Why Cutting Dead Weight from Small Caps Could Be the Secret Sauce to Outperforming the Market Long-Term—Here’s What Most Investors Miss!

Ever wonder why some small-cap stocks seem to churn out spectacular cash flows year after year, while others barely keep their lights on? It’s like spotting a hidden gem in a sea of glittering stones—companies delivering steady profitability don’t just pop up by accident. In fact, if you’ve ever scratched your head over how a firm boasting a free cash flow yield north of 15% manages to sustain that over a decade, you’re not alone. Markets are often pretty sharp at pricing in future growth, so when something flies under the radar, it piques curiosity and sparks questions about investment strategy. What if, instead of chasing the flashiest tickers, you systematically weeded out the low or no-profit players—would that basket shine brighter over time? This exploration dives deep into comparing the small-cap stalwarts of the S&P 600 with the broader but less discriminating Russell 2000, unraveling the tapestry of profitability versus inclusion. Spoiler alert: profitability isn’t just a nice-to-have; it might be the secret sauce to long-term outperformance. Ready to rethink how you view small caps and profit from their nuanced differences? LEARN MORE

img#mv-trellis-img-1::before{padding-top:57.421875%; }img#mv-trellis-img-1{display:block;}img#mv-trellis-img-2::before{padding-top:39.74609375%; }img#mv-trellis-img-2{display:block;}img#mv-trellis-img-3::before{padding-top:40.33203125%; }img#mv-trellis-img-3{display:block;}img#mv-trellis-img-4::before{padding-top:27.44140625%; }img#mv-trellis-img-4{display:block;}img#mv-trellis-img-5::before{padding-top:30.859375%; }img#mv-trellis-img-5{display:block;}img#mv-trellis-img-6::before{padding-top:27.05078125%; }img#mv-trellis-img-6{display:block;}img#mv-trellis-img-7::before{padding-top:31.0546875%; }img#mv-trellis-img-7{display:block;}

I was quite glad personally to write my last post.

I find that it is a good idea to write out some of these things that we been struggling to piece together because we might be able to connect things through the writing process.

Given the lack of comments, I am quite sure not many people got past half of the piece.

Our new Providend portfolio manager Glenn read my piece and shared his point of view. Somehow, in that process, something connected much better so I went back and re-wrote the part about the drivers of return. I would like to personally thank him for helping me frame things.

Today’s one is a data and mental exploration about something that I have been dealing with since this post:

What does Avantis Global Small Cap Value UCITS ETF’s 23% Cash Flow Yield Means?

The general idea is that if we have a company trading at a high free cash flow (don’t have to be 20%, but some might get as attractive to that), and the company focus enough on shareholder returns, that company can achieve pretty high growth.

But markets are pretty efficient and how can a company that has 15-20% free cash flow yield, not much future cash flow growth, and still maintain that yield for 10 years happen? It is possible if the company is small cap, neglected enough but not often.

If the markets are more efficient, the price the stock trades at kind of means that the company is less likely to maintain that free cash flow.

But what if we have a systematic strategy that removes from a basket of stocks those low profitable, and non profitable ones? How would they do?

There is a Difference Between Focusing on Low Profitability than Searching for High Profitability

It might be intuitive to think that you either screen for companies with high profitability compare to a basket of stocks based on market cap weight.

By right, the returns are better if you run a systematic strategy that screens and holds a basket of stocks that are high profitability. Dimensional has a US High Profitability ETF (DUHP) and Avantis recently has US Quality ETF (AVUQ) listed in the US to express that research and investment philosophy.

If you have went deep enough in prospecting individual stocks, you may recognize that aside from profitability, a lower hurdle is just to have earnings or free cash flow that is consistent enough in the first place.

That is a key metric that I check when reviewing individual stocks in the past. We will try to review the past 10 years, 20 years of earnings to appreciate if there are consistency.

In a way, we are trying to see if a company can be cyclical in their cash flow generation.

If you can find a company that trades cheaply, relative to its cash flow and has shown a history of consistent cash flow, that feels like a 20-year pseudo-equity fixed income.

However, we know that it is challenging for all individual companies to last so long and there are risks involve.

If we buy a basket of these stocks, and reduce our weightage on low profitable or not profitable, wouldn’t we have a cash flow that doesn’t die?

