Could Ethereum Really Hit $5K? Why Whale Moves Might Just Make—or Break—Its Next Big Surge!

Ever wonder what happens when a few colossal players make a massive move behind the scenes? Well, recently, three Ethereum whales snapped up a staggering $435 million worth of ETH in just 24 hours. That’s no small feat—and it’s shaking up the market in a way that could set us up for a surge to $5,000 per coin. But hold up—before you get too excited, there’s a twist: while these whales are doubling down, smaller retail investors seem to be cashing out, potentially throwing a wrench in the rally. Since dipping to $3.5k not long ago, Ethereum’s been grinding upward, flirting with $4.7k, but the real question is—can this whale-driven buying power sustain momentum, or will retail profit-taking pull the rug out from beneath us? Stick around, because the coming days might just reveal whether ETH shoots for the stars or takes a dip back down. LEARN MORE

Key Takeaways

Three Ethereum whales have accumulated $435 million worth of ETH over the past 24 hours. A hike in demand from whales could set the stage for a rally to $5k. However, beware retail profit-taking!

Since hitting a low of $3.5k nearly two weeks ago, Ethereum’s price [ETH] has traded within an ascending channel. In fact, thanks to the same, the altcoin’s price climbed to a high of $4.7k.

At the time of writing, ETH was trading at $4,646, following a minor drop of 1.72% in 24 hours. Prior to this drop, the altcoin’s value appreciated by 19% in just 7 days.

As expected, large entities took the opportunity to buy the dip as ETH’s price fell on the charts.

Ethereum whales buy the dip!

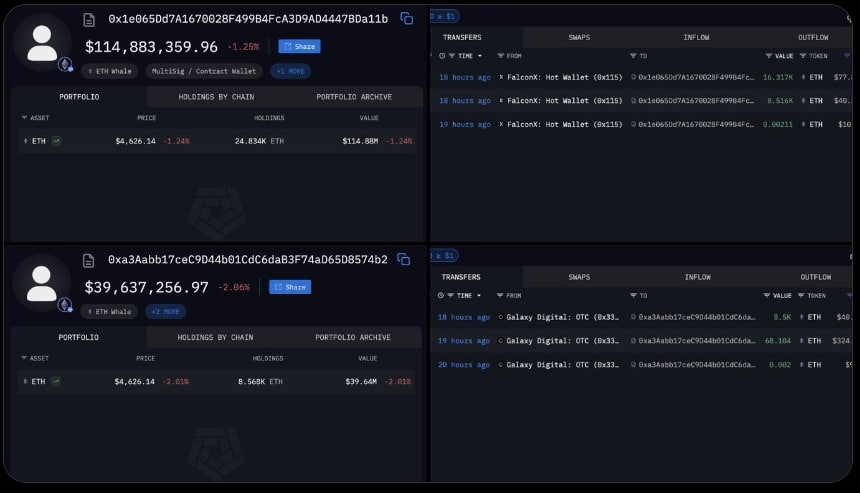

As the cryptocurrency’s price retraced, whales jumped into the market and scooped up more ETH. For example – According to Arkham Intelligence, three whales accumulated $435 million worth of ETH over the last 24 hours.

One of these whales bought 60,000 ETH tokens worth $284.76 million from Coinbase Prime. After the acquisition, the account moved 3.2k ETH to four different wallets and deposited some to Coinbase for staking.

Additionally, the other two whales bought $150 million worth of ETH. In this particular case, one acquired $118.2 million and the other $40.5 million.

As a result of this accumulation trend, Ethereum’s Taker Buy Sell Ratio surged from 0.92 to 1.05. Whenever this metric flips 1, it means that there are more buy orders compared to sell orders – A clear accumulation sign.

Retail’s turn to take up profit-taking

Surprisingly, while whales are accumulating, it would seem that small-scale investors may be cashing out.

Consider this – According to CryptoQuant, Ethereum’s Exchange Netflows turned positive again as they rose from -209k to 37k ETH.

Such a massive reversal is usually indicative of a sudden shift in investor behaviour, with some turning bearish. When Exchange Netflows turn positive, it means that exchanges are recording more inflows, compared to outflows.

As a result, Ethereum’s scarcity may be under threat.

In fact, the same can be evidenced by the low stock-to-flow ratio too. According to Santiment, the SFR had a value of 9.8 at press time, following a significant drop from a weekly high of 31.

Whenever this metric falls, it means that Ethereum available for immediate sale is on the rise. Lower scarcity often threatens the sustainability of upside on the price charts.

If demand fails to keep up while the supply increases, ETH could face intense downward pressure.

Which way will ETH’s price go?

According to AMBCrypto’s analysis, Ethereum has been seeing strong demand from large entities lately, either whales or institutions.

