Why Innovation Feels Dead—And How to Ignite the Next Big Boom Before It’s Too Late

Ever wake up on a Wednesday morning itching to HODL some crypto like it’s the last lifeboat on a sinking ship? Head swimming with FOMO, eyes aglow with dreams of Going To The Moon? If you’re reading this on Monevator, I’m guessing you probably gave yourself a solid reality check first. Phew, amen to that sanity! But here’s the twist: while most of us keep our cool, I still reckon there’s a rightful spot for Bitcoin in a savvy portfolio. So when the FCA did a U-turn on banning crypto exposure via exchange-traded notes (ETNs), I was ready to cheer… until the marketplace said, “Not so fast!” Despite the new rules kicking in on October 8, buying these crypto ETNs felt like waiting for rain in a drought—still off the table for retail investors. What’s going on? Bureaucratic ping-pong between the FCA and the London Stock Exchange, plus a tax treatment saga that feels like it was designed by Kafka himself. It’s enough to make an investor shrug and wonder: Are we witnessing a masterclass in stalling British innovation or just another episode of “Who Gives a Sausage?” in the world of investing regulation? Buckle up—it’s a bumpy ride through crypto’s latest red tape fiasco. LEARN MORE

What caught my eye this week.

Did you wake up on Wednesday ready to HODL? Your brain addled with FOMO? Your eyes on the horizon, heart set on Going To The Moon?

You’re a Monevator reader so probably not. Amen to that!

Still, I believe there’s a place for Bitcoin in sensible portfolios. Hence I welcomed the FCA’s reversal on banning us from getting crypto exposure via exchange-traded notes (ETNs) linked to cryptocurrencies.

The new rules came in on 8 October. My co-blogger wrote a huge guide to the ins and outs of crypto ETNs in advance.

But then Wednesday rolled around, and from what I could tell from my platforms we still couldn’t buy crypto ETNs.

From This Is Money:

…any keen investor looking to get in early will have been disappointed to find that despite the ban lifting, these ETN products are still not available to retail investors.

In fact, investors will have to wait until at least 13 October before they are able to but crypto ETNs.

The delay comes as a result ETN providers being required to submit their prospectuses for FCA approval before they can offer these products.

However, the FCA only began accepting draft prospectuses on 25 September.

According to Financial Times sources, one person familiar with the matter said the FCA and the London Stock Exchange were ‘going back and forth’ on whether they needed a new segment of the exchange for these crypto products.

So much for the UK getting back on the front foot when it comes to innovation and whatnot, eh?

Musical shares

Indeed it gets worse! Several readers (including an industry insider) forwarded me a link to further ‘guidance’ from HMRC.

Why the air quotes? Well, does this extract from the document seem like a clear route forward to you?

Initially, cETNs will be automatically eligible for inclusion in stocks and shares ISAs.

From 6 April 2026, they will be reclassified as qualifying investments within the Innovative Finance ISA (IFISA).

Say what now? Crypto ETNs will be allowed in ISAs – but then next year they’ll need to be shifted over to Innovative Finance ISAs? A wrapper some aficionados have been mentally moving on to the extinction-watch Red List?

Many brokers do not even offer Innovative ISAs. Are they going to build and get regulatory approval for them by April? Remember the FCA didn’t approve crypto ETNs in time for its own launch date.

My industry contact noted we saw similar shenanigans with Long-Term Asset Funds. These were initially only available in Innovative Finance ISAs. But from April 2026 you can hold them in normal ISAs after all.

Why all the kerfuffle and making life complicated? (Also, if you’re wondering what a Long-Term Asset Fund is then you’ve sort of proved my point.)

It’s hard to even find a list of the crypto ETNs that should get approval from the FCA. I eventually found this one at the broker Saxo. No idea if it’s accurate or complete.

Remember similar products have been busily trading in Europe and the US for many years now.

Who gives a sausage?

I asked my co-blogger The Accumulator for his thoughts on this Innovative Finance ISA crypto curveball.

TA was non-plussed:

Seems a bit like fractional shares again. Some traffic warden in a position of authority is saying: “well actually if you look at subsection 3, paragraph 6…”

But eventually a coalition of forces will shout, “broken Britain” at them enough times that they’ll just go, “yeah fuckit, just put it in an ISA, who gives a shit?”

Thinking about this – and whether the upcoming Budget will see the pension tax-free lump sum scrapped or stamp duty revamped or pension relief curbed – I feel a shiver of despair.

How can we help ordinary people get less confused about saving and investing when the powers-that-be seem bent on making everything as uncertain as possible?

Have a great weekend.

*With apologies to the spirit of Harold Wilson.

From Monevator

Our updated guide to help you find the best online broker – Monevator

Investing when the market is expensive – Monevator

From the archive-ator: Become your money hero – Monevator

News

First-time buyers could save hundreds in sales plan, government says – BBC

Chancellor gets £2bn Budget boost after VAT error – Yahoo Finance

Conservatives would scrap stamp duty, Badenoch announces – BBC

Resolution Foundation: it’s now almost impossible to work to riches – Sky News

HMRC’s brings in an extra £4.6bn thanks to big data – Pinsent Masons

Another major NIC tax raid on the cards, economists warn – City AM

EU steel tariff ‘biggest ever crisis’ for UK industry [Cough cough] – BBC

Shawbrook confirms plans to float on LSE at mooted £2bn valuation – Yahoo Finance

The council tax house price lottery – This Is Money

UK set to appoint a ‘digital markets champion’ – The Block

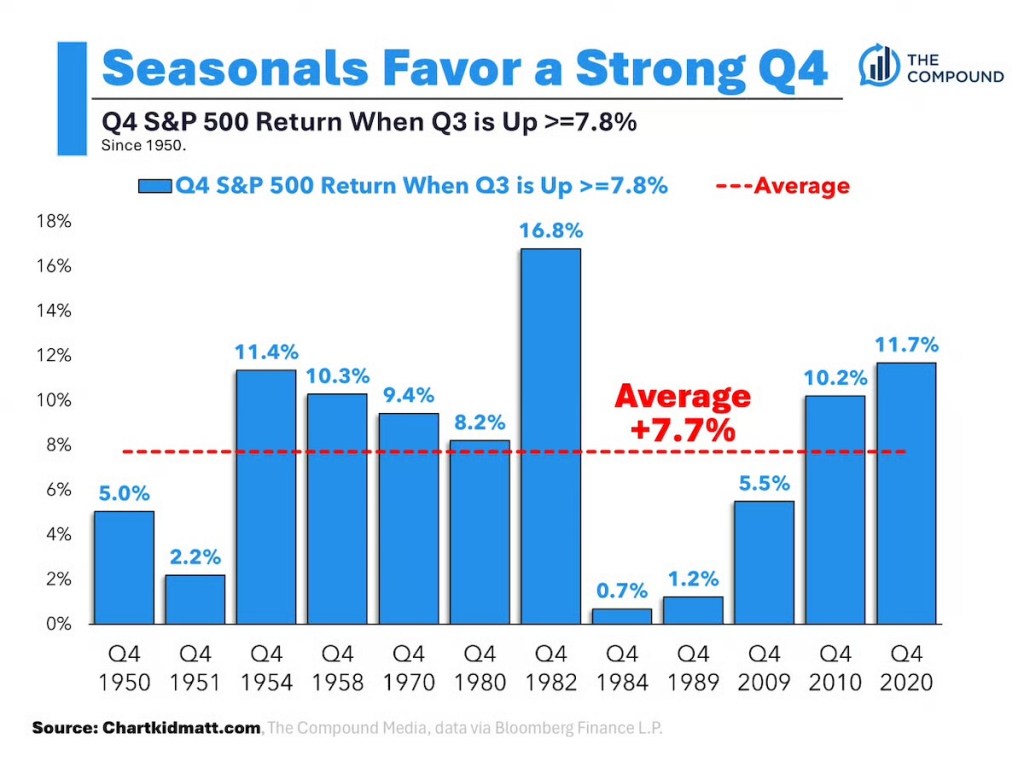

More gains would be normal – Chart Kid Matt

Products and services

Disclosure: Links to platforms may be affiliate links, where we may earn a commission. This article is not personal financial advice. When investing, your capital is at risk and you may get back less than invested. With commission-free brokers other fees may apply. See terms and fees. Past performance doesn’t guarantee future results.

Barclays switch offer: get up to £400 – Be Clever With Your Cash

What you need to know about car finance mis-selling compensation – Which

Lifetime ISA rates on cash reach nearly 5% – This Is Money

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

Should you pay for your funeral now? – Which

The British cities where buying a home is cheaper than renting – This Is Money

Get up to £100 as a welcome bonus when you open a new account with InvestEngine via our link. (Minimum deposit of £100, T&Cs apply, affiliate link. Capital at risk) – InvestEngine

Is Monzo Billsback worth it? – Be Clever With Your Cash

NatWest launches top 4.2% one-year cash ISA – This Is Money

Robinhood takes aim at UK investment platforms with no-fee ISA [Paywall] – FT

Homes for sale near botanic gardens, in pictures – Guardian

Comment and opinion

How free stuff from Amazon almost ruined retirement – Mr Money Mustache

Can the stock market predict the future? – A Wealth of Common Sense

When it comes to bonds, don’t be a hero – Morningstar

What’s more important than a safe withdrawal rate? – The Retirement Manifesto

Founders and VCs weigh in on the UK’s ambition deficit – CNBC

Morgan Housel: passive income is a scam [Podcast] – The Diary of a CEO

Why do people get paid to invest their money? – Noahpinion

Why a 37-year old on $390,000 at Google quit her job with nothing lined up – CNBC

Making things worse mini-special

Brown-stage capitalism – The American Prospect

Thinking of AI as a social problem – How Things Work

Naughty corner: Active antics

Go small for the maximum bang from factors such as value and profitability – Verdad

The high cost of managerial hypocrisy – Flyover Stocks

Lenders ‘extend and pretend’ as commercial property values drop – Financial Times

The US is really two economies in one – Klement on Investing

National Grid is an attractive income play – Interactive Investor [Affiliate link]

Maximum diversification beats market timing [Research] – via Springer

Gold mini-special

So you want to talk about gold – FT

Ingots we trust – Paul Krugman

Kindle book bargains

Narconomics: How to Run a Drug Cartel by Tom Wainwright – £0.99 on Kindle

Great Britain? by Torsten Bell – £0.99 on Kindle

Supremacy: AI, ChatGPT by Pammy Olson – £0.99 on Kindle

Chokepoints: Economic Warfare by Edward Fishman – £0.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

Global renewable energy generation surpasses coal for first time – Guardian

Thousands in biggest-ever UK environmental lawsuit on Wye river pollution – BBC

The growing benefits of climate adaption – Klement on Investing

Green turtle bounces back from brink in conservation win – BBC

UK plastic waste exports to developing countries rose 84% in a year – Guardian

Robot overlord roundup

How AI became our personal assistant [Neat graphics] – FT

Let’s talk about AI art – The Oatmeal

AI hyper-scaler maths doesn’t add up, and they know it… – Praetorian Capital

…call it the rising tide strategy – Spyglass

A 23-year old AI pundit running a $1.5bn hedge fund [Bubble, much?] – Fortune

The way to save your children from AI is to invest in AI – Financial Samurai

Marina Hyde: if Sam Altman is the future, can we go backwards? – Guardian

Not at the dinner table

Voters are not listening to Labour – Prospect

Who maintains the scaffolding of freedom? – Shruti Rajagopalan

Declining American democracy – Paul Krugman

Off our beat

On turning 40 – More To That

FIFA’s 2026 World Cup ticket scheme is a late-capitalist hellscape – Guardian

Tech billionaires are doom prepping. Should we be worried? – BBC

Milan lures global elite, especially from London – Wall Street Journal

We are different from all other humans in history – The Garden of Forking Paths

Ten insights from ten years of transformational conversations – The Leading Edge

Lessons from a dog that saved a life – Two Percent [h/t Abnormal Returns]

And finally…

“Personally what has been the most important [lesson] was to understand the value of time – and this is something that has come from observing [Buffett], learning his story and that time compounds.”

– Alice Schroeder, The Snowball

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Post Comment