Dow Jones Stalls as Fed’s Stunning Move Shatters December Rate Cut Hopes — What It Means for Your Portfolio Now

Ever wonder why the Dow Jones Industrial Average seems to be playing a suspense thriller on the trading floor lately? Thursday had the DJIA stuck near record highs, but instead of a smooth ride, investors found themselves rethinking their game plan right after the Federal Reserve’s latest act. Sure, we got our expected second consecutive quarter-point rate cut this week — no surprises there. But then came Fed Chair Jerome Powell, stepping up with a cautious tone that pretty much sent the market’s hopes for a December hat-trick of cuts packing. And here’s the kicker: the ongoing U.S. government shutdown is putting a serious wrench in the Fed’s ability to read the economic tea leaves, cutting off crucial data on inflation and employment. Without these vital signposts, Powell’s warning about a potential “wait-and-see” mode isn’t just Fed-speak fluff — it’s a big deal. So, what happens to those rate cut bets now? Do we hold our breath till 2026, or is there still a January or March lifeline? Buckle up, because this rollercoaster is far from over. LEARN MORE

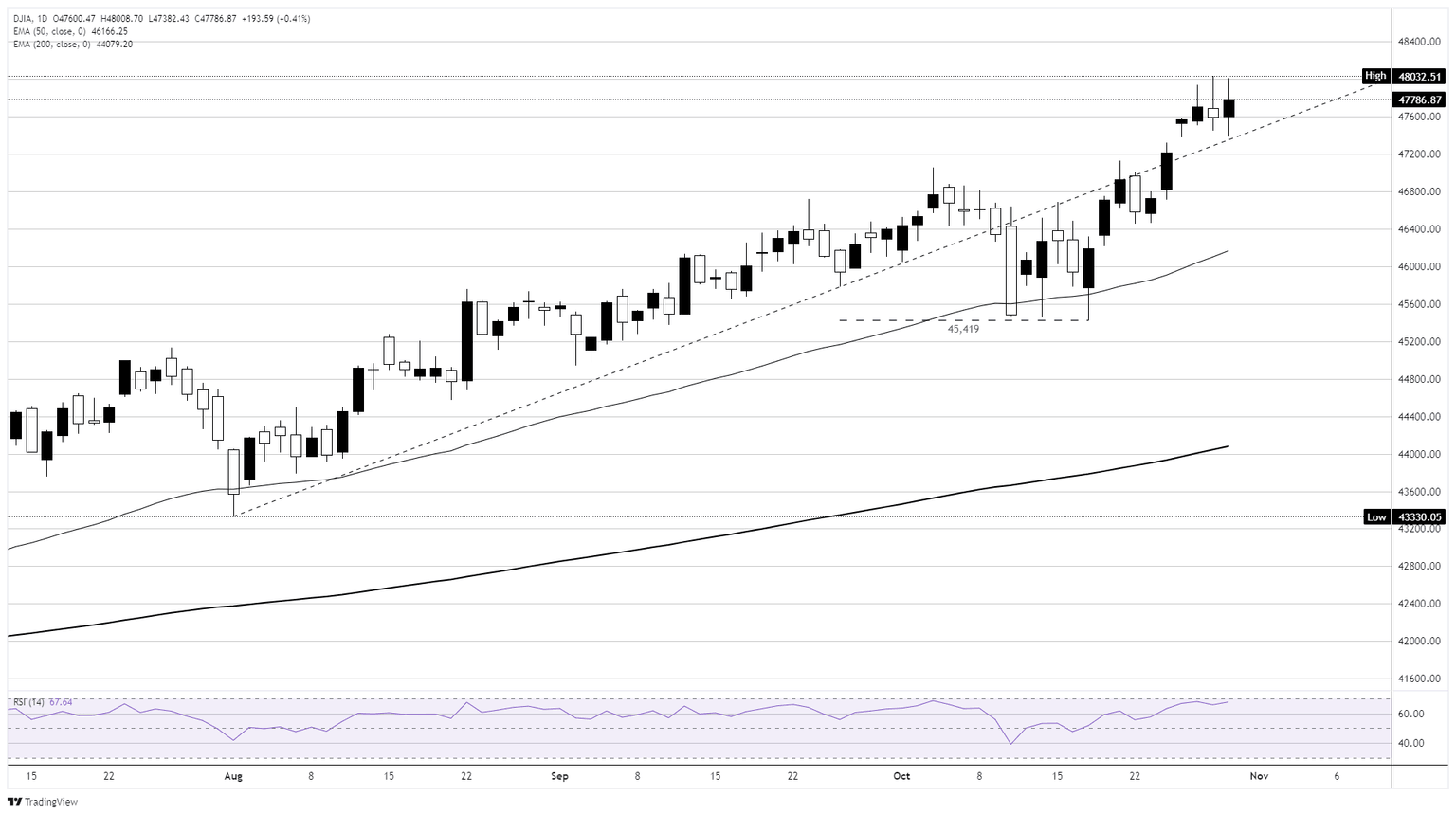

The Dow Jones Industrial Average (DJIA) held in place on Thursday, churning chart paper near record highs as investors reconsidered their stance following the Federal Reserve’s (Fed) latest appearance. The Fed delivered a second straight quarter-point interest rate cut this week, as many broadly expected. However, a decidedly cautious appearance from Fed Chair Jerome Powell has dashed market hopes for a threepeat rate cut in December onto the rocks.

As noted by Fed Chair Powell during Wednesday’s post-rate-cut press conference, the still-ongoing US federal government shutdown has dried up the flow of official data sources, specifically key inflation metrics and critical monthly labor data. Lacking the two main information streams that allow the Fed to perform its dual functions of controlling inflation and supporting employment, Fed Chair Powell warned that Fed policymakers may be forced back into a wait-and-see stance until official numbers can resume regular reporting.

Threepeat rate cut when?

With the Fed facing an inability to monitor the economy, market bets of a third consecutive rate cut on December 10 have faltered, with rate traders placing a much higher emphasis on the Fed’s first policy meeting in 2026 for a third rate trim. If the Fed misses December’s rate cut opportunity, investors will be hoping for a follow-up rate cut on January 28, with a few particularly begrudging rate betters seeing a third cut in March of next year.

Dow Jones daily chart

Post Comment