Crypto Crash Unveiled: The Hidden Forces Shaking Markets Today That Every Investor Must Know Now!

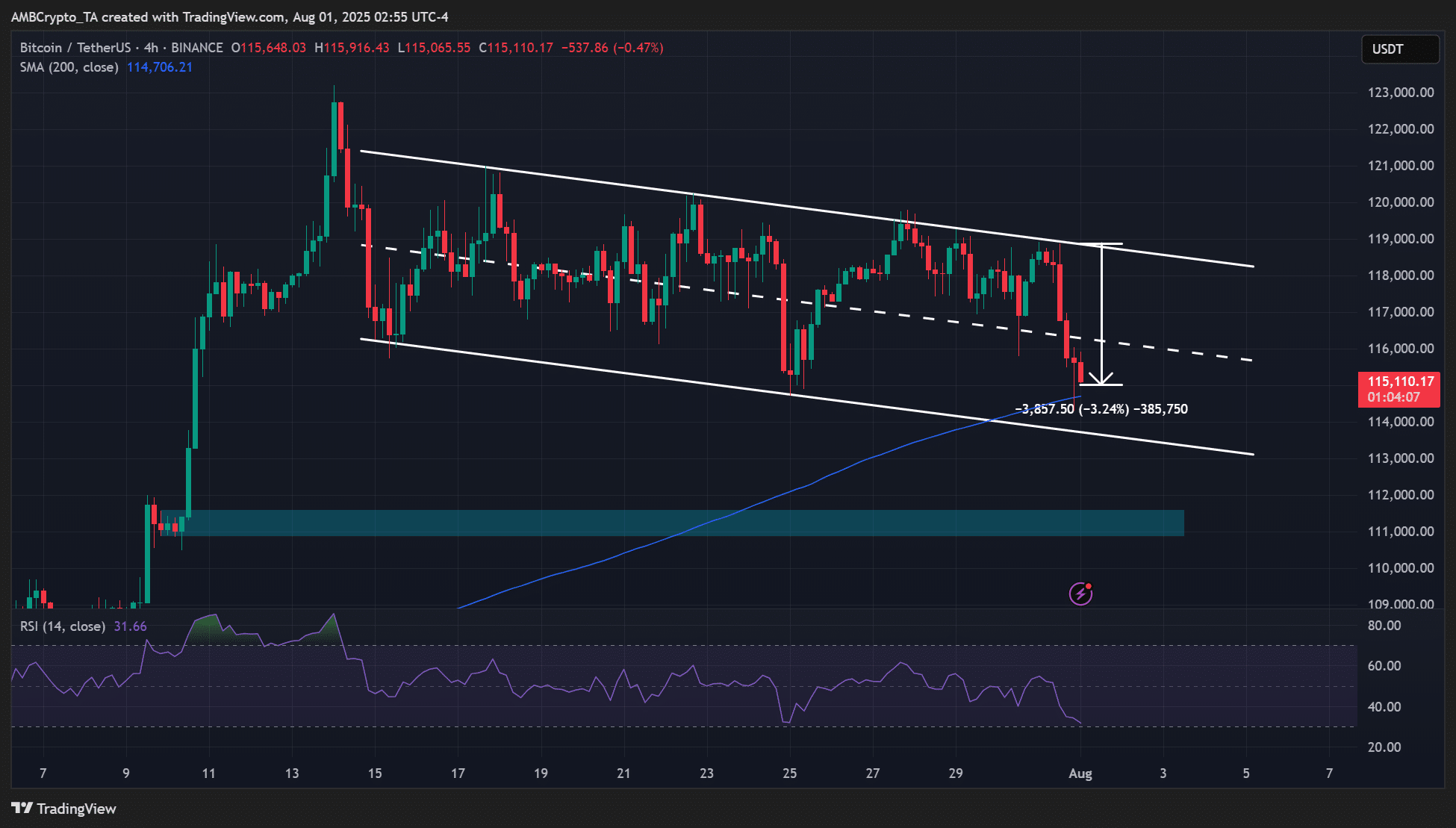

When macroeconomic storms brew, the crypto seas rarely stay calm – and boy, are we seeing some wild waves lately. New tariffs slamming down like unexpected thunderbolts and that stubborn inflation just refusing to quit have sent shockwaves rattling through both crypto and U.S. equity markets. Bitcoin took a little dive, slipping 3% below $115K before managing to claw back—talk about a rollercoaster! Meanwhile, the S&P 500 wasn’t spared either, quietly retreating by 37 basis points. It begs the question: with the Fed’s rate cut chances in September hovering lower than a limbo stick, where does this leave risk-on assets and the bullish crypto run so many have pinned their hopes on? Let’s dig deeper into why these macro headwinds are steering the markets into choppy waters and what that means for your portfolio’s next move. LEARN MORE

Key Takeaways

Macro headwinds linked to new tariffs and sticky inflation triggered crypto market sell-offs, as the chances of a Fed rate cut in September continue to drop.

Crypto and U.S. equities markets dropped lower, amid new macro headwinds induced by inflation and tariff fears.

Bitcoin [BTC] slipped 3% below $115K before reclaiming the level as of press time. Similarly, the S&P 500 Index (SPY) declined 37 bps (basis points) according to Google Finance data.

Macro pressure intensifies

This downside risk followed a new White House announcement that President Donald Trump’s tariffs have now been formalized via an executive order, with Canada facing a steeper 35%, up from the current rate of 25%.

Overall, the new tariff rates have been hiked between 10% to 40% across several global trading partners, but they’ll go into effect after seven days of the order, leaving room for negotiations.

Part of the order read,

“These modifications shall be effective … on or after 12:01 a.m. eastern daylight time 7 days after the date of this order.”

As such, any negotiations and tariff outcomes in the next few days could trigger market swings.

Another pressure point came from the spike in the Fed’s favorite inflation gauge – ‘core’ PCE (Price Consumer Expenditures).

The indicator, which removes food and energy costs, showed a 0.3% spike in June, up from 0.2% in May.

While the month-on-month change was within the economists’ forecast of 0.3%, the year-on-year core PCE increased to 2.8%, above the expected 2.7%.

This meant that inflation was still sticky and above the Fed’s target of 2.0% and dented rate rate-cut outlook for September.

In a note to clients, Capital Economics assistant economist Harry Chambers echoed the same and said,

“The sharp rise in core goods inflation will do little to ease the Fed’s concerns about tariff-driven inflation.”

In the past three days, the chances of a 25 bps September rate cut have decreased from over 60% to 43%. The odds dropped even lower to 41% after the latest inflation data, as markets repriced expectations for the end of Q3.

Now, the traders were pricing in higher chances of another rate pause at 58% in September. And this could stall risk-on markets.

DOGE, XRP lead sell-off

Fed rate cuts help reduce borrowing costs but also make safer assets less attractive. This pushes investors toward riskier and higher-return assets like stocks and crypto.

So, a rate pause or a hike is typically viewed as negative to crypto, and top assets dropped 2% to 8% in the past 24 hours as a ‘pause’ becomes more likely.

Dogecoin [DOGE] and Cardano [ADA] sold off 8% while Ripple [XRP] shed off 6%. Solana [SOL] also slipped 6.7% while Binance coin [BNB] only dipped 3%.

Post Comment