Bittensor Rockets 32% Overnight—Is Grayscale’s ETP the Catalyst That Could Propel TAO to $500?

Is this the moment Bittensor’s TAO token breaks free from its chains and races toward a $500 finish line? The latest uptick—a staggering 32% leap—was fired up by none other than Grayscale’s bold SEC filing to convert its TAO Trust into an Exchange-Traded Product (ETP). Institutional eyes are locked on TAO, signaling a surge of capital that might just be the rocket fuel this altcoin needs for its next big run. But here’s the kicker: TAO’s next move hinges on one critical barrier—the $403 resistance level. Crack that, and we’re potentially looking at an open runway stretching all the way to $489, maybe even $500. Intrigued? Well, buckle up, because the game-changing dynamics of institutional flows, derivative market setups, and retail profit-taking are converging into a thrilling tug-of-war. So, will TAO hold the line, or are we in for a reset? Let’s dive deeper to unravel the signals that could make or break this rally. LEARN MORE

Key Takeaways

What triggered Bittensor’s latest rally?

Grayscale’s SEC filing and strong inflows fueled a 32% jump, lifting TAO toward its $403 resistance.

What could decide TAO’s next move?

A confirmed close above $403, with Open Interest near $250 million, could open room toward $489–$500.

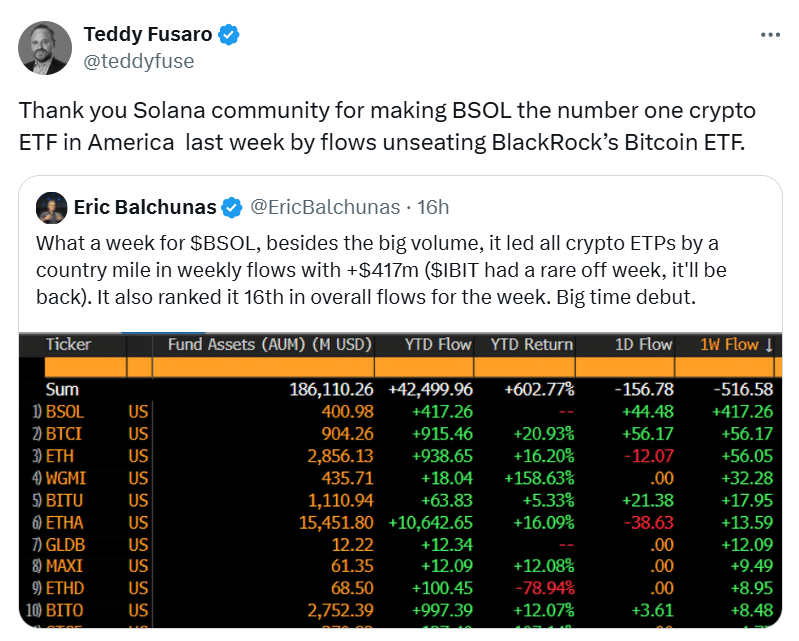

Institutional interest in Bittensor [TAO] continued to drive strong momentum. Grayscale filed a Form 10 with the U.S. Securities and Exchange Commission (SEC) to convert its TAO Trust into an exchange-traded product (ETP).

If approved, institutional capital inflows could rise and attract retail investors seeking early exposure before the altcoin’s valuation increases with institutional entry.

This anticipation has already driven a 32% gain for TAO in the past 24 hours.

Michael Sonnenshein, CEO of Grayscale Investments, said

“We believe that converting the Bittensor Trust into an Exchange-Traded Product reflects our commitment to increasing accessibility and regulatory alignment for institutional investors.”

A run to $500 for TAO?