And what if we buy this always profitable basket at a cheap price? Relatively speaking, would we be earning a high yield, 20-year pseudo-equity fixed income?

You don’t need growth if the returns is good enough for your financial goal.

This is why my boss Bryan says a basket of securities is the ultimate blue chip and not one or two or three blue chip that you select because of the systematic nature that you can shape your earnings and cash flow.

The S&P 600 versus the Russell 2000

I always wondered how to best test this concept, until the stars lined up.

The first was when I realize that we have Russell data on Dimensional’s ReturnsWeb! This means that those of us who has access to ReturnsWeb (who are the advisers who have linked up with Dimensional) can easily model some of the stuff in our minds (or at work).

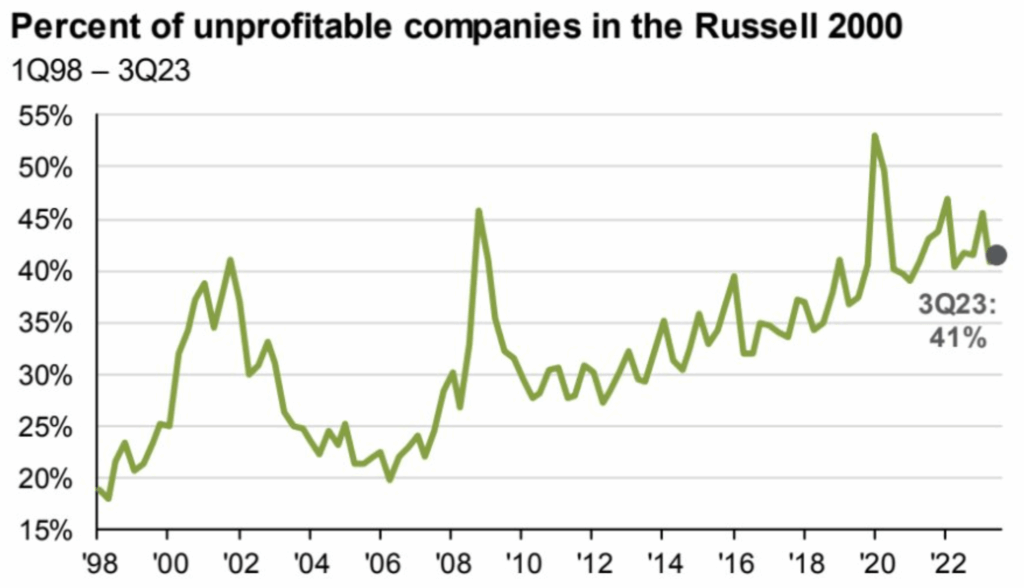

The second is I was reminded of how much people shit on the Russell 2000 because more and more, it is made up of more unprofitable firms and therefore they cannot outperform (which unfortunately did recently!)

There are more hard hitting comments then this.

But since we know that one of the key criteria to quality for the S&P 600, which is a small cap index is that they need to be profitable for a period, it sets up a very good situation to compare the small cap performance between [profitable + unprofitable] versus the [profitable]

Here is a comparison between the two from ChatGPT:

📊 Russell 2000 vs S&P 600: Small-Cap Index Comparison

| Category | Russell 2000 | S&P 600 |

|---|---|---|

| Provider | FTSE Russell | S&P Dow Jones Indices |

| Launched | 1984 | 1994 |

| Parent Universe | Russell 3000 Index (largest 3000 U.S. stocks by market cap) | S&P Composite 1500 (S&P 500 + S&P 400 + S&P 600) |

| Approx. # of Constituents | 2,000 stocks | 600 stocks |

| Market-Cap Range (typical 2025) | Roughly $200 million – $7 billion | Roughly $850 million – $7 billion |

| Selection Method | Purely rank-based by market cap (bottom 2,000 of Russell 3000) | Committee-selected from eligible small caps (S&P U.S. Index Committee decides) |

| Eligibility Criteria | – U.S. incorporation– Adequate liquidity (trading history & float)– Must be in bottom 2,000 by market cap rank within Russell 3000– No profitability requirement | – U.S. incorporation– Public float ≥ 10%– Positive GAAP earnings in the most recent quarter and over the past 12 months (total)– Adequate liquidity & seasoning (≥ 12 months since IPO in most cases)– Chosen by committee to represent U.S. small-cap economy |

