Dogecoin Plummets 55% — But a Hidden Signal Could Ignite a Massive Comeback You Can’t Afford to Miss!

You ever wonder how a single tweet—or in this case, a fiery post from President Trump—can send ripples across global markets and knock a beloved memecoin like Dogecoin [DOGE] off its feet? Well, that’s exactly what happened recently when hints about tariff hikes against China triggered a domino effect, leading to a massive market correction. Dogecoin wasn’t spared, crashing over 55% and wiping out nearly $6 billion in market cap in just a day. But here’s the kicker—could this dramatic plunge actually mark the dawn of a fresh bull market, the kind that savvy investors dream about? Analysts reckon these sharp declines often clear the decks for robust upward swings, setting the stage for DOGE’s potential comeback. As sellers fight to hold their ground and buyers eye opportunities lurking below current prices, the burning question is: are we on the brink of Dogecoin’s next big leap or just riding a volatile rollercoaster for now? Let’s break down the chaos, the charts, and the chatter to find out. LEARN MORE

Key Takeaways

Why did DOGE crash?

The price of Dogecoin crashed following a broader market correction that resulted from President Trump’s tariff hike suggestion.

Is this the start of a bull market?

Analysts suggested such crashes trigger trends in bull markets, which could lead to a DOGE price reversal.

Dogecoin [DOGE] price crashed following the tensions ignited by President Donald Trump’s post on the Truth Social platform. Trump hinted at hiking tariffs for China, which resulted in the broader financial market crashing.

The memecoin was among the biggest losers in the last 24 hours. The drop happened simultaneously across all markets, with DOGE losing about $6 billion in capitalization.

DOGE price crashes!

On the charts, DOGE dropped by more than 55% from the onset of the post. The memecoin made a new low for the year of around $0.09. This was after having stayed below its yearly highs to date.

Dogecoin has broken below the price range it maintained since mid-February.

At the time of writing, it was stabilizing just under $0.20, with the Relative Strength Index (RSI) showing an oversold reading of 34.

If the current levels hold, Dogecoin could bounce back above the resistance at the $0.28 to $0.30 level. Upon clearing this level, DOGE could eye the $0.48 to $0.50 zone, the previous bull season highs.

Still, further drops or consolidations could be expected in the meantime. However, the dip is being bought hard, as the $11 billion trade volume seen in the charts suggests.

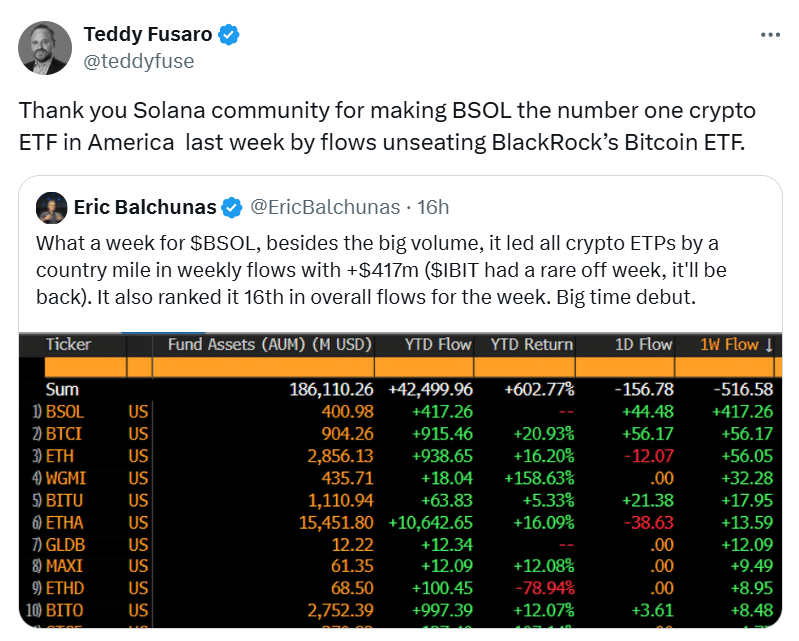

Sellers still dominate

The Spot Taker CVD analysis revealed that sellers maintained control over the last few days of October.

This was an indication that more drops could be anticipated in the short term before a reversal was seen. However, they were getting exhausted.

But this continued selling could drive buyers to trigger their long positions, which were resting below current levels.

Is this the start of a bull market?

According to some analysts, the market was setting up for a bullish run, just like last year. In a post, Cephii backed this sentiment on X (formerly Twitter), writing,

“All $DOGE longs were liquidated. This is usually how bull markets begin…”

The chart clearly showed that long positions were wiped out, with DOGE stabilizing near $0.18.

Since large order clusters sat below $0.20, especially around $0.179 with $7 million in orders and another $6.74 million just beneath, the price could likely dip slightly below $0.18 before potentially reversing.

In the meantime, the largest concentration of liquidity clusters was above $0.24. The zone was the next and most realistic target, looking at the current market outlook of Dogecoin.

Post Comment