ENA Traders at a Crossroads: Will Smart Money’s Surge Silence Futures’ Sell-Off?

Ever wonder what happens when the sharpest players in the market suddenly back a coin that’s just taken a bit of a hit? Well, Ethena [ENA] just dropped 7.75% in the last 24 hours, wiping out nearly half of its 30-day gains — and yet, here comes Smart Money, quietly pumping $1.2 million into the fray. Alongside $4.8 million from fresh new wallets jumping in, it’s like watching a tug-of-war between those doubling down with conviction and those cashing out profits. Is ENA undervalued, or is this just the calm before a storm? Spot investors are unloading from exchanges into private wallets, signaling they’re stacking up, while derivatives traders seem content to take profits off the table, creating a bubbling clash. So, what’s next for ENA — a breakout rally or a deeper dip? Let’s peel back the layers and see which way the wind might blow. LEARN MORE

Key Takeaways

Smart Money drove $1.2 million into ENA, joined by $4.8 million from new wallets. Could the clash between conviction buyers and profit-takers decide its next big move?

In the past 24 hours, Ethena [ENA] fell 7.75%, erasing nearly half of its 30-day 15% gains. Smart Money, meanwhile, has been quietly building exposure, hinting at a deeper story behind ENA’s latest moves.

This came amid liquidity rotation and a tussle between spot and derivatives investors. AMBCrypto’s analysis shows how these flows shaped ENA’s trajectory.

Smart money takes bold bet on ENA

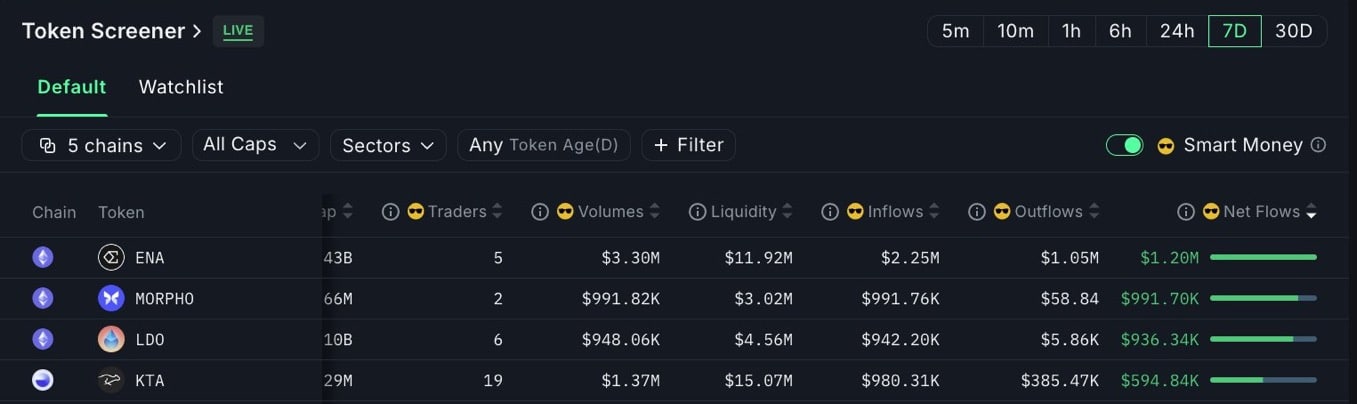

Smart Money, often recognized for making profitable bets when assets are seen as undervalued, has taken a bold position in ENA.

Over the past 7-day timeframe, this group funded the market with $1.2 million inflows — a sign ENA may have been undervalued.

Smart Money was not the only one to take this bet. Nansen analysis reported that New Wallets also joined during this period.

First-time buyers funded the market with $4.8 million worth of ENA purchases, which further confirms possible undervaluation.

This level of activity adds weight to the overall bullish outlook for the token’s price.

Spot investors bet hard

Spot investors contributed the strongest bullish effect to ENA’s price performance.

According to CoinGlass, Spot Exchange Netflow recorded significant demand within the 7-day window.

During this period, total inflows reached $46.45 million, as investors moved their tokens from exchanges to private wallets.

This activity suggests reduced sell pressure and points to stronger accumulation.

Moreover, the Accumulation Distribution Indicator confirmed that massive accumulation took place as well — showing 1.39 billion ENA absorbed.

Together, Smart Money, spot investors, and new wallets signaled conviction that ENA remained a buy.

Having said that, Derivatives investors have played a significant role in shaping ENA’s weaker performance over the past day.