| Reconstitution Frequency | Once per year (end of June “Russell reconstitution”) — large turnover events | Continuous maintenance by committee (added/removed as needed) — lower turnover |

| Profitability Screen? | ❌ None | ✅ Required (positive GAAP earnings) |

| Liquidity Screen? | ✅ Basic minimums only | ✅ Stricter — requires adequate trading volume |

| Float Adjustment | Yes (uses free float) | Yes (uses float-adjusted market cap) |

| Style Bias from Methodology | More inclusive → contains many unprofitable, early-stage, or microcap stocks → lower quality bias | Profitability requirement → tilt toward higher quality, profitable small caps |

| Index Weighting | Market cap (weighted by float) | Market cap (weighted by float) |

| Rebalancing Impact | Sharp annual rebalancing creates temporary volatility (“Russell reconstitution effect”) | Ongoing add/remove keeps composition stable — less index turnover |

| Common ETFs Tracking It | iShares Russell 2000 ETF (IWM) — largest small-cap ETF Vanguard Russell 2000 ETF (VTWO) | iShares S&P Small-Cap 600 ETF (IJR) — largest S&P 600 ETF SPDR Portfolio S&P 600 Small Cap ETF (SPSM) |

| Historical Performance Trend | More volatile & lower long-term returns (drag from unprofitable stocks) | Historically higher returns and higher quality tilt (quality screen removes weak names) |

| Typical Sector Weights | Heavier in biotech, speculative tech, and micro-industrials | More industrial, financial, consumer, and profitable tech exposure |

They are not always an apples to apples comparison but this is better than nothing.

S&P 600 Performance Over Russell 2000 Over 1 Year

We have total returns (capital appreciate + dividends) data that overlap from 1994 to 2025 or about 31 years. So we can form rolling 1-year returns. This allows us to visualize the returns performance difference if you put in $20 mil lump sum investment anytime and invest for 1 year.

Then we take S&P 600 returns minus Russell 2000 returns:

Each bar represents a 1 year performance difference between the two index. If the bar is above zero, S&P 600 did better. If the bar is below zero, Russell 2000 did better.

Generally, more bars are above zero, which kind of shows that focusing on eliminating non-profitability does help.

But there are some great performance if we include non-profitable small caps like the 2020 period.

S&P 600 Performance Over Russell 2000 Over 5 Years

Now let us lengthen the investment period of that $20 million lump sum investment over 5 years:

Whoa. Most bars end up above zero, which shows that the S&P 600 doing better over a 5 year period. You will still have those that did better in the 2016 period, most likely those no-earnings stocks that did well during the Covid period.

S&P 600 Performance Over Russell 2000 Over 10 Years

Let us lengthen it to 10 years:

If you invest in the S&P 600 for 10 years any point in the past 31 years, you would do better than the Russell 2000.

You might be curious about the annualized performance of the S&P 600 and Russell 2000 and so I plotted the annualized rolling return in the chart below:

Every point on the chart represents a 10-year annualized return. You can see the performance difference. Honestly, I should just show the cumulative one because the optical difference will be bigger.

You also notice something interesting: In the past 31 years, if you invest the $20 million any time, your 10 year returns would have been positive.

S&P 600 Performance Over Russell 2000 Over 15 Years

This is the last set.

Epilogue

I wasn’t expect the long term outperformance of the S&P 600 to be so… consistent.

I think that may be a reason why I seldom make strong statements if I have not taken a look at the data.

Comparing the S&P 600 and Russell 2000 seem to provide evidence that just by eliminating the unprofitable companies improve the quality of the aggregate earnings/cash flow of the portfolio, which improve the returns.

I feel this is a good test because:

- Each security in both the S&P 600 and Russell 2000 is a very small percentage of the index, which allow us to examine how an aggregate cash flow performance will look like.

- The Russell 2000 is more diversified and if we say diversification helps to capture the returns of the small number of good performers that drive the overall basket returns, then the Russell 2000 long term performance should do better. But it didn’t.

Most likely, I will do for Russell 1000 and S&P 500 before I make any strong conclusion.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Post Comment