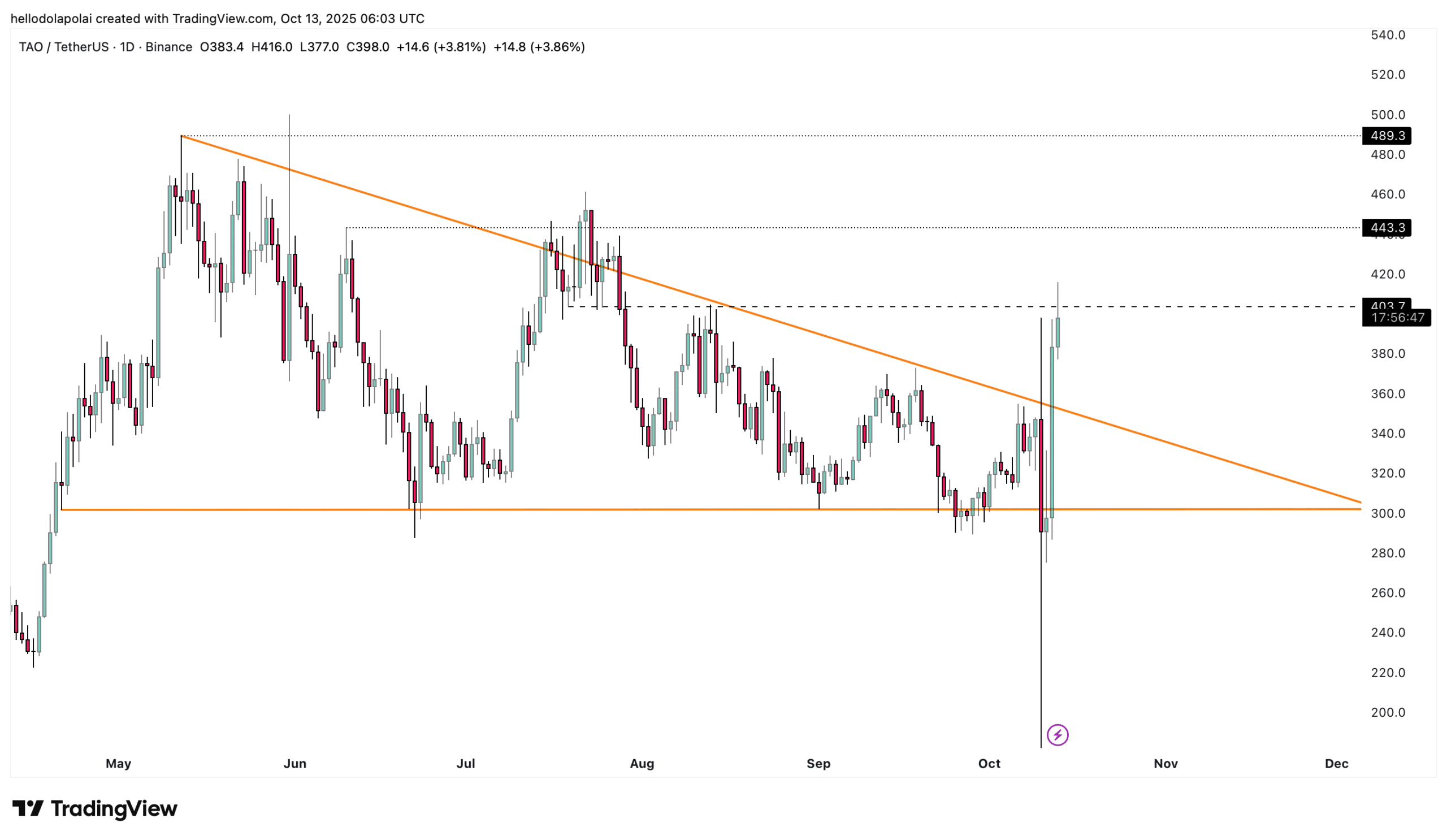

TAO’s latest rally showed clear bullish intent. Price action broke out of a long-term consolidation pattern bounded by descending resistance and horizontal support.

Chart analysis identified three short-term targets: $443, $489, and $500. However, for confirmation, TAO must close above its resistance level—a typical bullish indicator—near $403.

That level has repeatedly rejected rallies, showing strong sell orders around it.

AMBCrypto examined other market factors to assess whether this rally could sustain momentum.

Bittensor’s derivatives maintain a bullish setup

The overall market setup remained bullish across multiple segments.

In the Perpetual Futures market, capital inflows surged notably to $250 million in the past day, signaling that investors are increasing their long positions.

At press time, Derivatives Volume stood at $553 million, while rising Funding Rates suggested confidence in continued upside. Rising volume alongside increasing price action typically indicates a continuation of the upward trend.

