Bitcoin Hits 17: Will This ‘Red October’ Be the Wake-Up Call or the Beginning of a Breakout?

Seventeen years ago, on a seemingly unremarkable Halloween night, the blockchain ball dropped—penned in a modest nine-page whitepaper by the enigmatic Satoshi Nakamoto. Who could’ve guessed that this little manifesto would ignite a financial revolution, introducing proof-of-work and the very backbone of decentralized currency? Fast forward to today, Bitcoin isn’t just surviving—it’s holding an iron grip on nearly 60% of the cryptocurrency market, a clear beacon for investors seeking refuge when uncertainty is the name of the game. But here’s the kicker: despite this dominance and the still-thrumming institutional interest, the market’s mood is far from festive—like watching a heavyweight champ pacing the ring, waiting for the bell to drop. So, what’s next for this digital titan as it marks its 17th birthday amid the jitters and jabs of a “red October”? Buckle up, because this isn’t just a story about price—it’s about resilience, strategy, and the silent game-changers quietly shaping Bitcoin’s future. LEARN MORE

Key Takeaways

Why is Bitcoin’s whitepaper significant?

It introduced blockchain and proof-of-work technology in 2008, laying the foundation for decentralized digital currency.

What does Bitcoin dominance at 60% mean?

It shows most crypto value is concentrated in Bitcoin, suggesting investors prefer BTC to altcoins during uncertain times.

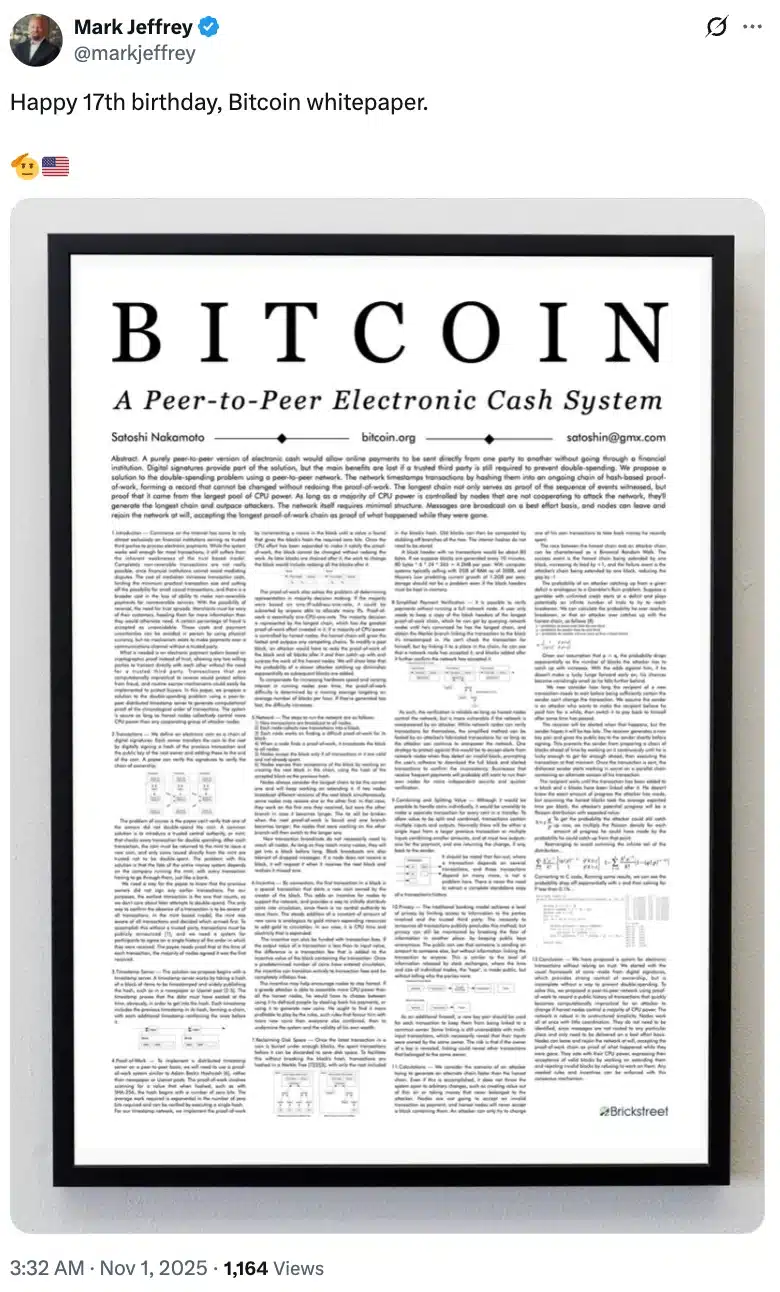

Seventeen years ago, on a quiet Halloween night in 2008, a nine-page document appeared on a cryptography mailing list.

