Dogwifhat Tanks 11%—The Untold Strategy That Could Skyrocket WIF Back to $1 and Beyond!

Ever wondered why some memecoins make such a splash even when they’re dipping below the $1 mark? Take dogwifhat [WIF], for example — it’s taken a bit of a tumble recently, dropping over 11% in just 24 hours. Not exactly a walk in the park for holders, right? But here’s the kicker: while WIF is wobbling just under $1 and Solana [SOL] treads near $200, the big whales aren’t just watching from the sidelines — they’re diving in, scooping up millions worth of discounted tokens like pros spotting a bargain at a clearance sale. This frenzy paints a fascinating picture of accumulation, consolidation, and perhaps, the brewing storm before a breakout. So, what’s really holding WIF back from reclaiming that elusive $1 threshold, and could this be the calm before the memecoin surge? Let’s sink our teeth into the data, whale moves, and market mood swings to decode what lies ahead for WIF. LEARN MORE

Key Takeaways

WIF leads daily whale flows in USD after dropping below $1. The memecoin is down 11% in 24 hours. Now, WIF is consolidating in a triangle, a pattern that signals accumulation.

dogwifhat [WIF] dropped by more than 11%, at press time, in the past 24 hours. The Solana-based memecoin struggled while Solana [SOL] traded just below $200.

The move has sparked frenzy among whales as most memecoins trade at discount. WIF could be gearing for a reversal as anticipated by traders who are in accumulation.

Big players snag WIF at cut price

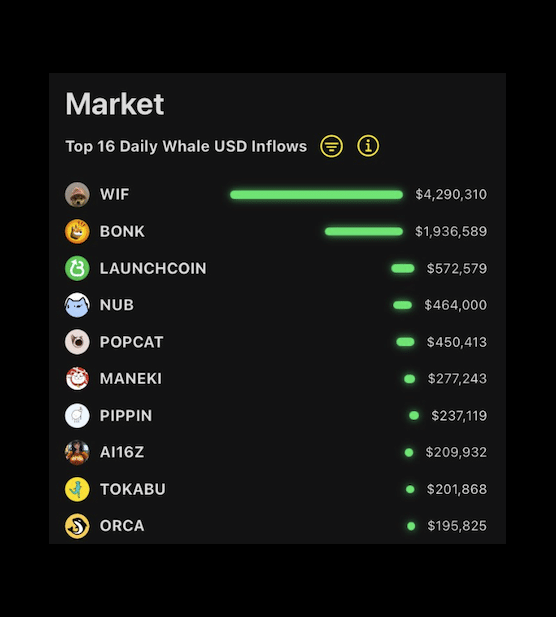

According to Curb.sol on X (formerly Twitter), WIF topped the charts for meme tokens purchased by whales, with $4 million bought during the dip—twice the amount of Bonk’s [BONK], which ranked second.

Other notable meme tokens receiving whale inflows included Popcat [POPCAT] and ai16Z [AI16Z]. In total, the top 16 meme tokens saw over $8 million in USD inflows at the time of reporting.

Meanwhile, retail traders stayed on the sidelines.

Data from CryptoQuant showed the frequency was neutral. Historically, retail was active only when WIF traded above the $2 level.

Having said that, what preventing WIF from reaching this milestone?

What is needed to reclaim $1?

WIF faces a key resistance at $0.97, where approximately $1.4 million in leveraged short positions are concentrated.

Another significant cluster of shorts sits just above the $1 mark, posing a challenge for WIF to reclaim the $1 level.

On the other hand, longs were at $0.90 level and below. A fall to this level would trigger these buy positions. A reversal could be started at this level.

For WIF to reclaim $1, the shorts at $0.97 needed clearance. This would result in a short squeeze.

On a technical perceptive, a crypto analyst highlighted that WIF was consolidating in triangle on the daily charts.

In fact, the pattern supported whale accumulation strategies. The expert predicted dogwifhat would hit $2 if a bullish breakout happened.

