AAVE Set to Ignite: Is This the Hidden Bull Run Investors Can’t Afford to Miss?

Ever find yourself wondering if a dip in crypto is just a setup for an epic comeback? Well, AAVE might just be cooking up something exciting right under our noses. After bouncing off a key market gap and clinging tightly to its trendline support, this altcoin’s latest move has my attention—especially with exchange outflows tapering off. It’s like watching a suspense thriller where the hero refuses to stay down, signaling a potential rally ahead. But hey, with spot activity cooling off somewhat, it’s a nudge to keep your eyes peeled and your wits sharp. Could this be the calm before the storm, or just a fleeting pause? Let’s dive into what the charts and data are whispering—and maybe shouting—about AAVE’s journey. LEARN MORE

Key Takeaways

AAVE is gaining momentum after rejecting a key market gap and holding trendline support. Fading exchange outflows signals potential rally despite the cooling spot activity raising caution.

Aave’s [AAVE] price action is showing signs of renewed strength. The altcoin has managed to turn a recent pullback into a springboard.

After sliding into a gap left by its last rally, the token caught a sharp rejection and bounced, climbing more than 5% in the past day.

A confluence of support

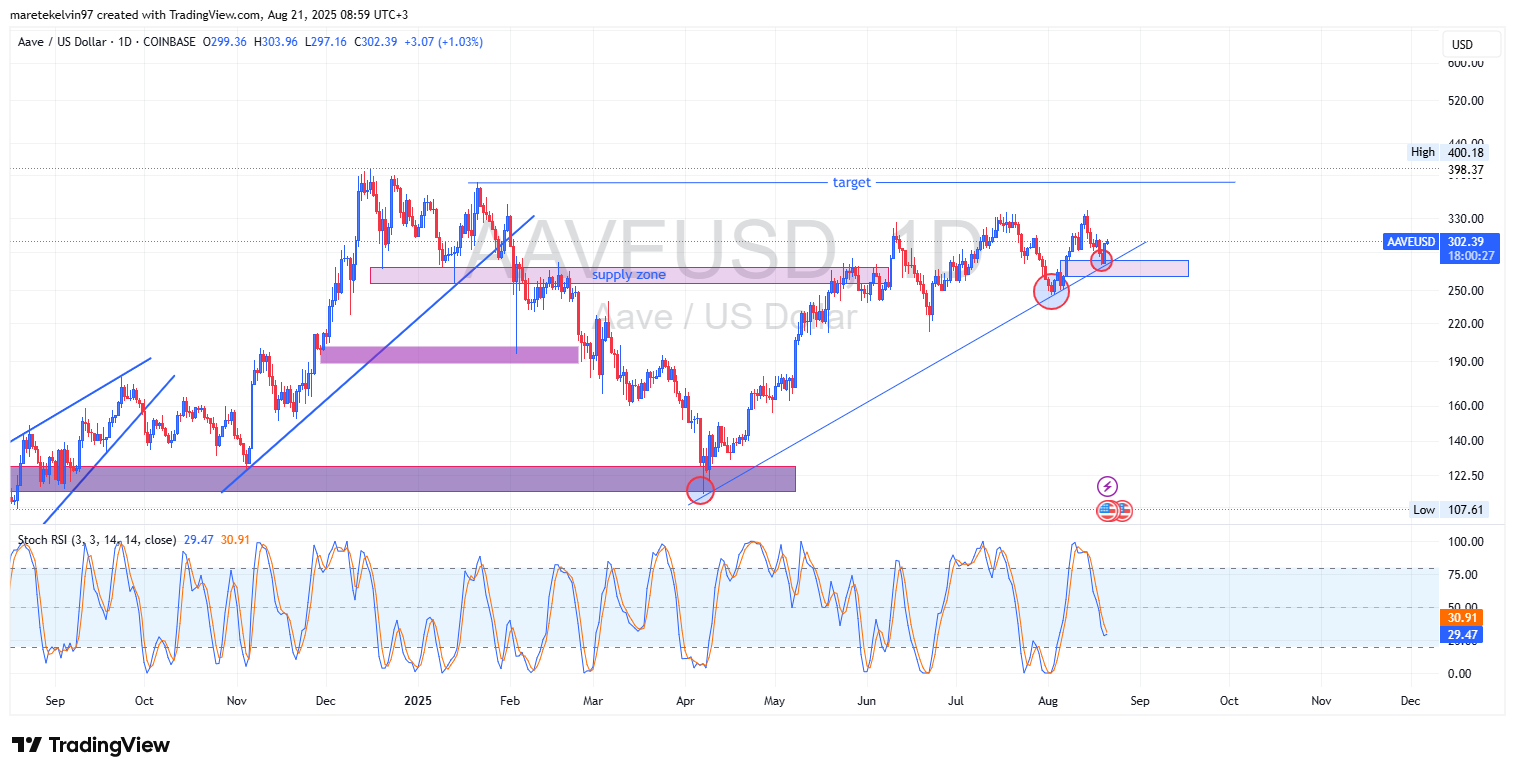

The rebound was not random. Prices held right at a confluencing zone of a rising trendline and the filled gap zone at around $270 — a level that has now produced three solid bounces since April.