Technical indicators also confirm this outlook.

The Moving Average Convergence Divergence (MACD) crossed into bullish territory for the first time, with a positive reading of 567.77 at press time.

Similarly, the Chaikin Money Flow (CMF) remained high at 0.67, showing strong buying pressure that could continue pushing TAO toward a new high.

These factors together point to a potential continuation toward $500, provided TAO holds above its breakout zone.

Retail takes profit

Despite the bullish setup, retail sentiment showed some caution.

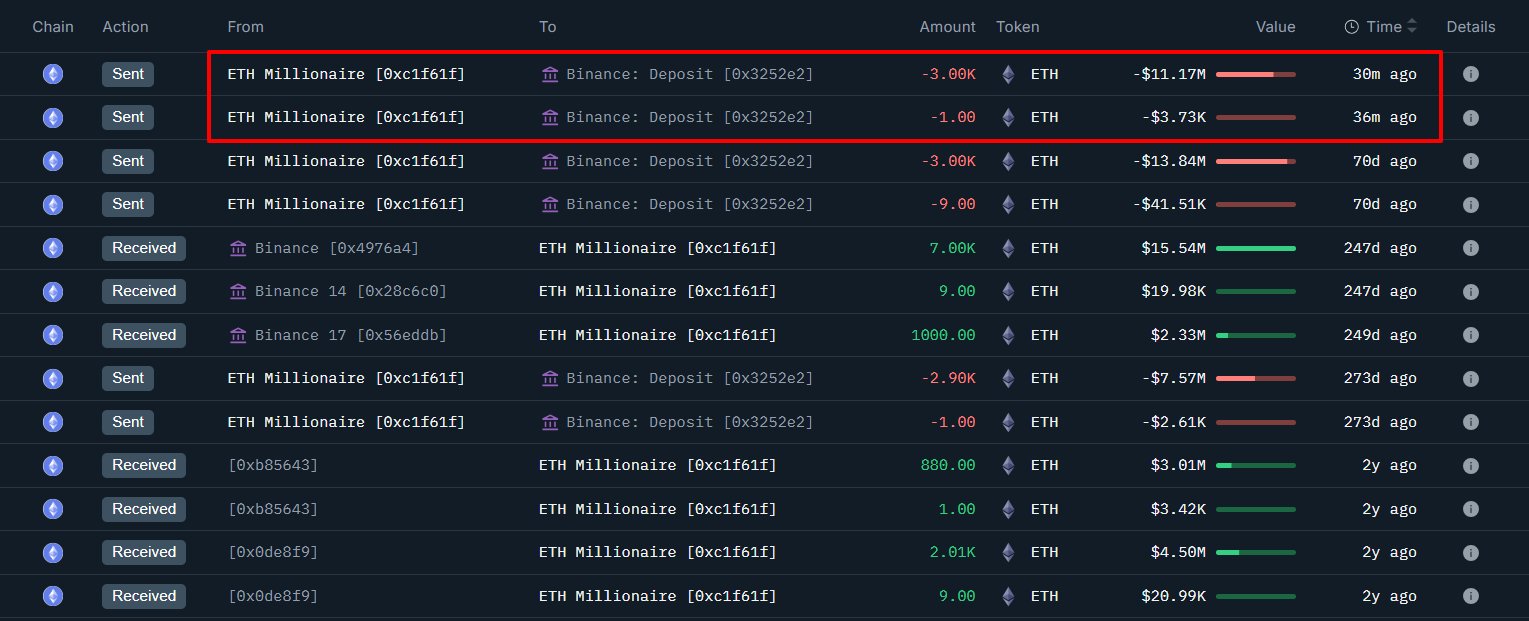

Many traders appeared to be taking profits as TAO’s value soared over the past day. On-chain data showed a total sell-off of roughly $7 million in the last 48 hours.

The sell-off began at the week’s open, with investors offloading about $5.6 million, signaling that bearish sentiment remains active. As of press time, an additional $1.4 million had been withdrawn.

Even so, short-term selling may represent healthy profit-taking rather than a reversal, as inflows continue to offset broader outflows. Sustained closes above $403 could confirm strength, while failure to reclaim that level may reset the rally.

Post Comment