Unlock the Hidden Power of UK Retail Sales: The Game-Changer for Your GBP/USD Trades You Can’t Afford to Miss!

Ever wonder what the flickering pulse of the UK economy looks like when the retail sector catches a cold? Well, retail sales data just might be that thermometer—this Friday, the Office for National Statistics (ONS) rolls out the September figures, and if the whispers are right, we’re in for a slight dip after August’s little rally. It’s kinda like watching a seesaw gently tilting downward by 0.2% month-over-month, while the yearly gain slides barely by 0.6%—not exactly a blockbuster, but enough to get heads turning. Now, strip away motor fuel and we see core sales inching up by a modest 0.7% year-over-year, signaling a cautious consumer crowd out there, maybe tightening their purse strings a tad. This isn’t just number-crunching for the sake of charts; these shifts ripple through markets—especially the GBP/USD currency pair, which could feel the squeeze if spending softens. So, how will these retail murmurs mingle with interest rate bets, tariff talk, and inflation jitters to sway the pound and the mood of investors? If you’re sharpening your investment radar or just curious about what’s stirring under the UK’s economic hood, stick around. There’s more than a little drama in these numbers. LEARN MORE

The UK Retail Sales Overview

The United Kingdom (UK) docket has the Retail Sales data for September to be released by the Office for National Statistics (ONS) on Friday, later this session at 06:00 GMT.

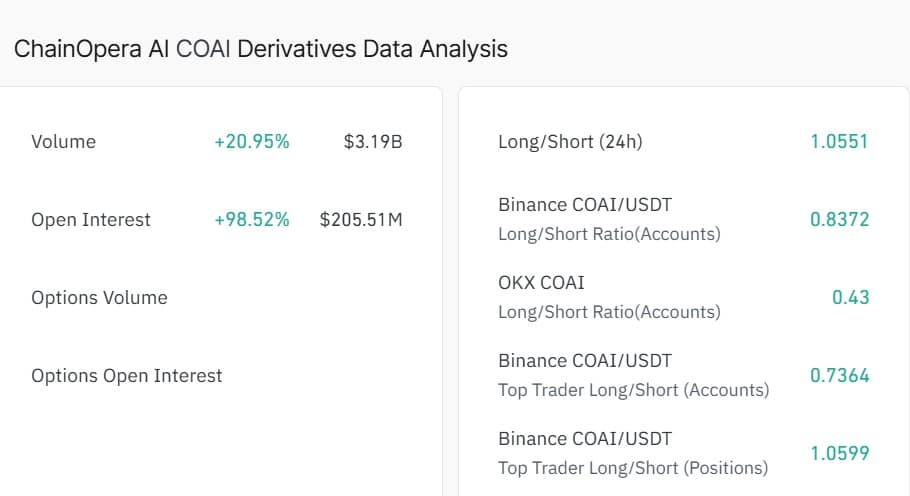

UK Retail Sales are expected to decline by 0.2% month-over-month (MoM) in September, swinging from a 0.5% increase seen in August. On an annualized basis, Retail Sales are seen rising 0.6% during the reported month, inching lower from 0.7% prior.

Core Retail Sales, stripping the basket of motor fuel sales, are anticipated to have climbed by 0.7% year-over-year (YoY), lower than the previous reading of 1.2%.

How could the UK Retail Sales affect GBP/USD?

UK Retail Sales data for September could contribute to the downward pressure on the GBP/USD pair amid signs of softer consumer spending. Even the surprise uptick may struggle to help the pair hold ground amid rising bets of more interest rate cuts by the Bank of England (BoE) in the remaining year.

The Pound Sterling (GBP) faced challenges after BoE Monetary Policy Committee (MPC) member Swati Dhingra signaled on Thursday that United States (US) tariffs could put downward pressure on prices in the medium term. The preliminary United Kingdom (UK) Purchasing Managers’ Index (PMI) data by S&P Global will be eyed later in the day. Attention will be shifted toward the US Consumer Price Index figures due on Friday.

Technically, the GBP/USD pair remains steady after five days of losses, trading around 1.3320 at the time of writing. The pair may target the two-month low of 1.3248, recorded on October 14, followed by the six-month low of 1.3141. On the upside, the initial barrier lies at the nine-day Exponential Moving Average (EMA) of 1.3365, followed by the 50-day EMA at 1.3433. A break above these levels would improve the short- and medium-term price momentum and open the doors for the pair to test the monthly high of 1.3527.

Post Comment