Titled ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ and signed by the still-unknown Satoshi Nakamoto, the paper introduced an idea that felt experimental at the time.

It arrived at a pivotal moment, just as the global financial system was beginning to collapse under its own weight.

What started as a radical alternative to traditional banking has since transformed into a powerful financial ecosystem, now valued in the trillions.

Bitcoin whitepaper turns 17

Yet, as Bitcoin [BTC] marks the 17th anniversary of its whitepaper, the market isn’t celebrating.

Bitcoin faces “red October”

The asset is coming off its first “red October” in seven years, dipping more than 7% in the past month amid a $19 billion market correction.

Still, even in a cooling market, Bitcoin holds its place among the world’s top eight assets, underscoring just how far a nine-page idea has come.

Remarking on the same, Treasury Secretary Scott Bessent also noted,

“17 years after the whitepaper, the Bitcoin network is still operational and more resilient than ever. Bitcoin never shuts down. @SenateDems could learn something from that.”

Bitcoin price action and other trends

In fact, at press time, Bitcoin traded around $110,141, registering a modest 0.44% increase over the last 24 hours, according to CoinMarketCap.

However, market momentum appears restrained.

The Relative Strength Index (RSI) was hovering near the 42 mark, indicating that bearish pressure still outweighs bullish attempts to regain control.

This cautious tone is also reflected in broader market positioning.

Bitcoin’s dominance sat at 59.93%, meaning nearly 60% of the entire cryptocurrency market’s value is concentrated in BTC alone.

Such high dominance typically signals a flight to stability, with investors rotating out of altcoins and back into Bitcoin, particularly during periods of uncertainty.

Yet, despite short-term market turbulence, institutional appetite has not disappeared.

Spot Bitcoin ETFs recorded $191.6 million in net inflows, according to data from Farside Investors, suggesting that larger market participants continue to accumulate during the pullback.

What’s more?

This steady inflow of capital supports the idea that the recent market correction may not signal a prolonged downturn.

Instead, it could lay the groundwork for the next accumulation phase, as investor confidence begins to rebuild.

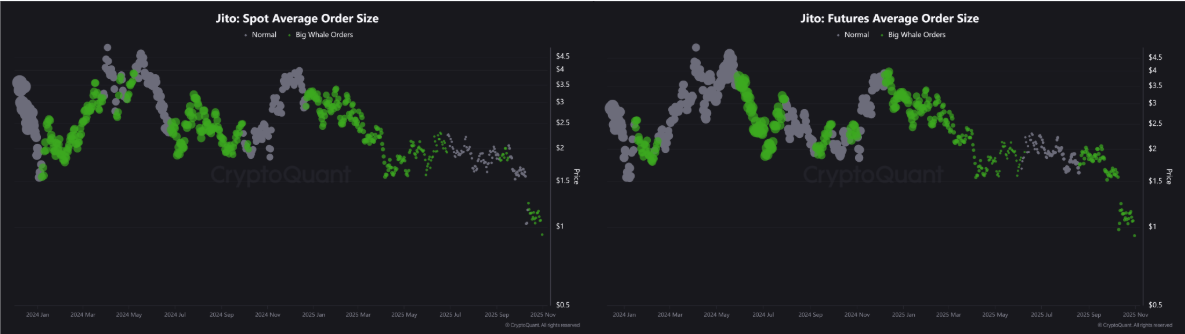

This coincided with Bitcoin’s current stability, masking a market running low on conviction.

While retail traders continue to drive activity, shrinking trade sizes and muted whale participation suggest a lack of strategic accumulation.

Technical signals reinforce this slowdown, with fading momentum and weakening scarcity cues pointing to cautious sentiment.

Therefore, unless institutional players step back in with confidence, BTC is likely to remain range-bound, waiting for a clear catalyst to define its next major move.

Post Comment