Cardano’s Surge Faces a Hidden Threat: What Could Shatter ADA’s $1.15 Breakout Dreams?

Ever noticed how in a world where top crypto giants are stumbling like clumsy dancers, Cardano [ADA] is quietly slipping past with a sly grin—just inching forward while others falter? It’s like watching the underdog in a high-stakes game, nudging past $0.93 with a solid $0.51 safety net beneath it. Now here’s the kicker—open interest soaring to a staggering $1.82 billion signals institutional big shots are cozying up to ADA, yet the overbought RSI and a pretty bearish CVD whisper caution. So, what’s the play here? Will that juicy liquidity near $1.15 be the launchpad for ADA’s next moonshot, or are we staring down the barrel of a reversal? The crypto chessboard is set—time to see which move counts. LEARN MORE

Key Takeaways

Cardano [ADA] broke $0.93 with support at $0.51, while Open Interest hit $1.82 billion. Yet overbought RSI and bearish CVD raise doubts. Will liquidity near $1.15 spark continuation, or is a reversal brewing?

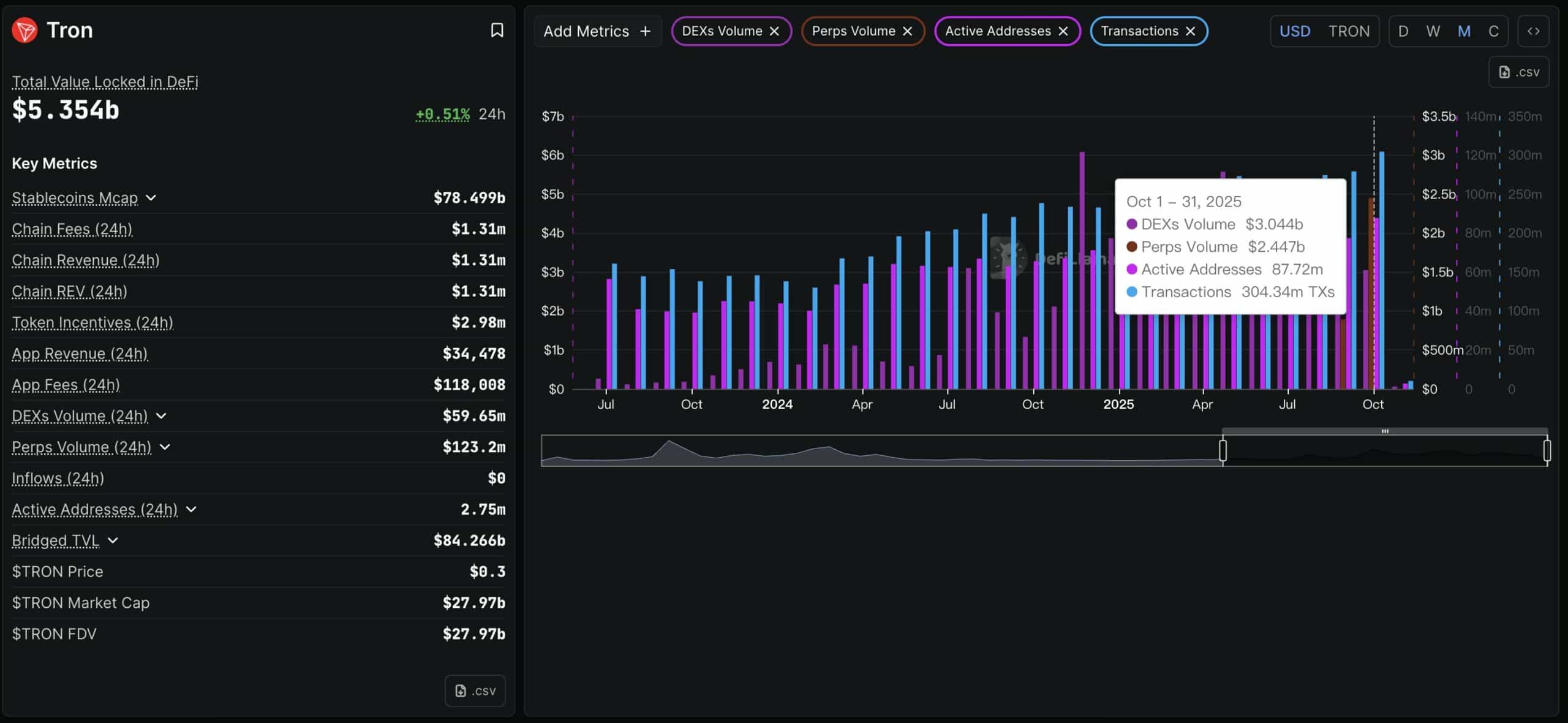

While most of the top ten crypto assets struggled in a short-term correction, Cardano [ADA] quietly held ground with a slight gain.

The altcoin extended its bullish rally after reversing at the $0.5154 support in late July.

Cardano prices could hit $1.15

Cardano broke above the $0.9382 resistance level on the daily chart, a move that gives its structure a more constructive bullish outlook compared to its peers.

Naturally, the bullish run seemed far from over, with liquidity clusters stacked near the $1.15 psychological level.

Having said that, the looming risk of correction persisted, as profit-taking usually follows rallies of this scale. Even so, futures data offered a potential stepping stone for ADA.

Record Open Interest backs ADA’s bullish technical structure

ADA futures market activity stands out as per AMBCrypto analysis on its on-chain metrics.

The altcoin’s Open Interest pushed to a record $1.82 billion, at press time, showing that traders were leaning into Cardano despite broader market weakness.

On top of that, if conviction held, rising institutional flows could propel ADA toward $1.15, where liquidity was clustered.

Cardano warning signs remain

But it’s not all clear skies.

At press time, the Stochastic RSI was in overbought territory on the daily chart, suggesting stretched momentum.

In fact, CryptoQuant’s 90-day Cumulative Volume Delta still leaned bearish, showing some investors continued offloading positions.

What’s next for Cardano?

The coming sessions will be critical. A clean move above $1.15 would likely confirm ADA’s breakout and unlock further gains.

However, failure to absorb selling pressure from dominant sellers could drag the token back in line with the broader market pullback.

As things stood, the constructive technical structure and surging institutional interest ticked the boxes for a bullish ADA run.

Post Comment