When $19 Billion Vaporized Overnight: Inside the Crypto Crash That Shook Wall Street and What Smart Investors Must Do Now

Ever wondered what a $19 billion crypto bloodbath looks like? It’s not your garden-variety market dip—it’s a seismic shake-up that pulverized over 1.6 million leveraged positions in a single day. When Bitcoin and Ethereum took a nosedive, sending shockwaves through the digital asset world, it wasn’t just market volatility; it was the biggest leverage reset we’ve ever seen. This meltdown wasn’t just numbers on a screen—it was a brutal liquidation wave sparked by escalating trade tensions, reminding us all that in crypto, fortune truly favors the nimble. Buckle up, because this story shakes the very foundations of leveraged trading as we know it. LEARN MORE

The event represents the biggest leverage reset.

Key Takeaways

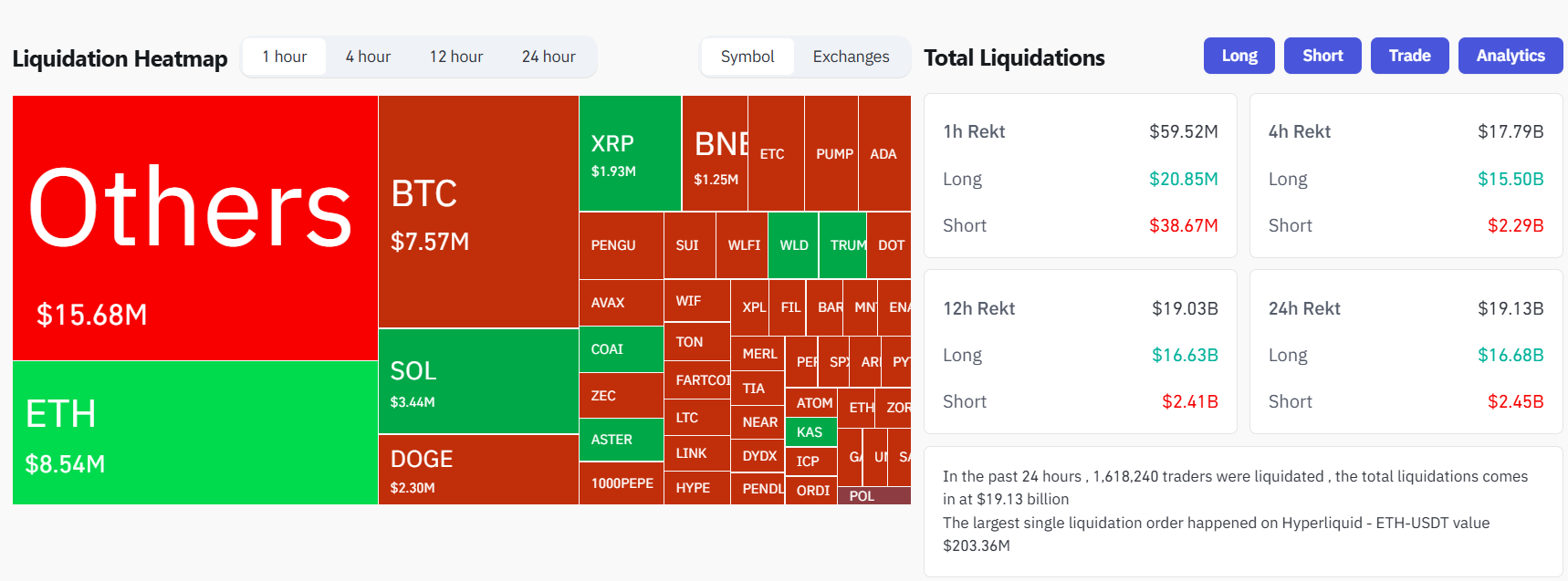

- Over $19 billion in leveraged crypto positions were liquidated in 24 hours, marking the largest single-day wipeout in digital asset history.

- Bitcoin and Ethereum long positions were hardest hit, with over 1.6 million traders affected across major exchanges.

Share this article

Roughly $19 billion in leveraged crypto positions were liquidated following a brutal sell-off that sent Bitcoin tumbling to $102,000. It was the largest single-day wipeout ever recorded in digital asset markets, according to CoinGlass data.

Most of the liquidations came from long positions, which totaled $16.6 billion in losses, compared to $2.4 billion for shorts.

Over 1.6 million crypto traders were liquidated across major exchanges, with Bitcoin and Ethereum long positions severely impacted during Friday’s US trading sessions.

The liquidation cascade was triggered after President Donald Trump proposed a massive tariff increase on Chinese imports, followed shortly by an announcement of a 100% tariff on Chinese goods in response to China’s planned export restrictions on rare earth minerals.

Bitcoin plunged from above $122,000 to around $102,000 on the news. Ethereum dropped below $3,500, while smaller-cap altcoins saw double-digit losses amid evaporating liquidity.

At the time of writing, Bitcoin traded above $113,000 after recovering from earlier lows but remained below its daily high of $122,500, according to CoinGecko data.

Share this article

Post Comment