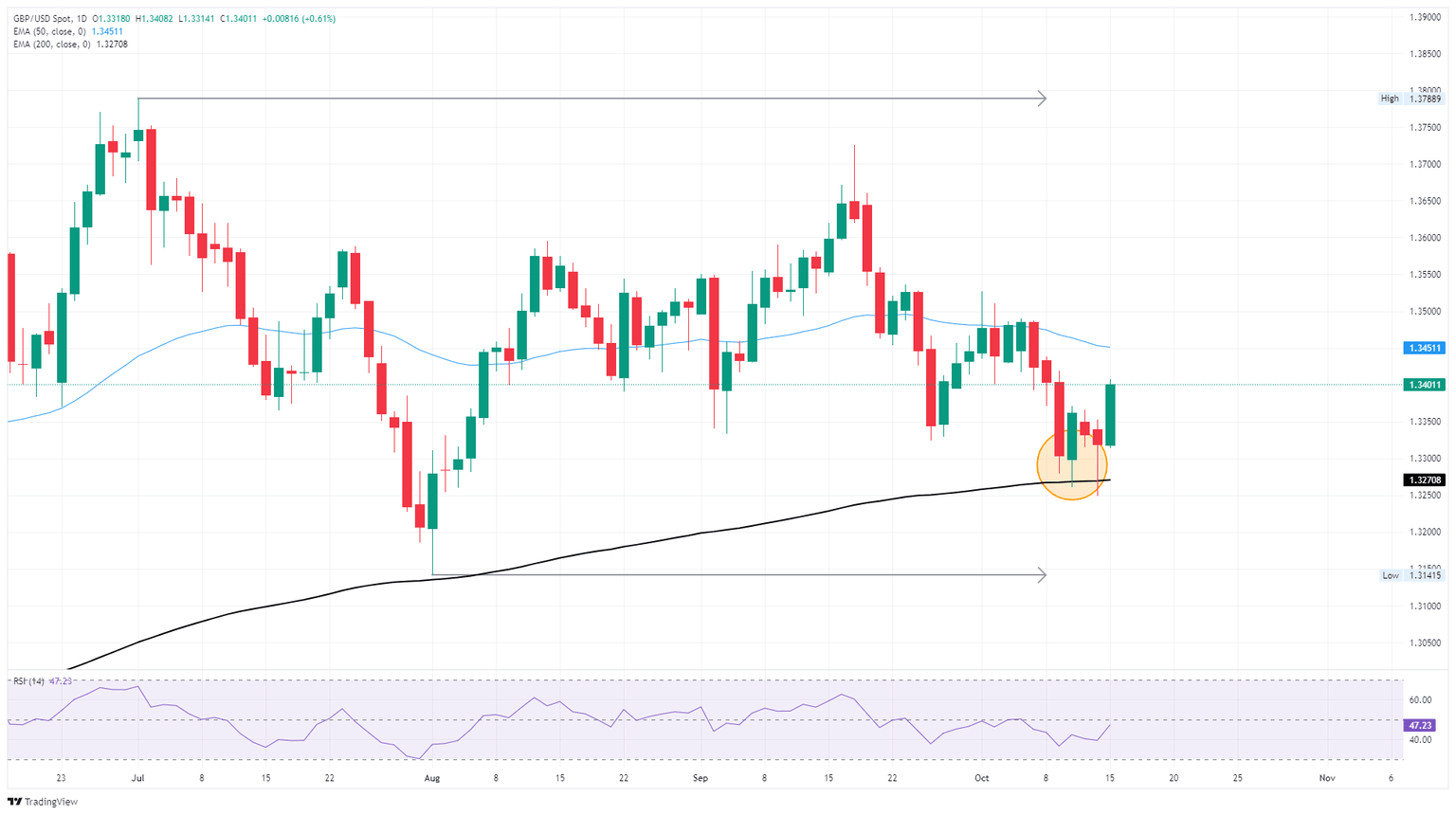

Is the GBP About to Break Out? What UK’s Next Economic Move Means for Pound Sterling Traders and Investors

Every trader watching the GBP/USD pair knows that timing is everything. So, with the UK’s August data—Gross Domestic Product and Industrial Production—set to drop at 06:00 GMT this Thursday, the big question is: how much juice could these figures really inject into Cable’s movements? Think about it—GDP forecasts a modest 0.1% uptick after a flat July, while Industrial Production eyes a slight 0.2% rise following a notable dip last month. Yet, on the annual front, production might take a step back, suggesting more layered dynamics at play. It’s not just numbers; it’s a potential game-changer for traders hungry for a fresh angle in a market stretched thin by sluggish American data flow. Could these mid-tier stats be the spark to turn the tide on GBP/USD’s recent battle near the 1.3400 mark? One thing’s for sure—when those numbers hit, the market won’t be the same. LEARN MORE

When are the UK data releases and how could they affect GBP/USD?

The United Kingdom (UK) docket has the Gross Domestic Product (GDP) and Industrial Production data for August to be released by the Office for National Statistics (ONS) on Thursday, later this session at 06:00 GMT.

UK Gross Domestic Product is expected to increase by 0.1% month-over-month (MoM) in August, against the 0% reading in July. UK Industrial Production may rise 0.2% MoM in August, after declining 0.9% in July. Meanwhile, the annual production could fall 0.6% in the same month, following a 0.1% increase prior. Read more…

GBP/USD shrugs off bearish momentum, recovers 1.3400 region

GBP/USD found room on the high side on Wednesday, clawing its way back to the 1.3400 handle after a near-term dip into the low end that saw Cable briefly battle the 200-day Exponential Moving Average (EMA) near 1.3290. A raft of mid-tier United Kingdom (UK) economic releases are due on Thursday, but the American side of the data docket remains tepid amidst the ongoing US government shutdown that has crimped the flow of key data releases.

UK Gross Domestic Product (GDP) growth, Industrial and Manufacturing Production, and UK Trade Balance data, all for the month of August, are all due, and while each individual figure is mid-tier at best, a notable down- or up-turn across the board could see a sharp shift in intraday Cable flows. Read more…

GBP/USD climbs as Bessent softens US stance, Powell’s dovish tilt

The Pound Sterling (GBP) recovers some ground, advancing 0.60% against the US Dollar (USD) on Wednesday during the North American session, as China-US tensions ease on comments of US Treasury Secretary Scott Bessent. At the time of writing, GBP/USD trades at 1.3396 after bouncing off daily lows of 1.3309.

On Wednesday, Bessent proposed a longer pause on high tariffs on Chinese products, in exchange for the recently tightened limits imposed by Beijing on critical rare earths. “Is it possible that we could go to a longer roll in return? Perhaps. But all that’s going to be negotiated in the coming weeks,” he said in a press conference in Washington. Read more…

Post Comment