Dow Jones on Edge: Uncover the Hidden Market Moves as New Trade Wars Threaten Your Portfolio’s Future

Ever get the feeling the financial world’s throwing curveballs just to keep us on our toes? The Dow Jones Industrial Average took a nosedive on Wednesday, shattering hopes with a drop of over 500 points at its worst. It’s like watching a high-stakes chess game where every move the Trump administration makes seems to ramp up tension — especially between the U.S. and China, with talk of new software export restrictions and retaliations over rare earth minerals. Meanwhile, the bankruptcy of yet another subprime lender, PrimaLend, throws fuel on the fire of investor anxiety, reminding us just how shaky things are beneath the surface. Oh, and don’t even get me started on the beef tariffs drama shaking up America’s farmers, caught in a whirlwind of policy twists no one quite saw coming. So, what does this all mean for your investments and the broader market? Let’s dive in and dissect the chaos. LEARN MORE

The Dow Jones Industrial Average (DJIA) struggled on Wednesday, declining a little over 500 points at its lowest point on the day. Investors are facing fresh risk-off sentiment as the Trump administration continues to toy with making already-tense trade friction between the US and China even worse. Another subprime lender declared bankruptcy, highlighting growing fissures in the credit and lending segment.

The Trump administration, according to sources, is weighing its options on imposing restrictions on the export of software to China, a move meant to lash out at China in response to its recent move to exert further government control over the export of rare earth minerals from within its borders. Key US industries, specifically the tech sector, are critically reliant on having open access to China rare metals markets.

Subprime lender PrimaLend filed for bankruptcy, adding additional pressure to investor sentiment regarding the health of US lending segments. This bankruptcy follows the collapse of an automotive lender in recent weeks.

US farmers lashed out at US President Donald Trump over his convoluted plan to import beef from Argentina in order to make up a shortfall after his administration imposed a 50% tariff on all Brazilian imports. American cattle farmers decried the move, drawing criticism from President Trump, who claimed that American beef farmers for “not understanding” how his tariffs have benefited them.

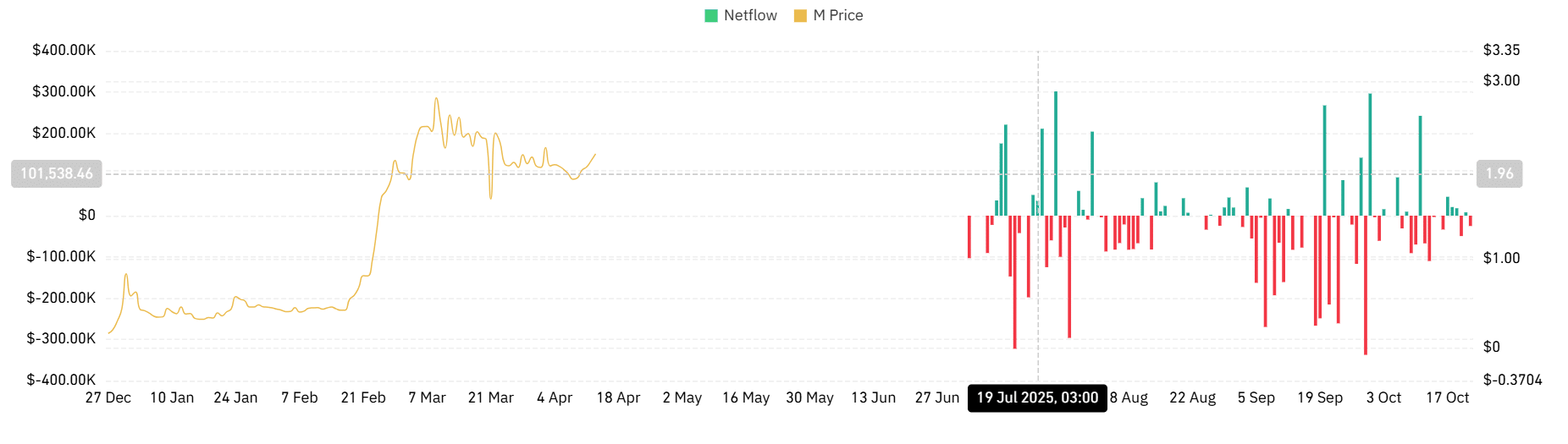

Dow Jones daily chart

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Post Comment