Derivatives investors go against ENA

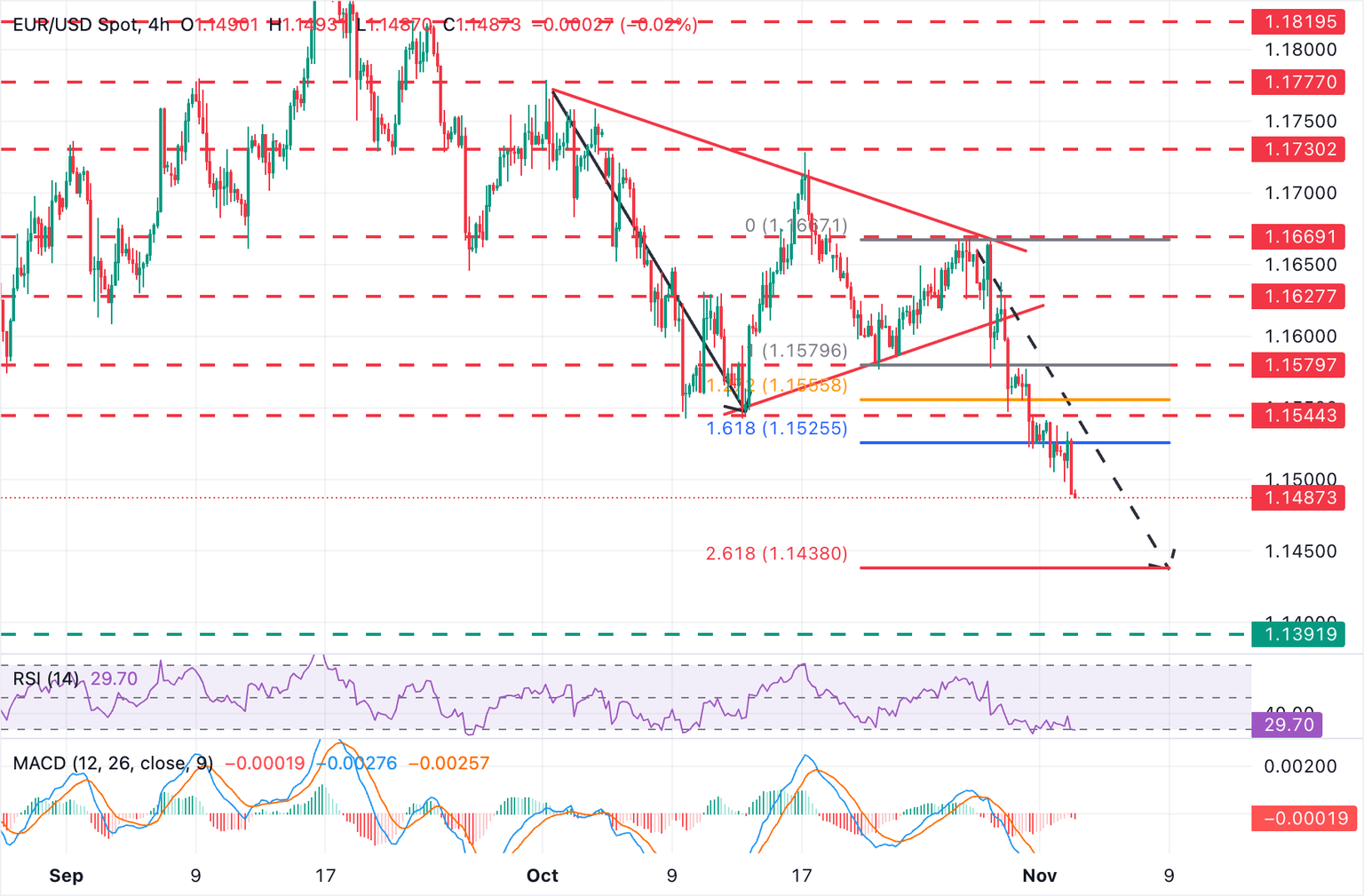

The recent daily decline was driven by Derivatives investors closing a large portion of their positions.

CoinGlass data showed that Open Interest fell by 7.54%, dropping to $1.25 billion. This translated into a $94 million outflow in contracts.

The decline in Open Interest corresponded with a surge in derivatives sell volume, confirming a bearish bias in the short term.

At the same time, analysis of the Liquidation Heatmap paints a more nuanced picture.

Clusters formed above and below the current price, but the heavier bands sat above, and that, in turn, suggested an upside break could sustain longer momentum.

While short-term pressure came from profit-taking and derivative flows, Smart Money and new wallets kept stacking ENA—a setup that favors the bulls if momentum breaks upward.

Post Comment