Dow Jones Dips to One-Week Low — Here’s Why This Shutdown Drama Could Wreck Your Portfolio Next

Well, if you thought the Dow was just taking a leisurely Sunday stroll, think again—Thursday’s market gave us a jarring jolt right back to reality. After dancing around the 46,600 mark, the Dow Jones Industrial Average plunged to about 46,300, shedding nearly 250 points by the closing bell. It’s like the market woke up and said, “Hold my coffee—this ride isn’t over yet.” But what’s really rattling nerves isn’t just the market’s mood swing; it’s the US government’s stubborn shutdown, creeping beyond a week with no end in sight. Politicians are locked in a no-holds-barred tug-of-war, mostly over healthcare—a familiar battlefield where millions of Americans’ coverage hangs in the balance. As Senate Republicans shoot down Democrat proposals and the elusive “Obamacare replacement” continues to hide in the shadows, markets are left squinting through the fog with fewer official economic signals to rely on. And just when you think things can’t get more tangled, the University of Michigan’s Consumer Sentiment Index is about to drop—offering a fresh peek at how jittery consumers really feel amid trade war drama and inflation woes. So, are we seeing just another dip or the early tremors of a bigger shakeup? Stick around—this rollercoaster is far from over. LEARN MORE

The Dow Jones Industrial Average (DJIA) knocked sharply lower on Thursday following a week-long meandering period. The Dow tumbled into the 46,300 region after opening the American market session near 46,600, knocking the major equity index down around 250 points at the closing bell.

The US government’s ongoing shutdown has officially extended past the one-week mark, reaching its ninth day on Thursday. Investors initially showed little to no reaction to the shuttering of federal services, but market apprehension is slowly on the rise as the US Senate shows no signs of progress. Senate Republicans have rejected multiple budget bridging proposals from Democrats, as the two sides of the US government vote down party lines.

US government tearing itself apart over healthcare

The key hangup between the two sides is national healthcare provisions that are set to expire, which will remove millions of Americans from already-existing care programs. Democrats want a patchwork extension while the Trump administration works on its proposal to replace ‘Obamacare’, the moniker given to the Affordable Care Act (ACA), crafted and established under President Barack Obama. The Trump team has been promising a total revamping of the ACA since Donald Trump first hit the campaign trail during his first term. Fast forward to today, any semblance of an ACA replacement has yet to see daylight, but Republicans refuse to include any kind of extension to ACA coverage in the current federal budget, stating that they will only discuss it after the budget has been passed.

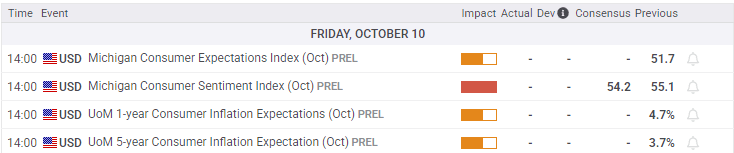

The government shutdown has also clamped down on the release of official datasets, leaving markets to grapple with newly added emphasis on private datasets. This week’s key release will be the University of Michigan’s (UoM) Consumer Sentiment Index for October, slated for Friday. Aggregated consumer survey results are expected to ease slightly as ongoing trade war headlines and rising inflation pressures eat away at consumer confidence.

Dow Jones daily chart

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Next release:

Fri Oct 10, 2025 14:00 (Prel)

Frequency:

Monthly

Consensus:

54.2

Previous:

55.1

Source:

University of Michigan

Post Comment