Why the Government’s 2024 Surplus Tripling 2023’s Could Be the Biggest Opportunity You’re Ignoring Right Now

Ever caught yourself wondering how a nation can flip the fiscal script so dramatically? Ireland did just that in 2024, pulling off a jaw-dropping General Government Balance surplus of €22.6 billion—that’s a solid 4% of GDP! Imagine nearly tripling the previous year’s surplus (€7.2bn) not just through steady growth, but thanks to some savvy legal windfalls and booming tax revenues. Now, here’s the kicker: over half of that revenue jump came from a one-off capital receipt triggered by a European court ruling. It’s like hitting the jackpot while still grinding the regular game. Revenue shot up by 20.1% to €148.6 billion, and despite a healthy increase in spending, Ireland managed to shrink its gross debt-to-GDP ratio down to 38.3%. For anyone tracking fiscal resilience amid global economic shake-ups, these numbers don’t just tell a story—they shout it loud and clear. Curious to unpack every thought-provoking digit and detail? LEARN MORE

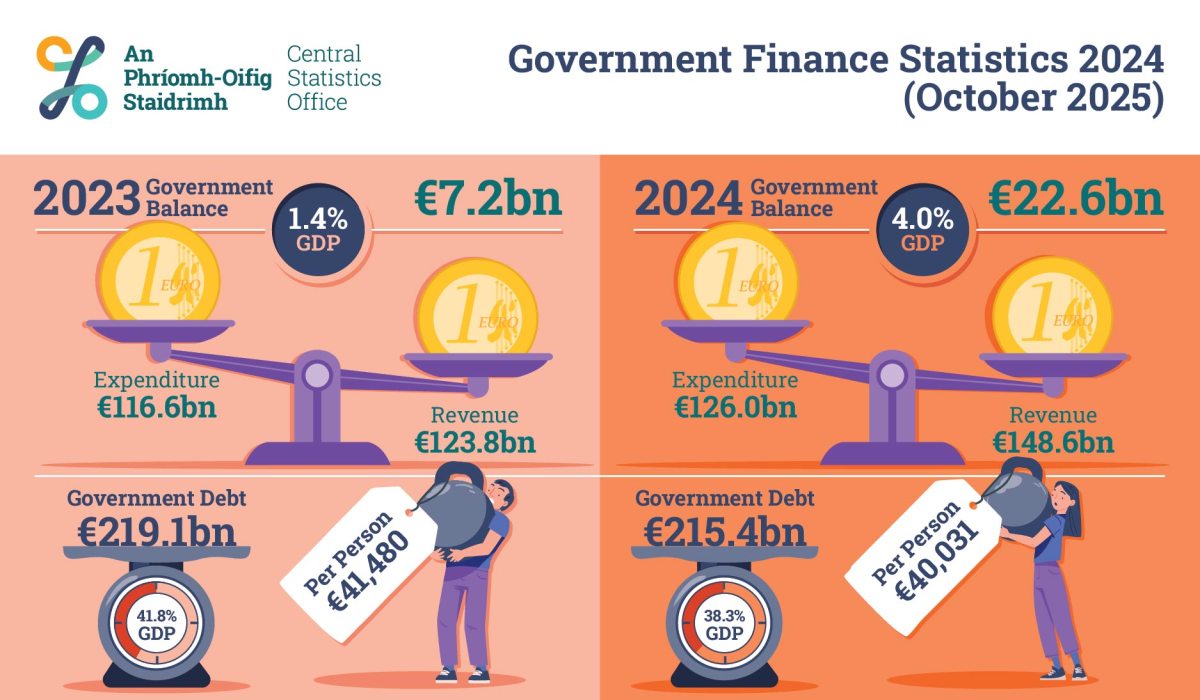

Ireland’s public finances recorded a remarkable performance in 2024, with the Central Statistics Office (CSO) confirming a General Government Balance (GGB) surplus of €22.6bn, equal to 4% of GDP.

This figure represents almost triple the surplus recorded in 2023 (€7.2bn) and reflects both exceptional one-off receipts and robust tax growth.

According to the CSO’s Government Finance Statistics released on 20 October 2025, total government revenue rose to €148.6bn in 2024 — an increase of €24.8bn (20.1%) on the previous year.

The report highlights that over half of this increase stemmed from a one-off capital receipt of more than €14bn arising from a ruling of the Court of Justice of the European Union (CJEU).

Commenting on the results, Bill Drakeford, Statistician in the Government Accounts Compilation & Outputs Division, said:

“Today’s results for 2024 show a surplus of €22.6bn, with revenue 20.1% higher than 2023, and expenditure up by 8%.

“Total government revenue of €148.6bn, is a €24.8bn increase on 2023.

“This was driven by a one-off capital receipt of more than €14bn arising from a Court of Justice of the European Union ruling, alongside continuing increases in tax revenue.

“Gross General Government Debt stood at €215.4bn at the end of 2024, down by €3.7bn in the year. This is the equivalent to 38.3% of Gross Domestic Product (GDP).”

Tax revenues continued their upward trend, rising €9.1bn (9.8%) year-on-year. Direct taxes, including corporation tax, increased by €6.5bn (10.9%), while indirect taxes such as VAT grew by €2.4bn (7.2%).

On the expenditure side, total spending reached €126bn, an 8% increase (€9.4bn) compared to 2023. Growth was recorded across most categories, including wages and salaries, which rose by €2.6bn (8.3%), and social benefit payments, up €2.4bn (8.2%).

Ireland’s gross debt-to-GDP ratio fell to 38.3%, down from 41.8% a year earlier, with net debt declining to €155.0bn.

The CSO also noted downward revisions to overall debt figures due to adjustments in how the Capital Advance Leasing Facility (CALF) is recorded in local government accounts.

The figures underline Ireland’s continued fiscal strength, even as spending pressures and global economic uncertainties persist

Post Comment