Cardano Whales Just Snatched 530M ADA in 48 Hours—Is a $1.20 Surge the Next Breakthrough for Smart Investors?

Ever wonder why Cardano whales suddenly decided to bulk up their ADA holdings by a staggering 530 million coins in just 48 hours? It’s like spotting a flock of strategic investors gearing up for something big—right in the middle of a price correction and an intense tug-of-war between longs and shorts. This massive accumulation isn’t just a coincidence; it screams bullish intent and sets the stage for an intriguing breakout. And here’s the kicker: if ADA manages to push past that critical $0.99 threshold, we could witness a swift 25% surge toward $1.20, fueled by a textbook ascending triangle and a slew of positive technical indicators. Now, that’s the kind of setup every savvy trader and investor needs to keep their eyes glued to. Curious to dive deeper into the whale activity and what it means for ADA’s next move? LEARN MORE

Key Takeaways

Why are Cardano whales active now?

530 million ADA bought in 48 hours signaled bullish positioning amid correction and rising long dominance.

What’s ADA’s breakout target?

Above $0.99, ADA could rally 25% toward $1.20, supported by an ascending triangle and bullish indicators.

Cardano [ADA] has been experiencing a correction, but whale activity showed rising interest that could fuel a rally.

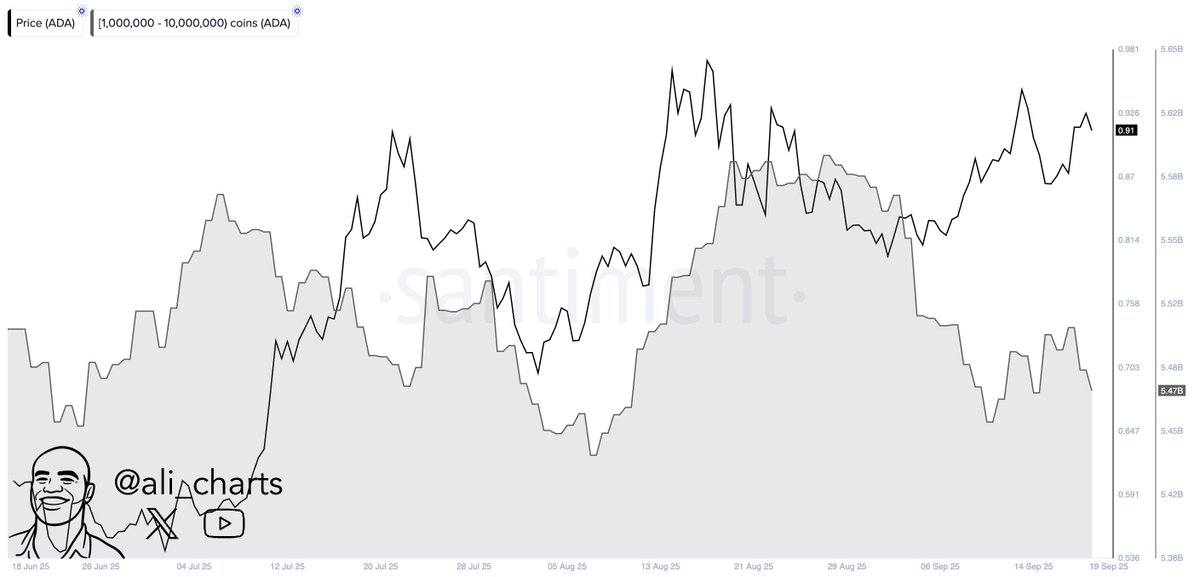

On that note, Data from Santiment highlighted 530 million ADA accumulated by wallets holding 1–10 million coins in the last 48 hours.

Whale accumulation soars

Cardano whales holding between 1 million and 10 million ADA purchased 530 million coins over the past 48 hours.

This massive accumulation hinted at potential preparation for a bull run that ADA holders have been awaiting.

However, some investors still appear to be dumping their holdings. CoinGlass data indicated $1.44 million in Spot Inflows at press time, suggesting sell pressure persisted despite whale bids.

So far, intraday traders also appeared to be following the same trend by heavily betting on long positions.

CoinGlass data showed the Binance ADAUSDT Long/Short Ratio reached 3.39, with 77.24% of accounts long and 22.76% short.

These combined signals show that bullish domination in ADA is at its peak despite the ongoing price correction.

Cardano technical outlook: Upcoming level to watch

At the time of writing, ADA traded near $0.90, down 0.90% in 24 hours. Trading volume also fell 39% from the prior day, suggesting sellers were not eager to push the price lower.

That left room for a potential reversal because market participants did not seem to be interested in pushing the price to lower levels.

Further, AMBCrypto’s technical analysis revealed that ADA appeared bullish at press time.

On the daily chart, ADA formed a textbook-style ascending triangle pattern, with the price moving into a narrow range that signals the pattern’s nearing completion.

Based on this price action, if ADA regains momentum, it could see a quick 8.50% uptick and reach the neckline at $0.963.

Moreover, if ADA regains momentum, it could rise 8.50% toward the neckline at $0.963. A close above $0.99 could extend gains by 25%, pushing the price toward $1.20 resistance.

ADA remained below the upper Bollinger Band, suggesting room for further upside. Meanwhile, the Supertrend indicator turned bullish, reinforcing a positive outlook.

Post Comment