Bitcoin Bleeds $10B Outflow — But Why Top Bulls Are Betting on a $200K Q4 Explosion!

Key takeaways

Bitcoin’s 7% dip looks more like a breakdown, with bullish momentum returning near the lows. Rising Binance stablecoin reserves and Q4 seasonality could fuel a rally toward $200K.

Despite a $10 billion capital outflow and a swift 7% correction from its $123.4K all-time high, Bitcoin [BTC] has shown resilience.

Instead of a breakdown, BTC is showing signs of bullish re-accumulation; a “bend” that absorbed pressure and potentially laid the groundwork for the next leg in price discovery.

Now it all comes down to a broader structural reset. With stablecoin reserves climbing and Q4 strength looming, Bitcoin’s next chapter could write itself above $200K.

Bearish pause and a bullish flip

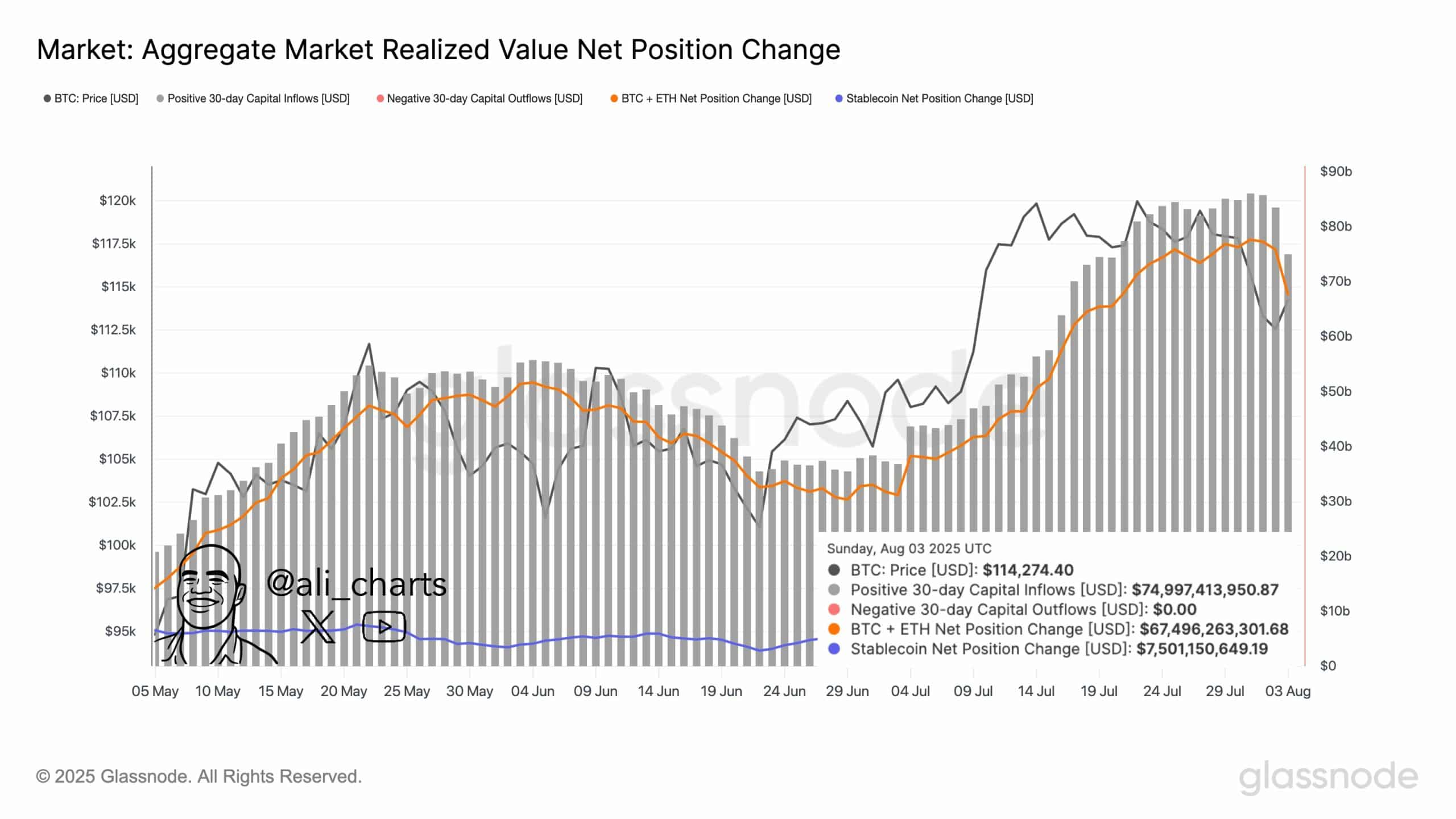

Bitcoin’s drop from $123.4K to $114K coincided with a $10 billion drop in crypto capital inflows, according to analyst Ali Martinez.

Yet, key metrics suggest this was more a technical correction than a trend reversal.

Data from Swissblock shows bullish momentum flipping before BTC hit its recent low near $112.3K; a sign of smart money stepping back in during weakness.

Moreover, the absence of negative outflows during this drop shows conviction: Bitcoin holders didn’t panic.

Ammunition on the sidelines

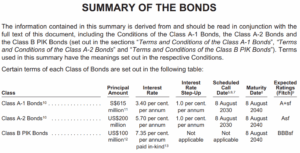

Binance’s ERC20 stablecoin reserves have hovered above $32.3 billion, nearing local highs. Such spikes usually precede capital deployment into BTC and large-cap tokens.

The data suggests whales are sitting on the sidelines, likely awaiting bullish confirmation.

With Bitcoin holding firm above $110K and reclaiming short-term bullish structure, this sidelined capital could fuel the next rally.

Data further proves that Bitcoin’s price discovery cycle remains intact; stretched, not broken.

The setup for Q4

Q4 is historically Bitcoin’s best-performing quarter, with strong positive trends; especially when institutions re-enter.

With net inflows holding steady at $75 billion and BTC + ETH position changes remaining positive at over $67 billion, the market setup appears constructive rather than corrective.

Post Comment