Bitcoin Bleeds $10B Outflow — But Why Top Bulls Are Betting on a $200K Q4 Explosion!

So, Bitcoin just took a 7% dip, and everyone’s wondering—was it the start of a crash or just a sneaky little stumble? Here’s the kicker: although a $10 billion capital outflow had many biting their nails, BTC didn’t just hold steady; it showed signs of a clever rebound—a “bend” if you will—that soaked up the pressure and could be setting the stage for its next big move. Now, I can’t help but ask: with Binance’s stablecoin reserves swelling and the historically bullish Q4 waving its magic wand, could we be staring down the barrel of a $200K Bitcoin rally? It’s as if the market’s paused for a deep breath before taking off—smart money is hovering, waiting to jump back in, and all eyes are on how this structural reset unfolds. If you thought the recent correction meant the party was over, think again. This might just be a well-timed shakeout, clearing the decks for a robust comeback. Curious how this plot thickens?

Key takeaways

Bitcoin’s 7% dip looks more like a breakdown, with bullish momentum returning near the lows. Rising Binance stablecoin reserves and Q4 seasonality could fuel a rally toward $200K.

Despite a $10 billion capital outflow and a swift 7% correction from its $123.4K all-time high, Bitcoin [BTC] has shown resilience.

Instead of a breakdown, BTC is showing signs of bullish re-accumulation; a “bend” that absorbed pressure and potentially laid the groundwork for the next leg in price discovery.

Now it all comes down to a broader structural reset. With stablecoin reserves climbing and Q4 strength looming, Bitcoin’s next chapter could write itself above $200K.

Bearish pause and a bullish flip

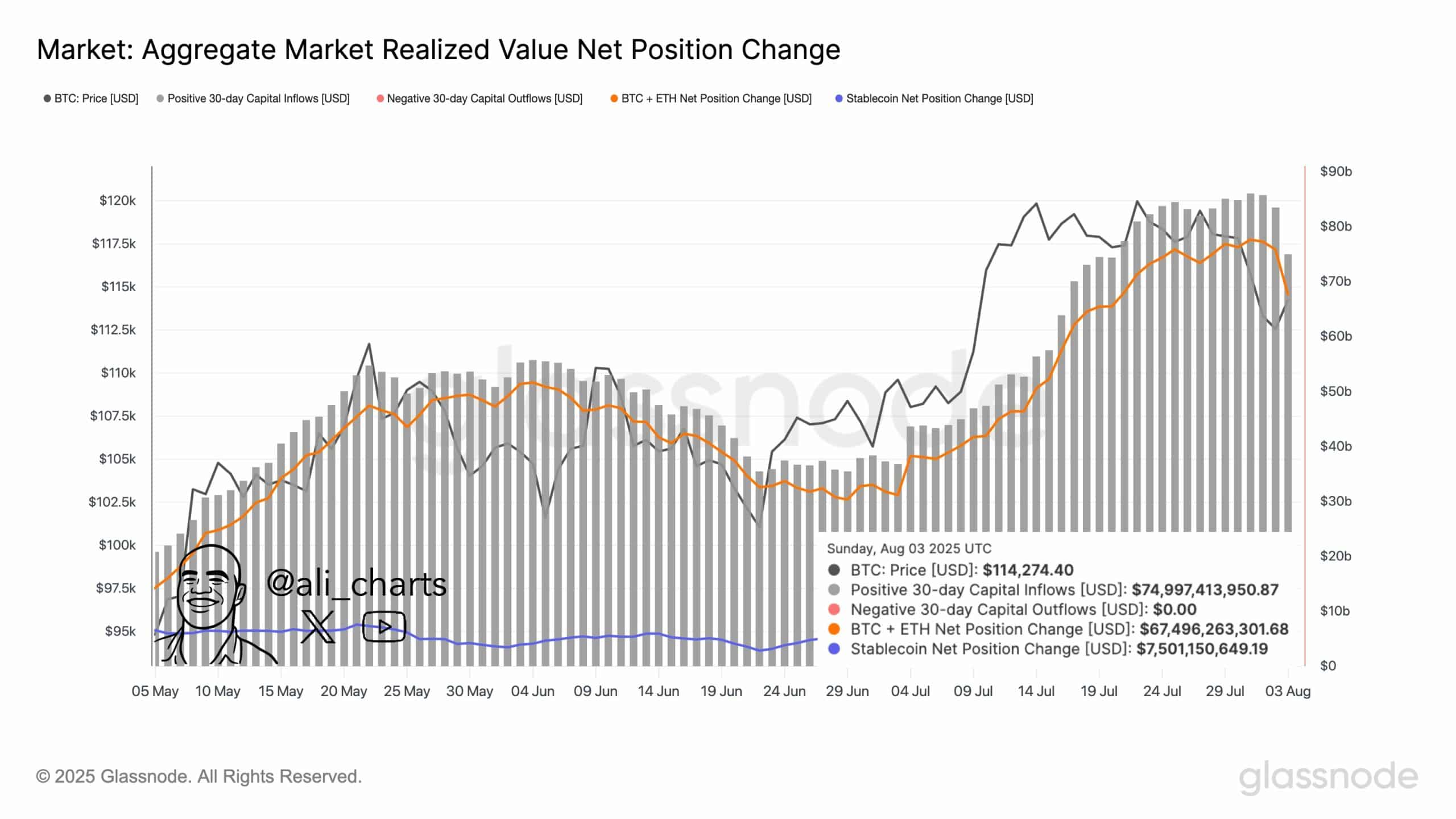

Bitcoin’s drop from $123.4K to $114K coincided with a $10 billion drop in crypto capital inflows, according to analyst Ali Martinez.

Yet, key metrics suggest this was more a technical correction than a trend reversal.

Data from Swissblock shows bullish momentum flipping before BTC hit its recent low near $112.3K; a sign of smart money stepping back in during weakness.

Moreover, the absence of negative outflows during this drop shows conviction: Bitcoin holders didn’t panic.

Ammunition on the sidelines

Binance’s ERC20 stablecoin reserves have hovered above $32.3 billion, nearing local highs. Such spikes usually precede capital deployment into BTC and large-cap tokens.

The data suggests whales are sitting on the sidelines, likely awaiting bullish confirmation.

With Bitcoin holding firm above $110K and reclaiming short-term bullish structure, this sidelined capital could fuel the next rally.

Data further proves that Bitcoin’s price discovery cycle remains intact; stretched, not broken.

The setup for Q4

Q4 is historically Bitcoin’s best-performing quarter, with strong positive trends; especially when institutions re-enter.

With net inflows holding steady at $75 billion and BTC + ETH position changes remaining positive at over $67 billion, the market setup appears constructive rather than corrective.

As capital stabilizes and reflexivity takes hold—fueled by corporate treasury allocations, ETF inflows, and rising liquidity—the projected $200K Bitcoin target for late Q4 seems increasingly plausible.

The recent correction may have served as a healthy shakeout, clearing excess leverage and setting the stage for renewed upward momentum.

Post Comment