Canary Capital’s Bold Trump Coin ETF Move: Could This Be the Next Big Market Game-Changer?

Ever wonder if memecoins are finally stepping out of the shadows of internet joke status and into the serious playground of institutional money? Well, Canary Capital’s recent registration of the “Trump Coin ETF” might just be the answer shaking up the crypto scene right now. This move isn’t just a paper shuffle—it’s a bold signal that big players are eyeing memecoins like TRUMP, spiking its token price and stirring a fresh wave of speculation across markets. Think about it: an ETF tied to a memecoin, nudging the door open for broader acceptance and liquidity infusion in a space often dismissed as whimsy. Sure, the ETF isn’t live yet, but this registration is the critical first step toward SEC approval, nudging memecoins closer to the mainstream spotlight alongside established names like Dogecoin. As the race heats up among firms like Grayscale and Bitwise, one question lingers—are we witnessing the dawn of memecoin’s institutional era, or is this just another flash in the pan? Either way, TRUMP token holders have every reason to feel hopeful today. LEARN MORE

Key Takeaway

The registration of Canary Capital’s “Trump Coin ETF” has boosted TRUMP token prices and fueled speculation of growing institutional interest in memecoins.

Canary Capital, an investment firm specializing in cryptocurrency ETFs, has made a move hinting at rising institutional appetite for memecoins.

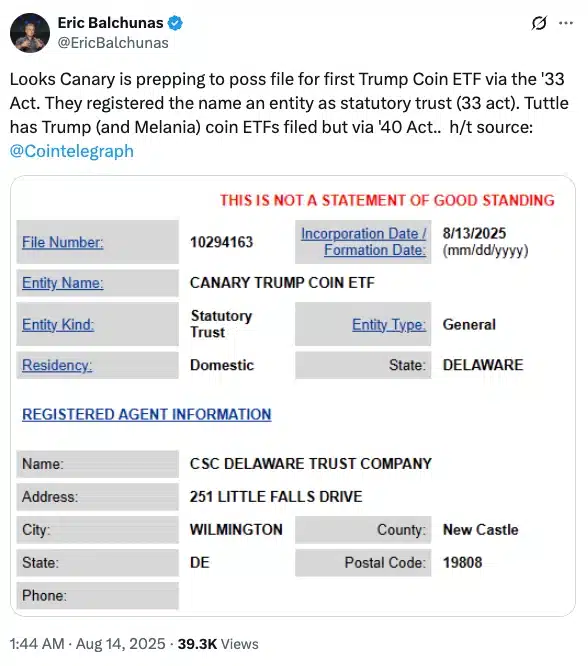

On the 13th of August, a new entity called the “Canary Trump Coin ETF” was officially registered with the Delaware Division of Corporations.

While this registration doesn’t launch the ETF, it’s typically the first step before submitting formal filings to the U.S. Securities and Exchange Commission (SEC), such as the S-1 and 19b-4 forms.

The filing highlights the intensifying race to bring memecoin ETFs to market.

The Official Trump [TRUMP] ETF joins a growing list of proposals, including those from Grayscale, Bitwise, and 21Shares, which have already sought approval for funds tied to Dogecoin [DOGE],the largest memecoin by market cap.

Meanwhile, Canary Capital is also advancing its Pudgy Penguins [PENGU) ETF application.

Analyzing reasons behind the move

Interestingly, Canary’s filing follows closely after Osprey Funds and REX Shares submitted applications to the SEC on the 21st of January, seeking approval for an ETF tied to the TRUMP memecoin, only a few days after the token first entered the market.

The prospect of a ‘Canary Trump Coin ETF’ has sparked renewed optimism among TRUMP token holders, with expectations that the fund could inject fresh liquidity into the memecoin’s ecosystem.

Given the SEC’s stance that memecoins are commodities rather than securities, approval odds appear favorable.

Remarking on the same, Bloomberg’s Eric Balchunas suggested Canary may be positioning for the first TRUMP ETF under the 33 Act, contrasting with Tuttle’s existing Trump and Official Melania Meme [MELANIA] ETFs filed under the 40 Act.

Following news of the ‘Canary Trump Coin ETF’ registration, TRUMP rebounded from roughly $9.40 to $9.60.

This marked over 10% gains in the past week, at press time, amid a wider market rally, though it still lags 64% below its $75 January peak.

Post Comment