Bitcoin’s Secret Signal: Why Smart Money’s Steady Grip Could Ignite the Next Market Tsunami While STHs Tread Carefully

Is Bitcoin flexing its muscles at $110K, or is this just another mirage in the crypto desert? Long-term holders are definitely smiling with solid profits locked in, but the market’s heartbeat still seems a bit faint—leverage is tiptoeing back on Binance, yet traders haven’t gone all-in on speculation just yet. It’s like watching a seasoned boxer pacing in the ring, waiting for that perfect moment to throw a knockout punch. What’s really going on beneath the surface? Are we on the edge of a breakout, or is resistance ready to push BTC back down a notch? Let’s dive deep into the numbers, the psychology, and the subtle shifts shaping Bitcoin’s next move—and see why staying above $110K might just be the confidence booster this market desperately needs. LEARN MORE

Key Takeaways

Is BTC strong right now?

Yes. LTHs remain in profit, and Bitcoin is holding near $110K.

Will trader confidence return to the market?

Slowly. Leverage is creeping back on Binance, but full speculation hasn’t returned yet.

Bitcoin [BTC] is trading near $110K, with long-term holders (LTHs) sitting on solid gains and leverage returning to Binance [BNB].

Traders see the move as psychological, with $113K acting as a key level that could either cause a breakout or help with another round of resistance-driven selling.

LTHs show no signs of stress yet

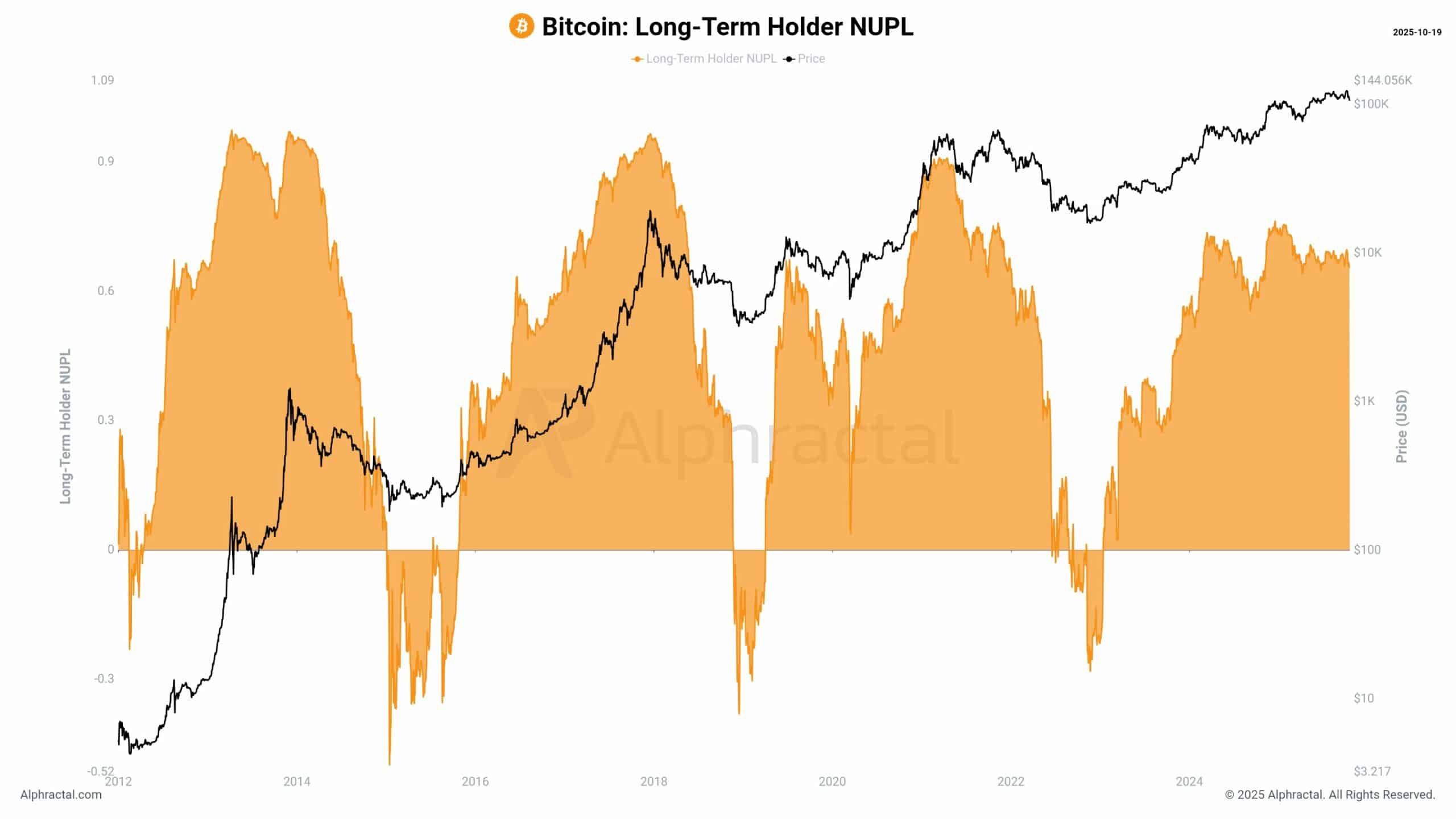

The Net Unrealized Profit/Loss (NUPL) for LTHs remains firmly in positive territory, which means that most are still sitting on significant unrealized gains.

This metric acts as a proxy for market confidence among seasoned investors. Despite recent price volatility near $110K, the data shows that long-term conviction remains unshaken.

For this group to experience real financial discomfort, Bitcoin would have to fall below $37K; a level not seen since early 2024.

As it stands, their positioning provides a psychological buffer, reducing the likelihood of panic selling in the current range.

A late cycle phase?

The LTH/STH SOPR ratio has been trending downward, which means that LTHs are reducing their selling activity while STHs continue to attempt to secure profits.

Such divergences have emerged near cycle peaks, as seen in late 2021 and mid-2017.

With the ratio hovering near its lower historical bound, it is obvious that LTHs are showing restraint, leaving room for STHs to dominate short-term price action.

This could cause a brief speculative upswing before broader market momentum resets — much like the pattern seen during previous high-volatility phases.

Additionally, Bitcoin’s STH Realized Price was just below $100K, acting as a crucial short-term support zone. As long as BTC trades above it, STHs stay in profit, keeping near-term sentiment stable.

However, a drop below could invite sharper corrections.

Leverage creeps back in

Leverage activity on Binance is slowly rising again after falling sharply in mid-October.

The estimated leverage ratio climbed from 0.148 to 0.166; a measured return of risk-taking behavior.

This aligns with Bitcoin’s gradual rebound from $104K to just above $110K, which means traders are testing the waters without going all in.

Unlike previous spikes, this leverage build-up is controlled, showing limited confidence in near-term upside. The lack of heavy speculation shows the market is still waiting for direction.

If Bitcoin stays above $110K, confidence may slowly return.

Post Comment