CME XRP Futures Surge to $9B – Could Spot ETF Approval Spark a Stunning Reversal of the 23% Plunge?

Ever notice how markets sometimes throw these wild curveballs just when you think you’ve got the full playbook figured out? Well, the CME XRP Futures market just smashed the roof with a record-high open interest—nearly 12 million XRP, valued at a staggering $9.02 billion. That’s not just a number; it’s a thunderous vote of confidence from institutional players gearing up for what looks like an imminent U.S. spot ETF green light. But here’s the kicker: even as this beast of demand roars, some heavy hitters are taking it slow on the distribution front. So, the million-dollar question spinning in my head—will XRP stage a comeback, or are we gearing up for a bit of a bumpy ride? Let’s unpack the layers behind this frenzy and see if this rally has legs or if it’s just a flash in the crypto pan. LEARN MORE.

Key Takeaways

CME XRP Futures market interest hit a record high. However, with large players slowing down distribution, will XRP rebound?

Institutional interest in Ripple [XRP] surged to an all-time high ahead of likely U.S. spot ETF approval.

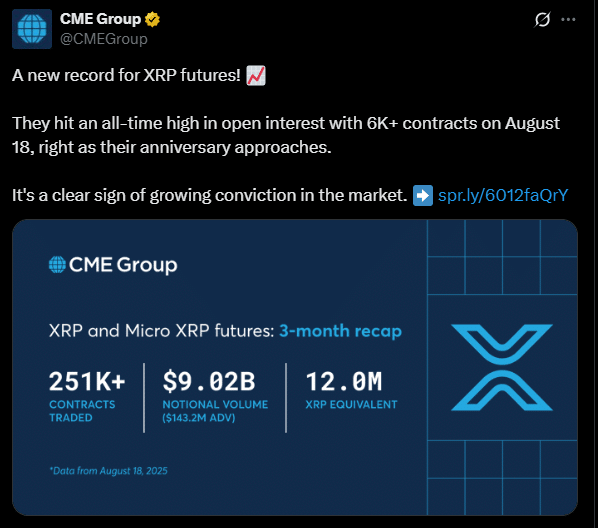

According to the Chicago Mercantile Exchange (CME), the XRP Futures market reached a record Open Interest of nearly 12 million XRP, equivalent to a cumulative value of $9.02 billion.

Per the exchange, the record demand was a –

“Clear sign of growing conviction in the market”.

Overall XRP Futures demand slips

Compared to the rest of the exchanges, CME ranked fourth after Bybit, Binance and Bitget. However, overall demand for XRP Futures has been on a downtrend alongside the price for the past few days.

After peaking at about $10 billion in Open Interest in late July, total Futures slumped to $7.3 billion on the 22nd of August. The cool-off has since dragged the altcoin’s value down 23% from $3.6 to $2.8.

The $2.8 was defended in the previous Q3 pullback. Whether it will hold again remains to be seen.

That said, as a benchmark for the approval of spot XRP ETF, the CME Futures growth was viewed by market watchers as a vote of confidence and a likely positive outcome for the products.

XRP vs. LINK

But there’s a cold war between XRP and Chainlink [LINK] investors on Crypto Twitter. In fact, a key Chainlink official claimed that Swift was working with the network instead of XRP.

Interestingly, LINK logged 75% gains over three weeks, outperforming XRP in Q3. This begs the question — Can it outperform XRP in the near term?

Still, the outperformance only began recently, as XRP had dominated for most of the past two years.

Whale activity shifts

Meanwhile, two key whale cohorts holding 10 million to 1 billion tokens have eased their offloading, seen in July and early August.

A strong bid from these large players could ease the XRP pullback and trigger a reversal.

Overall, the CME Futures boom was positive for XRP, especially for spot ETF approval. In addition, whales have eased their sell-off, raising hope for a potential recovery if they begin bidding strongly again.

Post Comment