Japanese Yen Plunges as Japan’s Lower House Endorses Takaichi—What This Means for Global Markets Now

Have you ever noticed how a single political shake-up can send ripples through the financial markets faster than you can say “fiscal stimulus”? Well, Japan just handed its first female Prime Minister, Sanae Takaichi, the reins, and the Japanese Yen (JPY) is feeling the heat – dropping to a multi-day low against a steadily firm US Dollar (USD). Why? The buzz is all about potential new spending policies and the Bank of Japan (BoJ) possibly hitting the brakes on interest rate hikes, which tends to weigh down the yen’s appeal. Meanwhile, the upbeat mood in equity markets isn’t exactly doing the JPY any favors either, as investors lean away from this safe haven. But hold your horses—investors still bet that the BoJ will play it steady amid sticky inflation and a resilient economy, setting up a fascinating tug-of-war with the Federal Reserve’s more dovish outlook. Could the narrowing Japan-US rate gap throw a lifeline to the yen, or is a deeper slide looming ahead? That’s the story unraveling right now—let’s dive into the complexities behind the currency moves and what it means for the USD/JPY pair’s next dance. LEARN MORE

The Japanese Yen (JPY) extends its steady intraday descent and drops to a multi-day low against a broadly firmer US Dollar (USD) after lawmakers in the Lower House have voted for Sanae Takaichi to become Japan’s first female Prime Minister. This, in turn, fuels speculations about more fiscal stimulus and that the Bank of Japan (BoJ) could delay raising interest rates further, which, in turn, weighs on the JPY. Apart from this, a generally positive tone around the equity markets turns out to be another factor undermining demand for the safe-haven JPY.

Investors, however, seem convinced that the BoJ will stick to its policy normalization path amid sticky inflation and a resilient economy. This marks a significant divergence in comparison to dovish Federal Reserve (Fed) expectations, which could keep a lid on further USD appreciation and cap gains for the USD/JPY pair. Moreover, the expected narrowing of the Japan-US rate differential could lend some support to the lower-yielding JPY. Hence, it will be prudent to wait for strong follow-through selling before positioning for deeper JPY losses.

Japanese Yen retains negative bias amid concerns about Japan’s fiscal outlook

- The ruling Liberal Democratic Party and Japan Innovation Party, known as Ishin, agreed to form a coalition Monday. Moreover, lawmakers in the Lower House have voted for Sanae Takaichi to become Japan’s first female Prime Minister.

- The development fuels speculations about more expansionary policy in Japan, which could allow the Bank of Japan to delay raising interest rates further. This, in turn, fails to assist the Japanese Yen to attract any meaningful buyers during the Asian session.

- The coalition holds a combined tally of 231 in the lower house, short of the 233 needed for a simple majority, suggesting that the government would need cooperation from other parties to pass any legislation. This keeps a lid on the so-called “Takaichi” trade.

- Inflation in Japan remains at or above the BoJ’s 2% target for more than three years, and the economy grew for a fifth straight quarter through June. Moreover, BoJ Board Member Hajime Takata said on Monday that Japan has roughly achieved the price target.

- This follows BoJ Deputy Governor Shinichi Uchida’s remarks on Friday, reiterating that the central bank will continue raising rates if economic and price developments move in line with its forecasts. This keeps hopes alive for an imminent rate hike this year.

- In contrast, the CME Group’s FedWatch Tool indicates that traders have fully priced in a 25-basis-points rate cut at each of the US Federal Reserve’s policy meetings in October and in December. This could undermine the US Dollar and cap the USD/JPY pair.

- The Senate on Monday voted against reopening the US government for the 11th time, extending the shutdown to a third week as Democrats and Republicans remain at odds and unable to resolve the deadlock. This, in turn, contributes to capping the buck.

- US President Donald Trump set the tone for his upcoming meeting with China’s President Xi Jinping. Trump said that the two countries would strike a fantastic deal and warned that failure to reach an agreement could see China face potential tariffs of 155%.

- On the geopolitical front, Ukrainian drones struck major gas processing plants in southern Russia. Trump said on Sunday that the Donbas region of Ukraine should be cut up, leaving most of it in Russian hands, to end a war that has dragged on for nearly four years.