For traders and investors alike, that confluence is worth paying attention to. It suggests the market still respects AAVE’s short-term structure, even after last week’s choppy action.

AAVE leans bullish

Momentum indicators also strengthen the bullish technical outlook. AAVE’s Stochastic RSI is drifting towards an oversold territory, pointing to a potential reversal points for another bullish push.

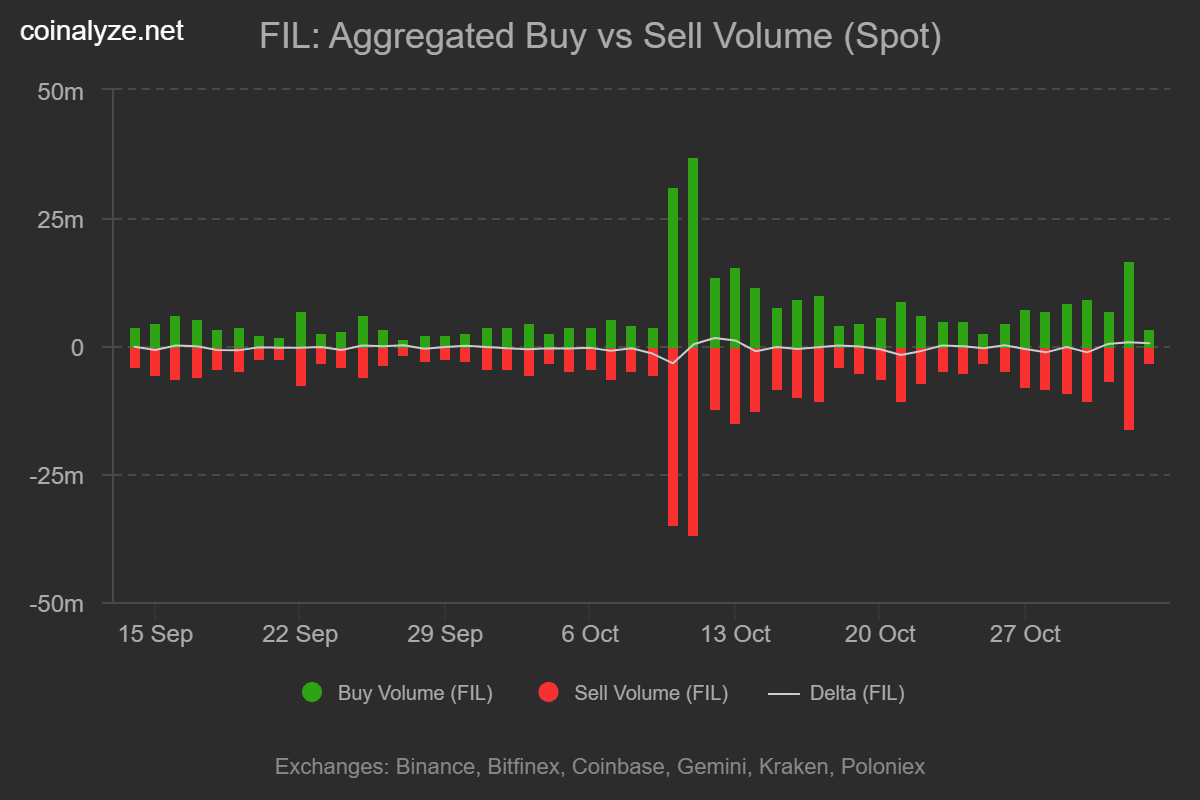

Interestingly, AMBCrypto’s analysis on the recent CryptoQuants exchange outflow data affirmed the bullish bias. AAVE outflows are fading, meaning fewer tokens are leaving trading platforms.

That could be a sign that big holders are in no rush to accumulate aggressively.

Cooling activity sparks cautionary signals

However, the Spot market data sparked some cautionary signals. Spot trading volume looked lighter than it did earlier this month.

The bubble map data indicated cooling trading activity, suggesting that AAVE market is catching its breath.

Historically a cool-down does not necessarily suggest bearish signals. Instead, the reducing activity could suggest that investors are holding their calm as they await market direction confirmation.

All in all, with the current bullish technicals and mixed on chain metrics, chances are the rally may continue in the short run until the market structure shifts.

Post Comment