Focusing on much lower timeframes, WIF has been respecting a rising support since the 3rd of August. Since price has bounced from the support, it could imply the recent fall is a normal correction.

Only breaking below this support would invalidate the anticipated leg up toward $1.

The sentiment was neutral from a level of fear in the previous day. This was an indictment that opinions were changing after the reaction $0.90 support.

WIF’s long-term prospects

The memecoin market is usually hit the hardest during corrections.

Notably, the WIF community remains strong, with 253,590 holders, according to Solscan.

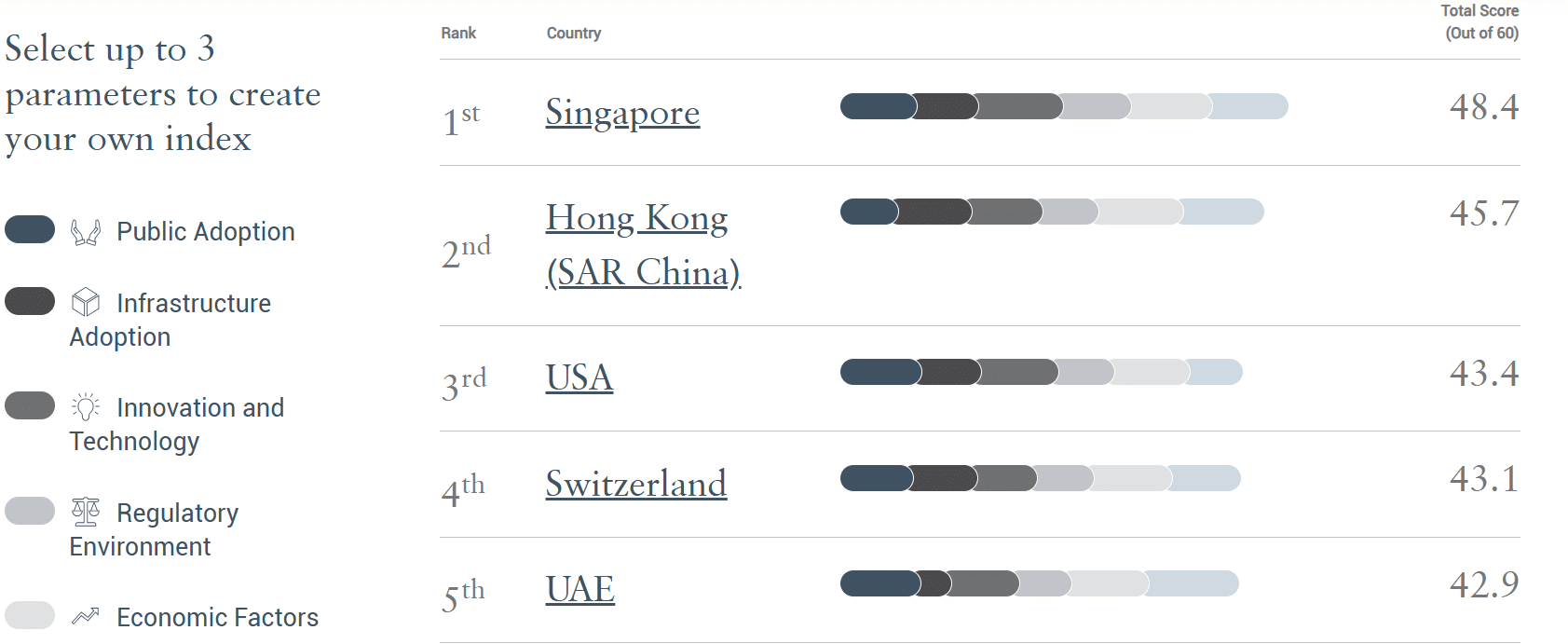

However, WIF’s dominance among top Solana memecoins is facing pressure, as newly launched tokens are offering more advanced utilities.

To stay competitive, Dev Corp has introduced a validator for WIF transactions, aiming to enhance its infrastructure and utility.

Post Comment