Binance Drops $283M Bombshell — What This Massive Payout Means for Crypto Investors and the Future of Market Trust

Ever wonder what it takes for a crypto giant like Binance to not just survive—but actually step up—when the market storms hit? On October 10, amidst a tidal wave of market turmoil and de-pegged assets, Binance didn’t just sit back watching the chaos unfold. Instead, they pulled a solid move by dishing out a staggering $283 million in compensation to users hit hard by sudden price swings and technical glitches. That’s right—while the crypto world was reeling, Binance was busy making things right, and fast. But what does this bold compensation initiative mean for trust and transparency in an industry often criticized for its volatility? Let’s dive into how Binance handled the fallout and what it signals for the future of crypto exchanges. LEARN MORE.

Shortly after the recent market pullback, Binance announced plans to compensate users impacted by market depegs on its platform.

Photo: Kanchanara

Key Takeaways

- Binance distributed $283 million in compensation to users affected by technical glitches and market volatility on October 10.

- Compensation addressed de-pegged assets like USDE, BNSOL, and WBETH caused by extreme price movements and platform issues.

Share this article

Binance announced Sunday that it had allocated about $283 million in compensation to users affected by market volatility and technical issues that occurred on Friday.

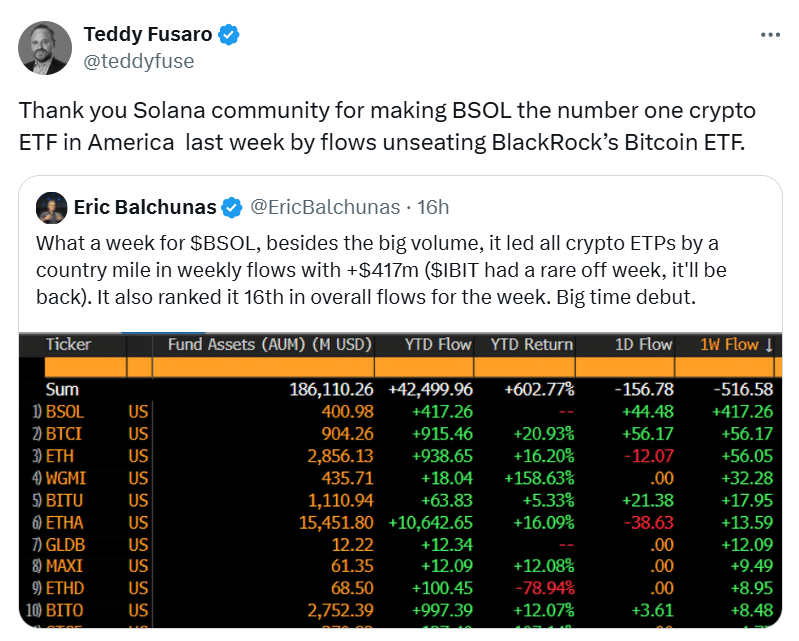

The compensation primarily covered losses tied to de-pegged assets, including USDE, BNSOL, and WBETH.

Binance said that between 20:50 and 22:00 UTC on October 10, heavy institutional and retail selling drove sharp declines across crypto markets. The de-pegging followed the downturn, with prices bottoming between 21:20 and 21:21 UTC and severe de-pegs starting after 21:36 UTC.

The exchange completed compensation within 24 hours after extreme volatility triggered widespread sell-offs and collateral de-pegs.

“Binance remains committed to addressing these issues responsibly and transparently, as transparency has always been one of our core values,” the exchange stated in its announcement.

The company also identified extreme price movements in certain spot trading pairs, attributing them to historical limit orders dating back to 2019 being triggered during periods of low liquidity.

Some trading pairs displayed “zero prices” due to recent changes in decimal place parameters, which Binance clarified was a display issue rather than actual zero-value trades.

The Friday crash that shook crypto markets erased roughly $19 billion in leverage, including $16.6 billion in long positions. Triggered by President Trump’s economic policy announcements, the sell-off dragged Bitcoin from $122,000 to $102,000 and sent Ethereum tumbling.

Bitcoin was trading around $113,800 at press time, recovering from the “Black Friday” and now sitting about 10% below its recent high.

Share this article

Post Comment