BlackRock’s Shocking Snub: Why XRP and SOL ETFs Are Still Off the Table Even After SEC Clears Ripple—What This Means for Investors Now

Ever wonder why some of the biggest names in asset management play it safe even when the market signals opportunity? With Ripple finally settling its lengthy SEC battle, many of us expected BlackRock to jump eagerly onto the XRP and Solana bandwagon—especially after their recent Bitcoin and Ethereum ETF launches stirred up quite the buzz. But guess what? They’re hitting the brakes hard, citing something unexpected: a surprisingly low demand for spot ETFs beyond the crypto heavyweights. It’s a move that makes you ponder—are Bitcoin and Ethereum truly the only stars worth spotlighting, or is BlackRock just pacing its dance cautiously, warding off diminishing returns? Let’s dive into why the asset giant is passing on XRP and SOL ETFs for now, despite a market that’s anything but ordinary. LEARN MORE.

BlackRock previously reported high client interest in Bitcoin and Ethereum, but low demand for other crypto ETFs.

Key Takeaways

- BlackRock has stated it currently has no plans to offer spot ETFs for XRP or Solana.

- The asset manager clarified their position amid speculation following Bitcoin and Ethereum ETF launches.

Share this article

With Ripple closing its long-running legal battle with the SEC, industry analysts anticipate that the resolution will make major fund managers more comfortable offering investment products tied to XRP, Ripple’s native crypto asset.

Pro-XRP users, in particular, have been eyeing BlackRock, the asset management giant. But it appears BlackRock has no immediate plans to get on board.

A BlackRock spokesperson recently told The Block that spot XRP and Solana (SOL) ETFs are not on the firm’s roadmap for now.

The confirmation came shortly after ETF Store President Nate Geraci suggested that BlackRock would eventually enter the XRP ETF market as Ripple and the SEC wrap up their appeals.

He said it’s hard to justify ignoring crypto assets apart from Bitcoin and Ethereum, but if BlackRock really stays away from other crypto ETFs, they’re essentially stating that only BTC and ETH are worth investing in.

Yes, I think BlackRock was waiting to see this before filing for iShares XRP ETF…

I’ll own it if I’m wrong.

IMO, makes *zero* sense for them to ignore crypto assets beyond btc & eth.

Otherwise, they’re basically saying btc & eth are only ones that will ever have value. Bold. pic.twitter.com/FtBqMRFpOl

— Nate Geraci (@NateGeraci) August 8, 2025

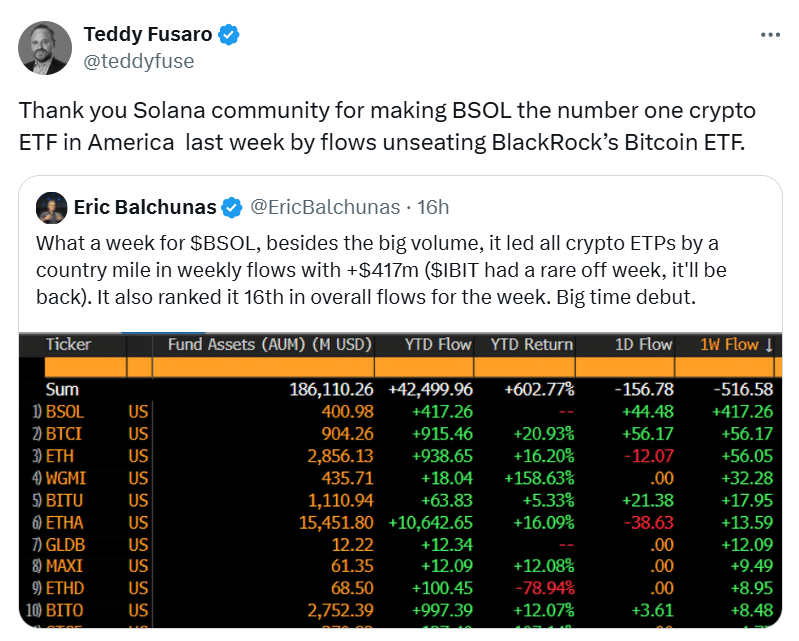

However, Bloomberg ETF analyst Eric Balchunas thinks BlackRock is content with its two existing ETFs, those tied to the two largest crypto assets, and sees diminishing returns in expanding further.

I just think they are happy w the two. Law of diminish returns from here on out. But again I’ve nothing to go on but my own spidey sense here.

— Eric Balchunas (@EricBalchunas) August 8, 2025

The analyst is also doubtful that BlackRock will file for an index-based crypto ETF, which potentially includes major assets like XRP, later this year.

“Very little” demand for other crypto ETFs: BlackRock’s executives

Robert Mitchnick, BlackRock’s Head of Digital Assets, revealed at the Bitcoin 2024 convention that there is ‘very little’ client demand for crypto ETFs beyond Bitcoin and Ethereum.

Samara Cohen, BlackRock’s Chief Investment Officer of ETF and Index Investments, said in an interview with Bloomberg that the firm would not launch a Solana ETF in the near term.

“We really look at the investor’s ability to see what meets the criteria, what meets the bar to be delivered in an ETF,” Cohen said. “For us right now, both between [investing] ability considerations and also what we hear from our clients… Bitcoin and Ether definitely meet that bar. I think it will be a while before we see anything else.”

Share this article

Post Comment