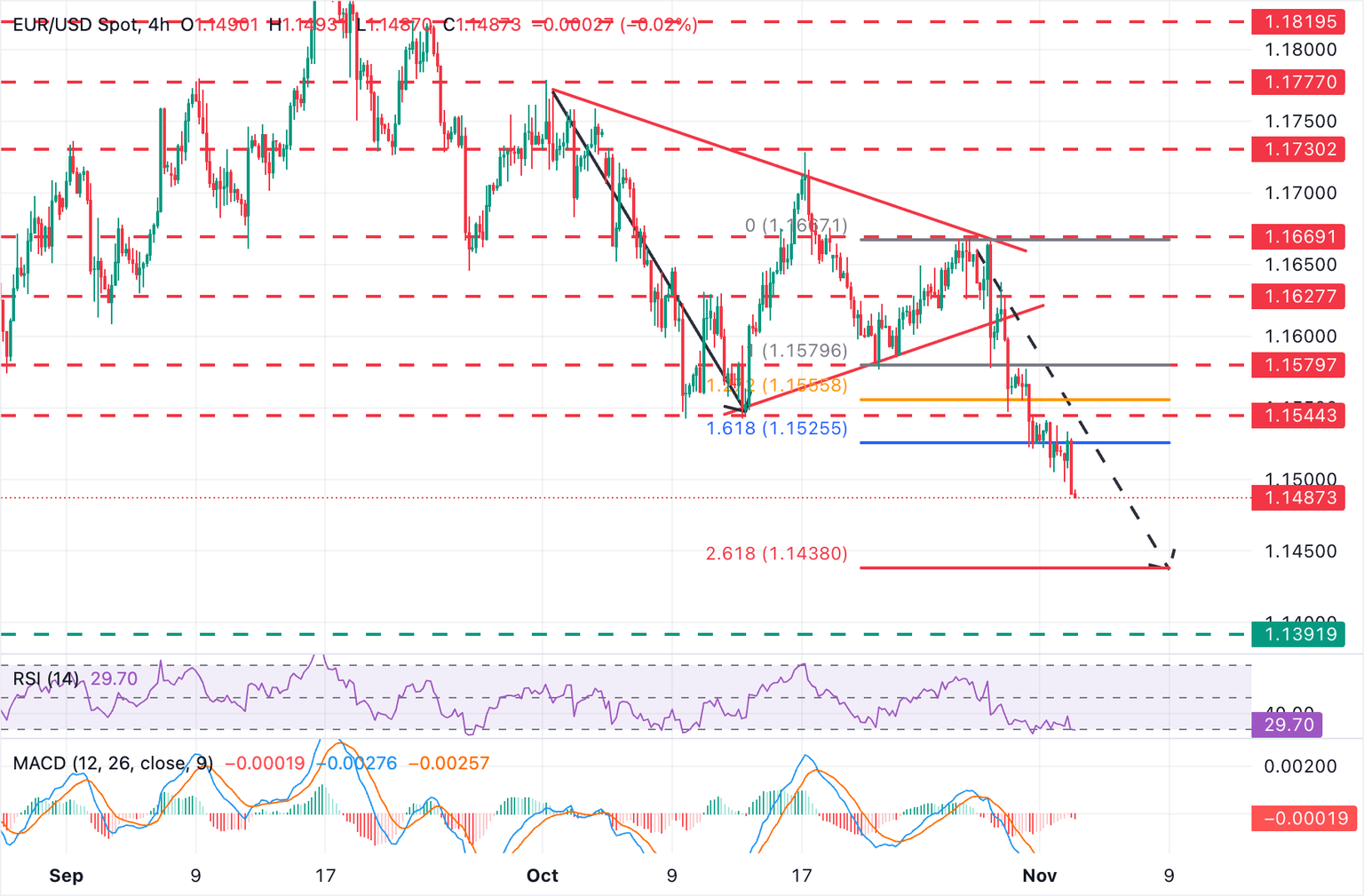

That may be why the altcoin’s Moving Average Convergence Divergence (MACD) surged from 171 to 328 at press time. Such a spike is often a sign of rising buyer dominance.

Hence, it can be argued that whales helped spur ETH’s price action. The same can be evidenced by a bullish Parabolic SAR, with a higher accumulation rate clearly visible too.

If whales continue to accumulate, they will fuel ETH’s northbound movement. If that happens, ETH will reverse course and reclaim $4,7k. In doing so, it will successfully retest its ATH at $4,891 and target $5k.

On the contrary, if retail continues to lag while cashing out at every opportunity, the uptrend will reverse itself. If whale accumulation slows down, while retail selling persists, ETH will retrace to $4,165.

Post Comment