Q4 Showdown: Is HYPE About to Eclipse ASTER and Dominate the Market?

When it comes to the DeFi perp DEX showdown, the turf is split but the stakes couldn’t be higher. On one side, you have ASTER—a playground for high-leverage thrill-seekers rubbing shoulders with speculative frenzy. On the other, HYPE sails steadily with a vault of deep liquidity and a trading experience that’s as smooth as a centralized exchange. So, the real question is: Are we witnessing a marathon or a sprint? ASTER’s dominant 24-hour perp volume screams short-term excitement and aggressive bets, while HYPE’s long-term liquidity muscle flexes with a TVL nearly four times that of ASTER’s. It’s almost like watching the tortoise and the hare, except one wears a suit and the other prefers a rollercoaster ride. As traders grapple with risk versus resilience, which platform will truly emerge as the go-to hub for serious, sustainable trading and which will remain the hotspot for speculators chasing quick wins? Dive in with me, because this battle isn’t just about numbers—it’s about the evolving heartbeats of DeFi itself. LEARN MORE

Key Takeaways

Which platform shows stronger long-term liquidity?

HYPE clearly outpaces ASTER, signaling deeper, more resilient market depth.

Where is short-term speculative activity concentrated?

ASTER dominates 24-hour perp volume, highlighting aggressive, high-leverage trading behavior.

In the DeFi perp DEX race, Aster [ASTER] and Hyperliquid [HYPE] each bring their own flavor. Aster brings high leverage, while Hyperliquid offers deep liquidity, steady activity, and a CEX-like experience.

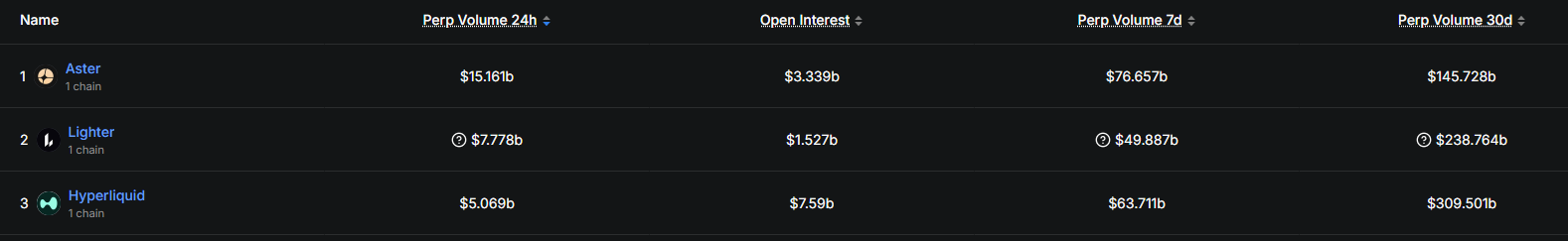

However, based on 24-hour perp volume, it seems investors are still chasing the “high-risk, high-reward” thrill in ASTER, with its volume topping $15 billion, nearly 4x the volume of HYPE.

Simply put, the higher perp volume on ASTER signals strong speculative interest. It shows the market is currently favoring short-term, high-leverage strategies over stable, long-term liquidity.

Zooming out, the story looks very different.

Over the past 30 days, HYPE has clearly outperformed ASTER in capturing perp liquidity, with total volume hitting $310 billion, about 2.14x ASTER’s $145 billion, signaling that HYPE is still winning the longer-term game.

This trend is reinforced by its stronger liquidity position.

HYPE’s TVL sits at $4 billion, nearly 4x ASTER’s, signaling more resilient market depth. Given this momentum, is HYPE now the go-to platform for serious traders, leaving ASTER to chase short-term speculators?

HYPE holds firm as ASTER faces speculative pressure

On-chain divergence is clearly showing up in price action.

Over the past month, HYPE has managed to limit its drawdown to around 15%. Meanwhile, ASTER has dropped 27%, taking the brunt of the mid-October crash that erased 21% of its gains in a single day.

This underscores ASTER’s higher risk profile. The heavy leverage and trader frenzy caused ASTER to carve a new lower low, retracing all the way back to late September levels, while HYPE reinforced its $30 support.

In short, traders are gravitating toward HYPE’s deeper market liquidity.

And this trend isn’t random. ASTER’s delisting from DeFiLlama and the controversy surrounding the Binance founder have pushed capital back into HYPE, showing how macro events can quickly shift on-chain flows.

Going into Q4, HYPE’s resilience against ASTER is becoming more apparent. Thus, making it a lower-risk play in an already volatile perp market, while ASTER’s elevated risk profile remains fueled by speculation.

Post Comment