and O’Reilly will pay. It is just that after they pay First Brands then who gets paid due to the double counting.

The $48 million exposure may affect Jeffries net income of about $669 million and it may look bad.

But at this period, we are revisiting the Silicon Valley Bank situation where the markets are wondering about the health of the financial sector, if there is another shoe that could drop.

I think all the ring fencing that were put in place in the financial industry since the Great Financial Crisis should not make this systemic. What I understood from learning about regional banks is that there are some healthy mechanism in there to absorb failed entities by the strong ones if need to, with the government incubating the portions that cause the distressed.

The issue is where the financial regulations are less: the Apollo, Blackstone, KKR and Ares

State of the Economy

I always think the market finds reason to correct itself.

These events are just an excuse wrapper to go about doing that.

Still where are we on divide between strong economy/inflation and weak economy/recession?

Renaissance Macro Research’s weekly podcast may give us some insight.

Jeff Degrauff’s Key Points

Jeff Degrauff, focusing on the markets, offered the following views:

- Market Cycle and Fed Easing: He noted that the RenMac market cycle clock is in a zone that historically suggests good forward returns [07:46]. He explained that the market is “two steps ahead” of the current data, believing that the Federal Reserve’s anticipated rate cuts will be sufficient to sustain market growth, even if economic data worsens [08:14].

- Inflation vs. Growth: He emphasized that the market cycle clock is more sensitive to lower inflation than to slower growth, as falling inflation gives the Fed more room to cut rates, which he views as good news [09:08].

- Bubble Risk: He estimated a 25-30% probability that the market is either entering or is already in a bubble environment [09:30]. However, he finds it historically difficult for a bubble to “pop” when the Fed is in an easing cycle, as past bubbles (dot-com, housing) popped when central banks were raising rates [09:58], [10:37].

- Gold and Parabolic Trends: He views the rise in gold as an international story, driven by foreign central banks and countries buying it as a “shadow mechanism” to avoid appreciating their currencies [20:50]. He pointed out that gold is going parabolic, and the risk-adjusted outperformance (alpha) is near levels seen in 1979, which is a warning sign [21:46], [22:02]. He advises that when a move first becomes parabolic, the initial action is often to buy, as prices can move substantially higher before a reversal [22:47].

- Areas to Watch: He is watching the discretionary versus staples sectors (currently favoring discretionary) and noted that some sentiment indicators are flashing sell signals, though these tend to be early [28:41], [28:51]. He expressed discomfort with the semiconductor sector due to excessive returns, valuations, and sentiment, suggesting a likely pause [29:27].

Neil Dutta’s Key Points

Neil Dutta, providing an economic outlook, made the following observations:

- Economy and Recession Risk: While he noted that most clients are optimistic and see “no recession” over the next 12 months [02:59], he believes recession risks are higher than the market is pricing in [03:15].

- Fed Action and Labor Market: He argues that the rate cuts currently priced into the market will not be enough to stop the economic slowdown [06:08]. He highlights that the labor market is already slowing, with sluggish employment growth and a rising unemployment rate (up a tenth every other month) [06:37].

- Slowing Employment: This slowing was happening before construction job losses and the government shutdown [06:57]. He stressed that the job market slowdown is evident in private sector metrics and that consumers are reporting increasing difficulty finding work [11:15]. He warned that the unemployment rate is currently rising because the recently laid off are having trouble finding new jobs, and if layoffs start to “build on themselves,” a more pronounced easing cycle will be required [11:39], [11:51].

- Gold’s Meaning: Regarding gold’s value surpassing the M2 money supply, he stated he doesn’t think it means anything specific, but rather that there is a “persistent bid for gold” regardless of the dollar’s strength, real rates, or inflation [19:11]. He does not view it as a major inflationary signal [19:57].

There are various portlet of bubbles but this drawdown could give those who have been crying there is no entry point an entry point.

Then again, you would be thinking about are you investing at a market top.

Every “corrections” that look like “you should buy” looks like a market top.

Days like today are normal markets.

There is no such thing as safe stocks and calm markets. You wait and wait until markets are calm to buy only to experience what comes after, which is uncalm markets.

If you are finding the best time to buy, you should be buying before the move and that is usually when things are the most uncertain.

Like what Renaissance Macro describe, ask where the puck is at and where the puck is going.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment