Zerebro’s 260% Surge Sparks Suspicion—But the Real Catalyst Will Blow Your Mind!

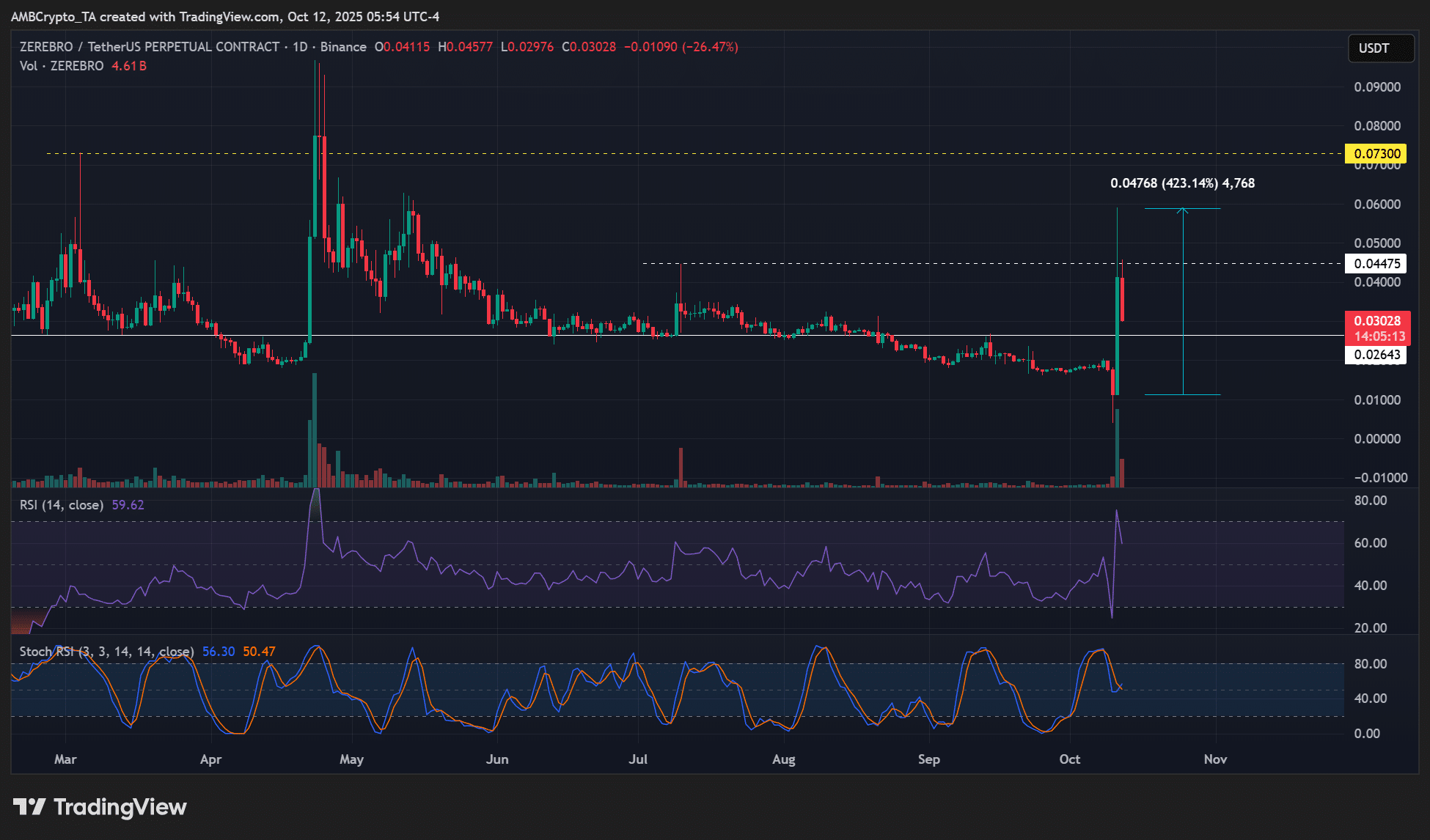

Ever wonder what it takes for a digital asset to surge over 430% in a single day? Zerebro’s meteoric rise from a humble $0.01 to a dazzling $0.05 on October 11th has got many scratching their heads—and for good reason. Behind this jaw-dropping jump lies not some organic frenzy of retail investors, but two massive wallets funded by Binance, flexing a cool $1.25 million in leveraged longs on Hyperliquid’s decentralized exchange. It’s a playbook move that pumped Open Interest to a six-month high but also stirred suspicions of insider maneuvers. Now, the pressing question is: can ZEROBRO hold its ground in the so-called “golden zone” between $0.031 and $0.038 and march back toward $0.05–$0.09, or will it slip beneath $0.03, inviting another wave of bearish momentum? With sharks circling and traders growing cautious post-crash, this rollercoaster is far from over—and it’s a textbook case of how whales can tilt the scales in crypto’s wild west. Buckle up, this one’s a doozy. LEARN MORE

Key Takeaways

What drove Zerebro’s 430% surge?

Two Binance-funded wallets opened $1.25 million longs on Hyperliquid, triggering leveraged gains and heavy Open Interest buildup.

Can ZEREBRO sustain its recovery?

If the $0.031–$0.038 Fibonacci zone holds, a rebound to $0.05–$0.09 is likely; below $0.03, bearish momentum could resume.

Zerebro [ZEROBRO] mooned nearly 3X on the 11th of October as the market reeled from the aftermath of a massive crash last Friday.

The altcoin rallied from $0.01 to $0.05, about a 430% run at the peak of the upswing, before closing the daily trading session with a 264% gain.

As of writing, however, it gave back more of the gains and traded at $0.03 amid claims that the pump was manipulated by a familiar whale on Hyperliquid DEX (decentralized exchange).

ZEREBRO’s suspicious whale activity

According to a pseudonymous on-chain analyst, MLM, two newly created wallets with $1.25 million opened a long position with 1X leverage on Hyperliquid.

The analyst noted that the wallets were funded from Binance and a wallet that made over $1 million during the JELLY JELLY incident in March.

In fact, that earlier incident involved a whale short-squeeze that forced Hyperliquid to halt JELLY JELLY perpetual trading, costing the DEX’s vault over $13 million in losses. As a result, the analyst cautioned about the ZEROBRO pump.

“High chance these are Binance-linked “insider” wallets – be careful trading ZEREBRO, the pump looks very sketchy.”

Golden zone defense in play

On the price charts, the altcoin’s pullback tagged the golden zone around $0.31-0.38. If defended, the dump could be eased, and likely recovery towards $0.05 or 0.09 could follow suit.

But the market is yet to fully digest the recent crash, and more clarity could be likely by this week.

In case the China-U.S. tariff war escalates and Bitcoin [BTC] slips lower, ZEROBRO could erase the entire gain.

Moreover, the Open Interest jumped to a six-month high of $82 million during the manipulated and leverage-driven pump.

After the headlines that the upswing was not organic, long positions dropped by nearly 10% to 60%.

The shift reflected growing caution among traders wary of another forced liquidation cycle.

That said, ZEREBRO saw about $2 million in Daily Exchange Netflow on the 11th October, suggesting profit-taking spiked after the upswing.

With whale caution, profit-taking, and broader sentiment post-market flash crash, the altcoin’s pullback could go below $0.03.

Post Comment