Dow Jones Bounces Back Despite Durable Goods Disaster—What Smart Investors Need to Know Now

Is the Dow Jones staging a comeback or just catching its breath before the next leap? Investors seem to be shrugging off recent losses, their sentiment climbing steadily like a tightrope walker regaining balance after a stumble. And while traders are holding onto hope (perhaps a tad stubbornly) that the Trump administration might dial down those sky-high tariff threats, the reality is trade deals are still treading water as the August 1 deadline creeps closer. It’s a classic waiting game, isn’t it? Earnings have mostly crushed expectations this quarter, pushing markets higher—but the Dow Jones, with its heavy hitters stumbling here and there, isn’t quite breaking into new record territory just yet. The question on everyone’s mind: will this cautious optimism carry us through, or are we just lucky to be on the upswing before the next pivot? Dive into the details and see what’s really moving the market gears. LEARN MORE

- The Dow Jones is clawing back recent losses as investor sentiment continues to climb.

- Traders continue to bank on an eventual walk back of the Trump team’s sky-high tariff threats.

- Trade deals remain limited, and the August 1 deadline is approaching fast.

The Dow Jones Industrial Average (DJIA) rebounded on Friday, recovering its footing after a mild downturn during the previous session. Q2 earnings broadly beat the street this week, sending most major indexes into record highs, but the Dow Jones grappled with some downside in key overweight stocks, crimping the blue-chip average’s top line.

Markets rise on milder-than-expected durables decline

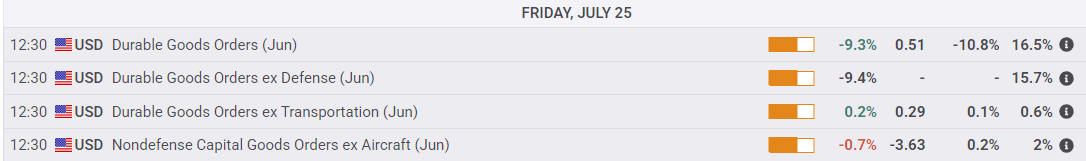

Headline Durable Goods Orders contracted sharply in June, contracting by 9.3% and marking in the worst two-month change since the covid pandemic. However, the top-line figure still beat median forecasts of a 10.8% contraction, bolstering immediate market reactions.

Durable Goods Orders excluding vehicles rose 0.2% MoM versus the expected 0.1%, highlighting how much of the headline decline was a result of a hard wobble in the US’s automotive sector as global-facing tariffs and steep steel and aluminum import taxes are beginning to hit US consumers and businesses alike.

US-EU trade deal: The eternal ‘maybe’

Rumors continue to swirl around the tank about a possible trade deal between the US and the European Union (EU), but a continuous cycle of teases and hints from staffers under US President Donald Trump has become rote for investors awaiting firm details. The Trump administration has scrambled to secure trade deals ahead of its own self-imposed deadline of August 1. Despite multiple announcements of agreements between the US and several other countries, including the United Kingdom (UK) and Japan, very little actual paperwork has been created, leaving most market participants in the dark about what the US’s physical trade environment will look like in the near future.

Dow Jones price forecast

The Dow Jones’ recovery on Friday has pushed the index back into the bullish side of recent congestion, and the DJIA is holding steady near all-time highs as bullish price action battles for a foothold near 45,000. Despite a firm upswing this week, the Dow is struggling to reclaim record high territory as its major index peers outperform the comparatively tech-light Dow Jones.

Dow Jones 15-minute chart

Dow Jones daily chart

Economic Indicator

Durable Goods Orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Last release:

Fri Jul 25, 2025 12:30

Frequency:

Monthly

Actual:

-9.3%

Consensus:

-10.8%

Previous:

16.4%

Source:

US Census Bureau

Post Comment