Bitcoin is at one of those thrilling crossroads — you know, the kind where you can almost hear the tension in the air? Picture this: $2.7 billion in short positions and $1.1 billion in longs are squished close to current prices, creating a pressure cooker scenario that’s begging for a breakout. Now, here’s the kicker — about 83.6% of Bitcoin’s supply is finally in the green, signaling a market filled with confidence. But hold on, because when profit percentages start inching beyond 95%, it’s like that sizzling overheated engine warning us a correction might be looming. So, what comes next? Will Bitcoin burst upward, or take a dive? With everyone from casual holders to hardcore traders locked in this tight tug-of-war, one thing’s certain: a big move is lurking just around the corner, and it’s anyone’s guess where it will head. Ready to dive into the drama? LEARN MORE

Key takeaways

Is Bitcoin ready for a major price move?

Yes. With $2.7 billion in shorts and $1.1 billion in longs stacked near press time levels, BTC is in a tight range.

What does the profit data say about market sentiment?

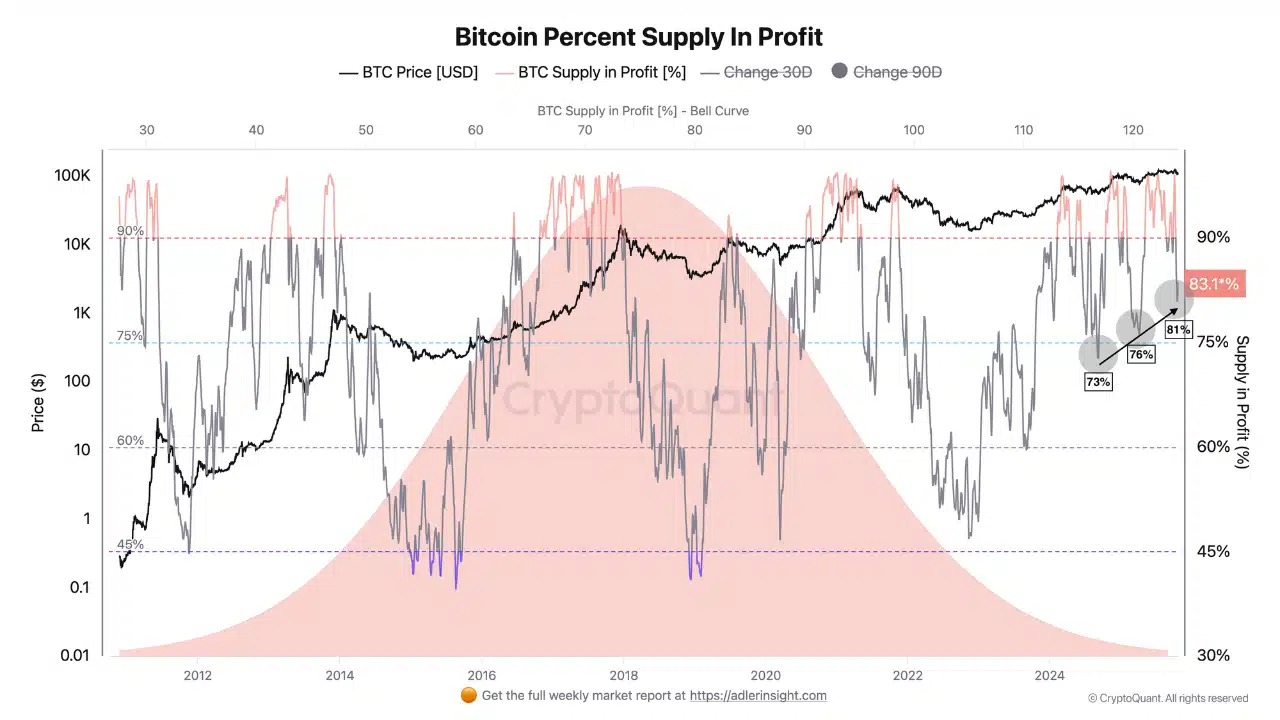

About 83.6% of Bitcoin’s supply is now in profit, but there’s a need to watch for overheating above 95%.

With most holders sitting on profits and traders piling into both long and short positions, Bitcoin [BTC] may be ready for a big move. Around $2.7 billion in shorts and $1.1 billion in longs are stacked close to the press time price, creating a tight zone of tension.

Whether Bitcoin breaks up or down next, a major price swing could be just around the corner.

Rising profits mean confidence

*]:pointer-events-auto [content-visibility:auto] supports-[content-visibility:auto]:[contain-intrinsic-size:auto_100lvh] scroll-mt-[calc(var(–header-height)+min(200px,max(70px,20svh)))]” dir=”auto” data-turn-id=”request-WEB:7aeb05a2-404a-42c8-a838-5e81806b7e9b-12″ data-testid=”conversation-turn-26″ data-scroll-anchor=”true” data-turn=”assistant”>

Bitcoin’s supply in profit climbed to about 83.6%, meaning most holders are now back in the green. This metric often serves as a useful way to figure out market sentiment.

Right now, it means the market’s got Bitcoin’s back.

Source: Cryptoquant

Usually, when the share of BTC in profit stays between 80% and 90%, the market tends to keep expanding as holders resist selling.

While the press time level looked healthy, traders should watch for signs of overheating once it pushes past 95% – A zone that is often followed by market corrections.

Source: Glassnode

Supporting this view, both Spot and Futures CVD

flattened for the first time since 10 October’s flush. This suggested that aggressive selling pressure has finally eased, with the market regaining balance too.

A major move ahead

*]:pointer-events-auto [content-visibility:auto] supports-[content-visibility:auto]:[contain-intrinsic-size:auto_100lvh] scroll-mt-[calc(var(–header-height)+min(200px,max(70px,20svh)))]” dir=”auto” data-turn-id=”request-WEB:7aeb05a2-404a-42c8-a838-5e81806b7e9b-15″ data-testid=”conversation-turn-32″ data-scroll-anchor=”true” data-turn=”assistant”>

Bitcoin, at the time of writing, was trapped between heavy liquidation zones – The perfect setup for a potential breakout. Around $2.7 billion in short positions are stacked just above press time levels, reaching up to $117,000. On the contrary, $1.1 billion in longs sit below, down to $113,700.

Source: X

Beyond these levels, the pressure starts to build. Around $15.35 billion in shorts extend up to $126,400, while $10 billion in longs are stacked down to $104,400. This setup puts BTC in a tight, high-stakes leverage range.

Even a small price move could trigger a wave of liquidations. The market remains coiled, and a major move could set off the next volatility phase.

Post Comment