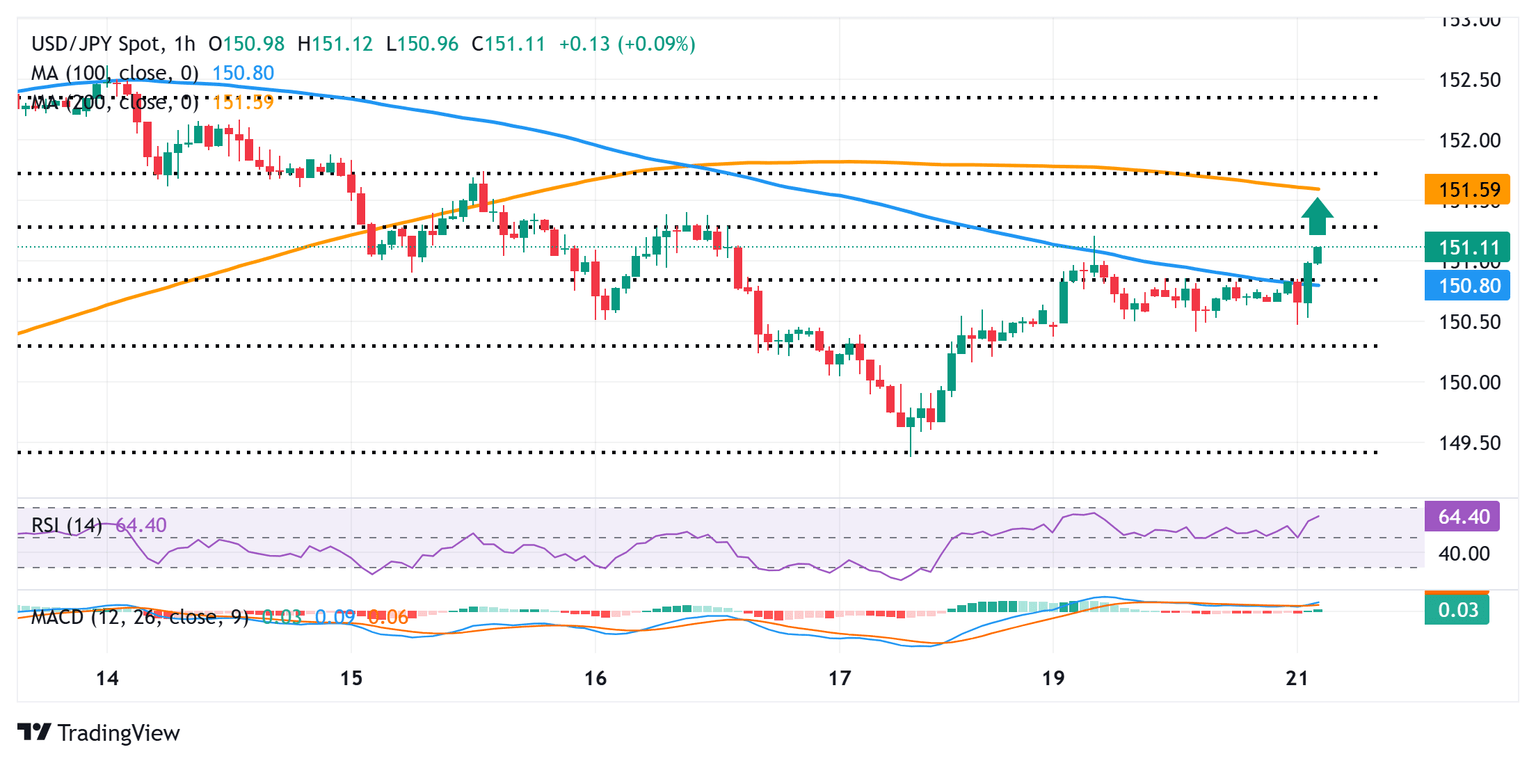

USD/JPY bulls have the upper hand; move towards 151.75 confluence remains a distinct possibility

The emergence of some dip-buying and a move back above the 151.00 mark favors the USD/JPY bulls. Adding to this, positive oscillators on 1-hour/daily charts back the case for a further appreciating move towards the 151.75 confluence – comprising the 61.8% Fibonacci retracement level of the recent decline from the monthly peak and the 200-hour Simple Moving Average (SMA). A sustained move beyond the latter should allow the USD/JPY pair to surpass the 152.00 mark and climb further towards the next relevant hurdle near the 152.25 supply zone en route to the 153.00 mark.

On the flip side, the 150.50-150.45 region, or the Asian session trough, might continue to act as an immediate support ahead of the 150.25 zone, or the 23.6% Fibo. retracement level and the 150.00 psychological mark. A convincing break below the latter might expose the 149.40-149.35 area, or a nearly two-week low touched on Friday. The USD/JPY pair could extend the fall further towards the 149.00 round figure before eventually dropping to the 148.45-148.40 strong horizontal resistance-turned-support.

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | 0.10% | 0.26% | 0.08% | 0.14% | 0.26% | 0.06% | |

| EUR | -0.05% | 0.04% | 0.21% | 0.03% | 0.10% | 0.20% | 0.00% | |

| GBP | -0.10% | -0.04% | 0.14% | -0.02% | 0.05% | 0.16% | -0.04% | |

| JPY | -0.26% | -0.21% | -0.14% | -0.15% | -0.08% | 0.02% | -0.16% | |

| CAD | -0.08% | -0.03% | 0.02% | 0.15% | 0.06% | 0.19% | -0.02% | |

| AUD | -0.14% | -0.10% | -0.05% | 0.08% | -0.06% | 0.11% | -0.10% | |

| NZD | -0.26% | -0.20% | -0.16% | -0.02% | -0.19% | -0.11% | -0.19% | |

| CHF | -0.06% | -0.01% | 0.04% | 0.16% | 0.02% | 0.10% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Post Comment